The purpose of this CXTech Week 3 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Rewind and Forward on Programmable Communications – what to expect from pandemic-induced changes

Thanks to Jean Shin of tyntec for this interview. We recapped what happened in the programmable communications space during the COVID-19 pandemic of 2020, and made some predictions for what to expect in 2021 and beyond in terms of how businesses will use communications for their workforce and customers. Its based partially on the 2020 Review weblog I published back in November.

Brave browser takes step toward enabling a decentralized web with IPFS

Congratulations to the Protocol Labs folks, David Dias et al, for this achievement. While HTTP is designed for browsers to access information on central servers, IPFS (InterPlanetary File System) accesses it on a network of distributed nodes.

We’ve covered IPFS at TADSummit since 2016, here’s a nice Web 3 session from TADSummit 2018. The work of the decentralized web takes time, Matrix / Element are also part of this movement, and we’re seeing broader market adoption of Matrix as well, e.g. Mozilla announced Matrix would replace IRC, CXTech Week 22 2020.

Web 3 should now be part of every programmable communications / telecoms business’s strategic planning.

The Joy of SPACS

Good review of this popular investment vehicle.

Special Purpose Acquisition Companies are blank check companies. A team of industry / finance veterans come together, and do an IPO on the promise of spending the cash to buy up companies or bits of companies to create value from being listed without the hassle of going through an IPO. We saw it last year when AVC bought Kandy, CXTech Week 32.

They tend to invest in fashionable segments, as that’s what works in the market, and as long as the financial results follow it seems to work. Else if the numbers are not reaching targets they do some more M&A to help another private company get listed fast and cheap.

SPACS are plentiful these days, and the market is frothy as much stimulus cash appears to not be going into the economy (employment and business operations) rather gambling on the stock market.

Enghouse Systems buys Altitude Software

Last year is was Dialogic. This year its Altitude, a contact center provider focused on omnichannel, based in Portugal, with $30M in revenues and 300 customers.

Programmable Communications Market Landscape and Sizing Update

I’ve gone through the bottom-up build of the CXTech market, across CPaaS, business messaging, in-app, UCaaS, CCaaS, etc.; revising the numbers, for example Bandwidth’s 2020 growth was 30% (pre-pandemic), now 40%. You can see the tables from last year here.

Overall the results are mixed:

- Twilio, Zoom, and a couple of others in the 100+% growth are the exceptions;

- 5% have 30% increase on pre-pandemic estimates;

- 30% have 10% increase;

- 45% are unchanged; and

- 20% have 10% decrease.

Migration of Telco Networks onto Google, Amazon and Microsoft

Nokia recently announced a partnership with Google to jointly develop 5G edge and core for both telco and enterprise. Back in March 2020 Google announced its Telco Cloud Strategy:

- Packaged Google Cloud for mobile edge and network applications;

- Insights through Google Big Query and Contact Center AI; and

- Packaged Google Cloud for BOSS with Amdocs and Netcracker.

Microsoft bought Affirmed Networks (CXTech Week 14) and Metaswitch (CXTech Week 21), hence is competitive with the network vendors. Such a partnership is more likely account based than strategic. For both telcos and the network vendors, retaining cloud talent across all levels has proven challenging. Partnering with the top cloud providers is currently their best option.

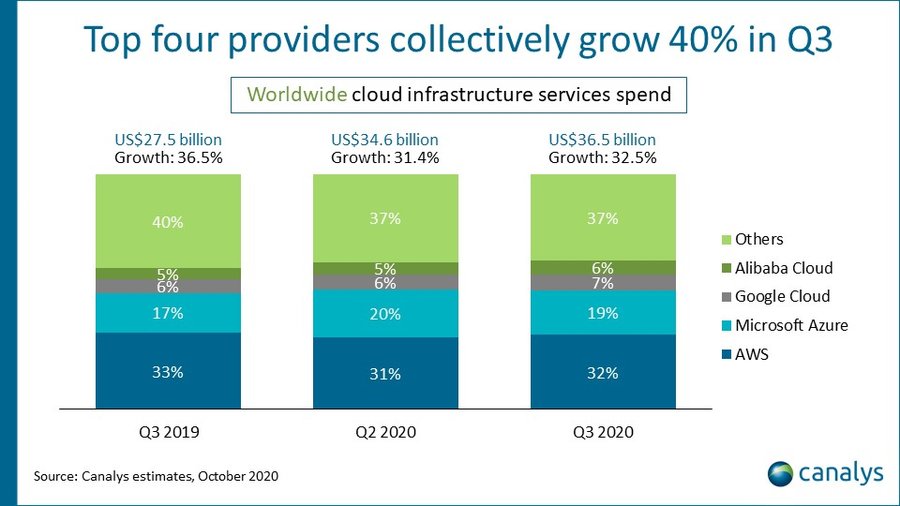

The cloud infrastructure business continues to accelerate for the top 4 providers, 40% growth in Q3 2020, see below. What will be interesting to see over the coming years is how Google+Nokia+Telcos versus Microsoft+Telcos plays out.

Its a balance of ‘cooks in the kitchen’ and ‘span of control’. I remember a decade ago discussing whether IMS and Cloud Infrastructure would be bundled by the same provider. Back then span of control, the complex mess of telco standards was considered a limiting factor. It’s still there, but slightly less of an issue today, as it’s easier to retain telco experts than cloud experts.

Netflix has a record year

Netflix ended 2020 with a total of 203.6 million paying users around the world.

The company surged in the first half of 2020 due to the impact of the pandemic, with its performance peaking in Q1 adding 15.8 million subscribers. Q3 meanwhile was more muted, with 2.2 million subs, while in the final quarter added 8.5 million subscribers.

Overall, the company added 37 million paid memberships in 2020, a record growth of 31%. This translated to revenues of more than US$24 billion for the year, up 24% year-over-year. Netflix’s operating profit grew by an even larger margin by 76% to US$4.6 billion.

I’ve noticed some content changes. The 6 episode season format is a mistake. For example, the School Nurse Files was excellent in places, but forcing a season into 6 episodes chopped up the story and rushed the ending.

Weekly release of new episodes is annoying. It’s nice to binge as a weaker episode doesn’t halt viewing of the entire series. I know people who are not watching a series until they can binge.

The Expanse on Amazon Prime Video has proven excellent every episode so far.

Yesterday we discovered there will be a new episodes of Ragnarok (Norwegian production), so my son is very happy, especially coupled with the new series of Disenchantment.

We enjoyed The Queen’s Gambit, a trite ending, though a nice journey. And finally caught up with both series of Hanna, which was fun. Though I’m not sure where series 3 will go. Even an 8 episodes season feels a little rushed, some characters do stuff for story progression, rather than motivation built through the story.

And yes, broadcast TV remains awful because of advertising. The cord has been cut in our home for 9 years, since 2012.

People, Gossip, and Frivolous Stuff

Camilo Segura is now React & NodeJS Junior Developer at IT Consultores S.A.S.. He is a TADHack winner (Popayán) from 2018 with Dnuncia by RM5 using Status, an excellent hack

Matteo Campana is now Application Development Manager at Accenture. I’ve known him since his time at Orange Libon.

Stephen McDonnell is now VP, Head Architect & IT Practices at Canadian Tire. He’d been with Rogers for quite some time.

Andrew Ragona is now a Licensed Realtor at Compass. I knew him during his ALU days, which he left in 2016, how time has flown.

Sandro Tavares is now Director, Telecom Systems Marketing at Dell Technologies. After many years at Nokia.

Michael Palmeter is now Sr. Director of Product, AI/ML for SaaS at Oracle. I’ve known him since his BEA days, that’s not last decade, but the decade before. Before BEA he did IMS app servers at Ericsson.

Ben Parsons is now Solutions Consultant at Element. He also keeps his senior developer advocate hat with Matrix.org. Hopefully, we can get Matrix back in TADHack soon.

Jevgenijs Vainshteins is now Telco & Cloud Strategy leader at Market Leader. I’ve known him since Canonical.

Soliman ElSaber is now Lead Data Engineer at Mindvalley. It’s great to see the progress of TADHackers!

Sanja Antic is now Head of People & Culture at Hunch.

Jennifer Kuipers is now Sr. Director, Business Development at Five9. Joining them from their Inference acquisition.

Russ McGuire is now Adjunct Professor at Oklahoma Christian University. I knew Russ back in his Sprint days.

You can sign up here to receive the CXTech News and Analysis by email.