This weblog provides a round-up of the main programmable communications headlines through 2021. It’s been another busy year.

Identity verification keeps getting hotter and could enter a phase of industry convergence in 2022 between enterprise / web and programmable communications industries. We’re already seeing similar convergence from the cloud infrastructure providers like AWS, Microsoft and Google are slowly and steadily moving into the telco core, as well as building out their programmable communications platforms, as they understand the importance of open source and owning your product / roadmap to be competitive.

Aggregation of the aggregators. Lots of M&A across SMS, voice, and channels to enterprises, the battle lines are being drawn. The work of AVA Network, a TADHack and TADSummit sponsor, is an interesting play given this consolidation.

January

Kicking off the New Year I reviewed the TSA Travel Stats, 7 day moving average was about 44% of 2020, see CXTech 2021 Week 1. A nice sign things were on the road to recovery. Since the summer of 2021 we’ve been consistently around 80%, the 20% gap is international travel. Delta and now Omicron continue to limit international travel. I visited Orlando in September and December while most US children were in school; the parks were quiet given few international visitors.

UK broadband usage doubled in 2020 (CXTech 2021 Week 1), a common figure for many countries. And given the prolonged pandemic broadband usage remains more or less constant through 2021.

On the M&A front:

- TelcoSwitch Raised £4m in growth capital funding, and began a series of acquisitions. In 2020 they bought Ziron, CXTech Week 3 2020.

- Kount (Identity Verification / Fraud Management) bought for $640M on about $25M Revenue by Equifax.

- Enghouse Systems buys Altitude Software, and as we saw later in the year broadvoice bought GoContact, another Portuguese CCaaS.

- The Joy of SPACS – a number of companies have taken this route, with generally mixed results for the companies, and preferential payouts for the SPAC.

- Slack backed Yac Raised $7.5M, voice becomes fashionable again.

- Hopin buys Streamyard for $250M, even though virtual events are nowhere near as good as in-person events, valuations remains high for virtual event enablers.

- BICS and TeleSign get New Leaders, this foreshadows some significant moves later in the year.

- TelcoSwitch acquires OneVoice after raising £4m in growth capital funding.

February

The Future of Simwood. This is an excellent, accurate, and honest review of the PSTN voice market. Picking up on some of the juicy quotes:

Wholesale voice is a tough market and has got tougher. It’ll get tougher still and quite possibly won’t exist in 25 years time. We’ve rolled with that, making incremental changes with mixed response along the way. In a market where the volume of minutes falls every year, and where the price at wholesale has been driven down every year (more by regulation than competition) we’ve done well to grow as we have.”

Simon Woodhead, CEO Simwood

Legacy transportation doesn’t go away, it has a role, albeit more limited than during its heyday. SS7 is still in use today, and I bet still by 2030. I think wholesale voice will be around in 25+ years, but it’s not a viable business for a technology company like Simwood. Its rolling up into global aggregators, as we saw with the latest Sinch acquisition of Inteliquent in CXTech Week 7 2021.

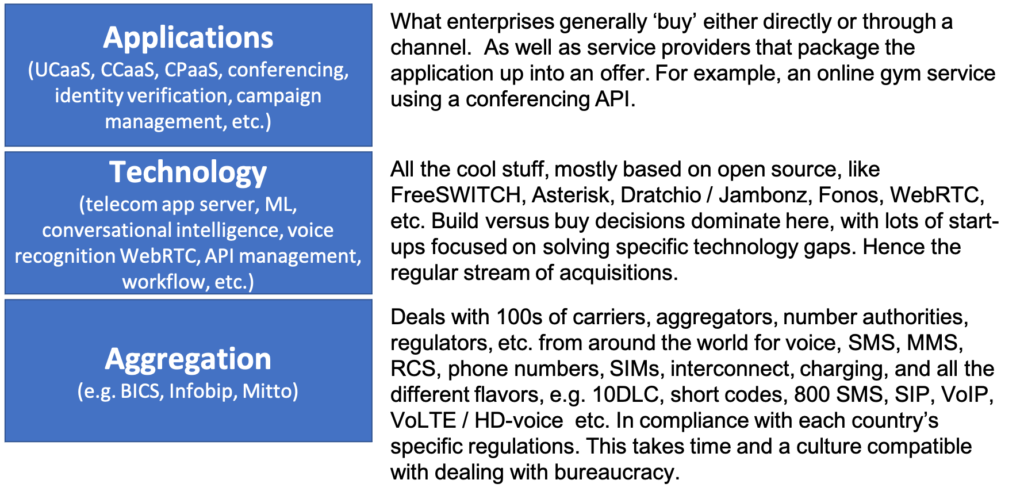

Simple Programmable Communications Model

This simple model helps explain the programmable communications market. I divide the market into 3 domains: Aggregation, Technology, and Applications.

The reason I segment the market this way is because ‘span of control’ has a significant impact on where an organization is strongest, and hence most competitive. And we see the financial markets value aggregators and CPaaS providers differently because of this.

On the M&A front:

- Audio-based social app Clubhouse raises $100M

- Sangoma Acquires Star2Star for US$437 million, UCaaS consolidation.

- Proximus Acquires BICS and TeleSign, we’ll see some more moves here by the end of the year.

- Agora Explodes thanks to Clubhouse and Yalla

- Sinch acquires Inteliquent, voice and SMS aggregation consolidation.

- Link Mobility acquires Dutch CPaaS enabler Tismi

- Tru.ID Raises 3M GBP Seed Round, identity verification.

- More Messaging Consolidation: Kaleyra acquires mGage for $215M

March

As a service provider, whenever a competitor has an outage, I’m always reminded of the John Bradford (1510–1555) quote, “There but for the grace of God go I.” Simwood and Twilio both reported outages. This foreshadowed the explosion of DDoS attacks later in the year. Which we reviewed in TADSummit EMEA Americas 2021 in Nov/Dec.

Simwood had a problem on handling 999 and 112. They shared the situation, root cause, and remediation for all to learn and not repeat their mistake. On 26th Feb Twilio had a broad outage. I noticed first from some posts on Reddit. It impacted most of Twilio’s services, with the exception of Programmable Voice, Elastic SIP Trunking (including voice calls), and email. Within a couple of hours it was resolved. It was unusual because of the breadth of services affected.

Dialpad and T-Mobile Announce a New Collaboration. TMO both uses and resells Dialpad. It’s always good to eat your own dog food.

Twilio closed down its Fax API. Check out this excellent presentation from Howard Avner from Voyant (who bought Phaxio, Howard was the founder / CEO, and also a TADHack sponsor) at TADSummit EMEA Americas 2019. Fax is like the postal mail, just faster and easier. To the Twilio fax API refugees, I strongly recommend you contact Howard, he’ll sort you out with a fax API that works, and stops it being a PITA for you. Also check out iFax, they’re giving J2 (spun out their fax business last year as eFax) a run for their money.

Keep an Eye on Malaysia, the 5G GOMSPV (Government of Malaysia Special Purpose Vehicle) appears trapped in politics. While Axiata has launched over the past 3 years a number of financial services that meet the needs of the bulk of the Malaysian market. The 2 main services are:

- Boost an e-wallet; and

- Asparasi, micro-financing and insurance.

- I also include in this list ADA (Axiata Digital Advertising) which raised $60M from SoftBank (announced in May 2021), Axiata is on a roll.

How TMO says Goodbye, sigh, US telecommunications is not customer-centric.

On the M&A front:

- Twilio Invests, not Buys, Syniverse, see the Simple Programmable Communications Model to understand on why Twilio chose to invest not buy.

- Vonage Scraps Plan for Sale of Consumer Business – likely valuations were poor for this mature competitive business, where many existing customers are unaware of the better deals available.

- Okta buys Auth0 for $6.5B. We’ve covered the identity authentication space for a few years. Mainly from a programmable comms perspective, beginning with 2FA, and expanding into insights like TeleSign’s Score and Smartnumber’s Protect. As the importance of these services grow, they start to run into broader IAM (Identity and Access Management) solutions.

- Gamma buys Mission Labs, a telco buying in open source expertise to own their product and roadmap. We’ll likely see more telcos attempt this.

- thinQ Announces Strategic Acquisition of Commio

- Crexendo Acquires NetSapiens

- Genesys to Acquire Bold360 (chatbot). Like Five9 and Inference, Sinch and Chatlayer, CM.com and CX, buying a chatbot is the fashion, an acqui-hire. But as we’ll see in TADSummit Asia in May, the road to adequate chatbots is long, and we’re only getting started.

- Pindrop Acquires Next Caller. Pindrop, identity, security, and trust for voice interactions, has acquired Next Caller Inc., enterprise-grade call verification and fraud detection technology for contact centers.

- Twilio acquires India-based CPaaS, ValueFirst. Accelerating its position in India.

April

Infobip’s channel to the Enterprise.

When Sinch bought SDI, it gave them SAP as a channel, that is big. Infobip has been working on Microsoft for some time and their omnichannel solutions are now available on Microsoft Azure, Bot Framework, and Dynamics 365 Marketing. Intelepeer and IBM have a close relationship in the US.

One juicy bit of gossip I learned is when Twilio invested in Syniverse, all Twilio’s SMS traffic moved off OpenMarket (now Infobip) onto Syniverse. Its obvious they’d do that, it’s just not explicitly stated. The ecosystems around Sinch, Infobip, Syniverse, and the rest are all forming into battle camps. The work of AVA Network, a TADHack and TADSummit sponsor, is an interesting play given this consolidation.

Microsoft’s CPaaS (Communication Platform as a Service) platform that is also the platform that powers Microsoft Teams, is now GA, which means it’s now under support and has a formal SLA (though some elements are still in preview).

On the M&A front:

- Microsoft buys Nuance. The focus is the Healthcare vertical, 62% of Nuance’s revenue ($1.5B in 2020). Healthcare / Pharma, as a vertical in Microsoft is >$15B, healthcare has received special attention within Microsoft for over a decade.

- TelcoSwitch makes second acquisition of 2021 with PBX Hosting.

- Wire Raises $21M

- MessageBird acquires email data platform SparkPost, closes $1B round. I was just writing about SparkPost as Daniel Chalef had joined as VP of Corporate Development. And MessageBird has just bought them. In CXTech Week 41 2020 I mentioned MessageBird’s $200M raise, looks like it wasn’t enough given how rich M&A has become. This move copies Twilio’s acquisition of SendGrid in 2018 for $2B. There’s money in email marketing! SparkPost and MessageBird have been partnering since 2019.

- Mavenir Announces $500 Million Private Placement with Koch Strategic Platforms. Mavenir were going to do an IPO in 2020, but pulled back, and instead took a minority investment of $500M from Koch Strategic Platforms (“KSP”), a subsidiary of Koch Investments Group, so Siris Capital (owner) could get a partial pay-out.

May

COVID ASSIST SURAT. Ravish Patel contacted me with an urgent request for a simple 2-way SMS service to help his local community access covid resources.

Ravish had just moved back to India with his family, after leaving TeleSign, as reported in CXTech Week 15 2021. TADHack regular and ‘hacks-in-his-sleep’ Sam Machin helped Ravish create COVID ASSIST SURAT. And in less than 24 hours it was live! The app even made it onto the Times of India.

The whole app follows a common recipe used at TADHack of: Vonage APIs (Sam worked for Vonage), Zapier platform, and Google sheets for the data backend. It’s great to see the TADS community having an impact.

TADSummit Asia 2021 ran through May. Here are just a few of the many excellent highlights:

- Accelerating Women Tech inclusion with effective usage of Telco API, by Sammani Kusaladharma, Specialist at Ideamart, Dialog Axiata.

* Where is your ‘Ideamart for Women’ program? - Mindful Connections, Sami Mäkeläinen, Telstra

* Make sure to follow Sami’s 3 steps to lessen the systemic failures being created by increasing coupling and interactions of communication systems. - Shona D’Arcy, Kids Speech Labs on ‘Voice technology for healthcare.’ An excellent introduction to the many uses of speech recognition in the Healthcare industry, which accounts for about half the voice technology investment.

- TeleSign’s Findings on the Future of Digital Identity by Guillaume Bourcy, Data Growth and Strategy at TeleSign. An excellent review of digital identity, the important role TeleSign plays in merging offline and online identities. Plus some highly entertaining scenes, taking advantage of this online format.

- Web is Communications by Dominique Hazael-Massieux, W3C, Web Technology Expert & Software Engineer. The Web is Communications, and any company involved in programmable communications should be part of the W3C.

- Pitfalls and potholes of content moderation for chatbots, Elayne Ruane: Thoughtful design is important (legally, morally, commercially…); Protecting the user is #1 – give users recourse and the benefit of the doubt; and Your chatbot is just ones and zeros but your team are people!

- How Not To Build a Chatbot, Muzzamel Mazidee. I love this quote he uses at the end, “One reason a chatbot takes more effort than either self-service or a human agent is that compared to us humans, it’s stupid.” Thank you Mel for one of the best bot implementation guides I’ve ever seen.

On the M&A front:

- SoftBank invests $60M in ADA. Axiata Digital Advertising (ADA) is a Malaysia-based digital marketing company with a valuation of $260M. Founded in 2018, ADA is a group company of Malaysian telco Axiata. I’m adding ADA to my list from the weblog, Keep and Eye on Malaysia.

- Infobip Acquires Anam. Infobip continues its acquisition spree buying SMS firewall service provider Anam that offers solutions to 80+ MNOs. No price was given. Anam is now part of Infobip’s Strategic Operator Partnerships group.

- Twilio buys Zipwhip for $850M: If you can not beat them, buy them

- IntelePeer Raises $110M in New Funding Bringing 18 Month Total to over $170M

- didXL Launches Local Termination in 22 Countries

- Five9 and Mitel Announce Strategic Multi-Year Partnership, at least RingCentral is not winning them all, let’s see….

June

SMiShing: SMS-based phishing. I had the good fortune to talk with Paul Walsh of MetaCert recently, on the importance of adopting a “Zero Trust” strategy for URLs / SMS, and the human factors around stopping people clicking on those URLs, it’s a complex technology and human factors problem. BTW, here’s an excellent piece from Paul on zero trust URLs, https://pkic.org/2019/10/10/the-insecure-elephant-in-the-room/ and more recently, he penned an ‘Open Letter’ to mobile operators with a goal to create a new security category for anti-phishing.

Matrix has become the messaging app of choice for top-secret communications. Nice review of how the French government selected Matrix.org. At TADSummit EMEA Americas last year, we interviewed Matthew and Amandine, and covered this topic and many more.

On the M&A front:

- Sinch Raises another $1.1B from Softbank and Temasek

- Signalwire Raises $30M Series B

- CSG buys Tango Telecom

- Sinch buys MessageMedia for $1.2B. MessageMedia are solidly SMS/MMS campaign focused. A business Sinch has been in for years. Last year they bought Wavy to consolidate their LATAM business messaging position, as reported in CXTech Week 14 2020.

- Congratulations to Webio, a Conversation Intelligence specialists in the credit, collections and payments industry, has announced that it has received €500k investment from Finch Capital to complete €1.5m in pre-series A funding.

- Stripe raises $1B for Identity Verification, more non-programmable telecoms companies investing in Identity verification.

- Biometric authentication platform Transmit Security raises $543M

July

How we created an open-source alternative to Twilio and why it matters. A nice review from Pedro Saunders on why he created FONOS.

AT&T joins T-Mobile in switching all Android phones to Google’s Messages app for RCS. And then there were none: Verizon is also switching to Android Messages as default for RCS. Google has been playing the long game on RCS. Trying to cooperate with carriers, giving up and doing it themselves, and then waiting for carriers to realize they can not do it themselves and join the Google bandwagon.

On the M&A front:

- Mapped (Jose de Castro ex-Tropo) raises additional $6.5M to build API for the ‘digital twin of data infrastructure’

- Aircall raised $120 Million Series D Funding at $1B valuation, and app on Twilio.

- Russia’s MTS acquires telecom and CPaaS provider MTT

- Kaleyra Acquires Bandyer

- Zoom bought Five9 for $15B, then didn’t. At TADSummit EMEA Americas (Nov/Dec) we have a great keynote discussion sponsored by GoContact and Broadvoice on the topic of UCaaS/CCaaS integration.

- Broadvoice bought GoContact.

- Element raises $30 Million

August

TADHack Sri Lanka focuses on Teens: TADHACK TEENS. While we’ve had teens involved at TADHack over the years, and Popayan also included many teen competitors from its work with local high schools. This year TADHack Sri Lanka has a stream dedicated to teenagers: TADHACK TEENS. Thank you to hSenid Mobile and Ideamart for making this possible. I’ll be writing a summary of our experiences with TADHack TEENS and plan to make this global in 2022.

On the M&A front:

- Congratulations to SureVoIP, bought by TelcoSwitch. Gavin has been part of TADSummit for many years.

- Talkdesk completes Series D fund raise with a new $10B valuation. Which is amazing for an app built on Twilio.

- Microsoft Buys Peer5

- Avaya Acquires Contact Center Developer CTIntegrations

- Syniverse to go public via SPAC

- Mavenir buys Telestax, finally an exit for Telestax. Given their carrier focus, it’s been a tough long slog.

- Comcast Business to buy Masergy

September

Thank you to everyone who took part in TADHack Global 2021 from all around the world. We had over 1000 registrations, kicked off a new initiative TADHack TEENS in Sri Lanka (150 registrations), had 3 in-person locations (Berlin, Chicago, and Orlando), South Africa achieved a MASSIVE 400 registrations, and many hacks did an excellent job in mashing up the sponsors. Well done everyone!

We had an amazing turn-out at TADHack Orlando at Valencia College, far exceeding my expectations, I had to double the lunchtime food order. It was gratifying to see everyone’s delight and relief in finally being able to hack together after an 18 month long break.

Thank you to our global sponsors, without whom, TADHack would not be possible: Symbl.ai, jambonz.org, Subspace, AWA Network, and Telnyx.

Thank you to Ayoba, MTN, hSenid Mobile, and Ideamart for making TADHack South Africa and Sri Lanka possible. Both are world-leading examples of country-wide innovation ecosystems.

You can read about all the amazing hacks in this summary.

On the M&A front:

- Singapore based Toku Raises USD 5 Million Series A. Toku initially positioned as a CPaaS. However, with the consolidating market and entrenched positions of Vonage (Nexmo legacy), TeleSign, Sinch, and Twilio; it was hard to compete. Instead they’ve focused on the plumbing (SIP trunking) to get cloud communication services like Microsoft Teams running for Asian businesses.

- Zoom App Fund invests in 12 Companies

- Unifonic has closed a $125M Series B round

- KT Corp Acquires Epsilon Telecommunications. South Korea’s largest telecommunications company, has acquired Singapore-headquartered Epsilon Telecommunications, a global connectivity provider that simplifies how businesses connect applications and data around the world using Epsilon’s NaaS (Network as a Service) platform. From TADSummit Asia 2021 you can see Liang Dong present on “Delivering the Future of Networking with Hyper-scalable Connectivity“. It provides a good overview of Epsilon’s NaaS. This is an example of a telco buying in programmable communications.

- Identity Transaction: TransUnion buys Neustar for $3.1 Billion

- Intuit (TurboTax) buys MailChimp (Email Marketing), email consolidation from the enterprise / web industry.

- Wazo raises $7.5 million CAD Seed Round

- thinQ Acquires Messaging API Platform teli, Rebrands as Commio

- Sinch buys MessengerPeople.

October

Check out MicroAcquire – avoid the Investment Bankers.

One of the reasons about 80% of announcements about acquisitions sound from another planet is Investment Bankers’ spin on fashionable categories. Essentially conning the buyer into spending money to ‘leapfrog the competition’ or ‘catch-up with a category’ they’re not likely to be considered in. Investment bankers have no magic insights, they are trapped in a world of spin and spreadsheets; detached from the technology, and especially the what and why end customers are buying.

MicroAcquire cuts out the banker, which I hope helps many more sensible transactions take place that generate long term value.

Two news items we’ve known for years

- Under 18s being exposed to harm by video sharing platforms like TikTok says Ofcom

- Facebook harms children and weakens democracy: ex-employee

Element One goes live: $5 a month with WhatsApp, Signal, Telegram bridges. This one surprised me given the consumer focus of the article. $5 per user per month for what my OS already sort of of does seems a bit of a tough sell. This is more likely enterprise price setting. It also has the smell of investors wanting to see a clear per user per month price point they can enter into their excel spreadsheets to work out what their investment is currently worth.

On the M&A front:

- Sinch Acquires Pathwire for $1.9B. Following Twilo (SendGrid for $2B in 2018), MessageBird (SparkPost for $1B in CXTech Week 17 2021), and Intuit (TurboTax) ($12B for MailChimp – but mark my words, this one will end badly).

- LoopUP buys MashMe

- Route Mobile buys Masivian for $50 million. Route Mobile, an India-based CPaaS, has acquired Masivian, a startup with operations in Colombia and Peru, for $50 million. This appears to be copying Sinch acquiring Wavy.

- Vonage Buys Conversational Commerce Startup Jumper.ai

November

Check out the world-class no-BS agenda here. A few sessions I’d like to highlight:

STROLID Keynote, VCons: A Proposal for an Open Standard for Conversation Data > Link to slides, video, summary and Q&A <

Thomas Howe, CTO STROLID

- From Voice to Everything: How conversations have changed in the past 100 years

- Elements of Conversations: Messaging, voice, participants

- Gathering the Conversation: A single container for a conversation

- Conversations as Data: Using conversations for analysis, collaboration and decision making

- Call to Action: Workgroup on Defining Conversations. Please take the time to review this keynote and join Thomas’s initiative.

The worst of enemies – let’s talk about DDoS and RTC > Link to slides, video, summary and Q&A <

Sandro Gauci, CEO / Senior Penetration Tester / Chief mischief officer at Enable Security

Why are VoIP and WebRTC services so vulnerable to DDoS and what can we do about it?

- Distinguish between volumetric and application-level DoS

- Why volumetric/bandwidth saturation is so effective

- Application-level DoS, appreciate the complexity of the topic

- Some demos to illustrate the point

- General recommendations: security testing, apply changes, preparations, repeat

On the M&A front:

- Infobip buys Peerless Network and Raises $500m. Following Sinch buying Inteliquent, Infobip has bought Peerless Network a US focused business VoIP provider, with a suite of voice, UCaaS, SIP, Messaging, APIs, MS Teams integration, and other collaboration products and services.

- Vonage and Etisalat Digital Partner for CPaaS – this one was a little odd, until you realize it was some window dressing for the Ericsson acquisition of Vonage.

- Congratulations to the Symbl.ai team in raising $17 Million in Series A to scale its conversation intelligence platform for developers.

- Mitel now Resells RingCentral, what about the Five9 deal? I guess Five9 are now reselling RingCentral 😉

- NEC Backs Rescheduled Intermedia IPO

- Ericsson makes a $6.2B bid for Vonage. Ericsson is trying to buy a telco, Vonage, $300M consumer VoIP / $1B Enterprise VoIP & VAS. Vonage was growing, just not as fast as Twilio / RingCentral. Rory Read, the current CEO, needed an exit, and Ericsson needed to show it was not asleep at the wheel, as Jana Partners (4% owner of Vonage) did its activist investor stuff.

December

TADHack-mini Orlando at Avaya ENGAGE ran on 11-12th December.

It’s a hybrid hackathon (in-person and remote) about using Avaya’s and its partners’ resources (Subspace, Telnyx, Toolwire, Red Hat, and Google) to solve problems that matter to you. You can see all the resources here.

Here are some of the photos from the hackthon, the videos (including prize giving and an update the latest on Avaya Spaces developments), and this weblog summarizes the event and the winners of the $15k prize money, plus lots of other goodies including great food (check-out the photos).

Despite the prolonged pandemic; the rise of a new variant resulting in new travel and gathering restrictions in some countries; and to my surprise holiday party season impacting teams 😉 We still had over 200 registrations, thank you to everyone who registered from around the world.

The plan for TADHack Global is to run sometime in October, hybrid as we’ve always done. I’ve started the process of talking with the location leaders, I hope we’ll have a firm date in January. If you want to be part of the largest global hackathon focused on programmable communications for 9 years straight, please get in touch!

For TADSummit, I’m going to roll Asia, EMEA, and Americas into one hybrid event in November 2022. The in-person part we’re hoping will be Aveiro, Portugal, but we’re not making a firm decision on that until Q3. This will be the 10th TADSummit, time flies!

Engaging Developers. Why are you doing it?

I’ve seen quite a bit of buzz / BS around ‘engaging developers‘ at the moment. Lots of ‘frameworks’ and overly complex fluff to justify expensive consulting fees.

This weblog is biased towards programmable communications, but it’s applicable to many industries.

The critical question is, “Why are you doing it?” Until you have a defensible answer to this question everything else is a waste of time and money.

On the M&A front:

- Well done WGTWO! CKH IOD selects Working Group Two for public cloud core network

- 8X8 buys Fuze for $250M

- Genesys raises $580M on $21B Valuation from Zoom, ServiceNow, Salesforce.com. The investment neuters competition. This is similar to how Twilio has invested in Syniverse, a competitor to Sinch. The call center is not going away, it will remain a dominant part of many customer experience use cases. So for Salesforce, Zoom, ServiceNow, it enables them to have a stake in a core part of the customer experience landscape, without the distraction such a large established business brings.

- BICS buys 3m Digital Networks, which was announced before TeleSign’s IPO through an SPAC. As TeleSign was supposed to be BICS CPaaS.

- Deutsche Telekom invests in SignalWire

- TeleSign and North Atlantic Acquisition Corporation (an SPAC) Announce IPO Plan with EV of $1.3B. This one surprised me a little, identity management space is growing rapidly. TeleSign’s competitors are private, or part of large corporations in enterprise identity verification and credit rating. Being listed will require focus on meeting the $1.1B revenue by 2026, than building market share. However, before 2026 its likely investors and executives will have cycled making it someone else’s problem.

- Dialpad nabs $170 million Investment at $2.2B valuation

Best Wishes for 2022 🙂