The purpose of this CXTech Week 19 2023 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email or by my Substack. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Please Complete the Open Source Telecom Software Survey 2023

- Speech companies are failing at conversational AI

- Directly Competing With Open Source Is a Losing Proposition

- The Significance of Network APIs for the Telco Industry

- Where’s Microsoft?

- YouMail: 78% of survey respondents were targeted by brand impersonation scams

- Agenda for TADSummit 19/20 Oct, Paris

- People, Gossip, and Frivolous Stuff

Please Complete the Open Source Telecom Software Survey 2023

The purpose of this survey is to gather your experiences and opinions in using Open Source Telecom Software, and share an anonymized aggregate result with those that compete the survey. I’ll also present a summary of the results at TADSummit in October 2023.

This survey follows on from the surveys run in 2022, 2021, 2020 and 2019, with the results presented here: 2022, 2021 2020 and 2019. Thank you for your continued support.

Thank you to Olle E. Johansson, Sandro Gauci, Dave Horton, Arin Sime, and Alberto González Trastoy for your support in creating this year’s survey.

Here is the link to the Open Source Telecom Software Survey 2023. Please complete the survey by June 15th, thank you. It should take 5-10 minutes to complete.

Please answer what you can, ignore what is not relevant. This survey is broader than just open source RTC software, we also examine technologies, trends or topics relevant to all Real Time Communications, which generally runs on open source telecom software.

The sections covered in the survey include:

- Respondent Category Information

- Cyber Security Regulations

- Using and Contributing to RTC Open Source Projects

- Representation in RTC OSS Projects

- Will the Enterprise desktop phone ever disappear?

- Large Language Models

- Voice CPaaS Evolution

- Messaging (SMS/RCS/MMS/variants) CPaaS Evolution

- IP Messaging CPaaS Evolution

- Fraud and Identity CPaaS

- CPaaS Dashboard

- Where do you think open source projects can best help these parts of CPaaS?

- WebRTC

Speech companies are failing at conversational AI

Following on from Dave Horton’s TADSummit Special presentation in March, ‘Why conversational AI providers are moving to open source‘. In this article Dave provides 3 pieces of advice to speech recognition providers:

- fine-tuned control of endpointing,

- an API interface that includes relevant prompt, and

- suitable billing models.

“Endpointing” is a feature wherein the speech provider uses speech energy detection to determine the end of an utterance and then returns a transcript for that utterance.

Augment APIs with current prompt the user is responding to with their speech. Then, use that information to create more accurate responses. For example, I just prompted the user, “Could you please spell your last name?”, so the recognizer should now expect some spoken letters (i.e. don’t transcribe “T” as “tee”).

The billing model that most (all?) speech providers use is per-second billing, even though the voice gateway does not need recognition. A pause/resume feature on the API would be really handy.

Conversational AI has some unique requirements for speech recognition, and today’s speech providers are not meeting them. The result is that conversational AI experiences are by and large not matching the industry hype. Speech providers need to stop looking at transcription as a one-size-fits all solution and build the services that we in the conversational AI space need to create the experiences that will truly delight customers.

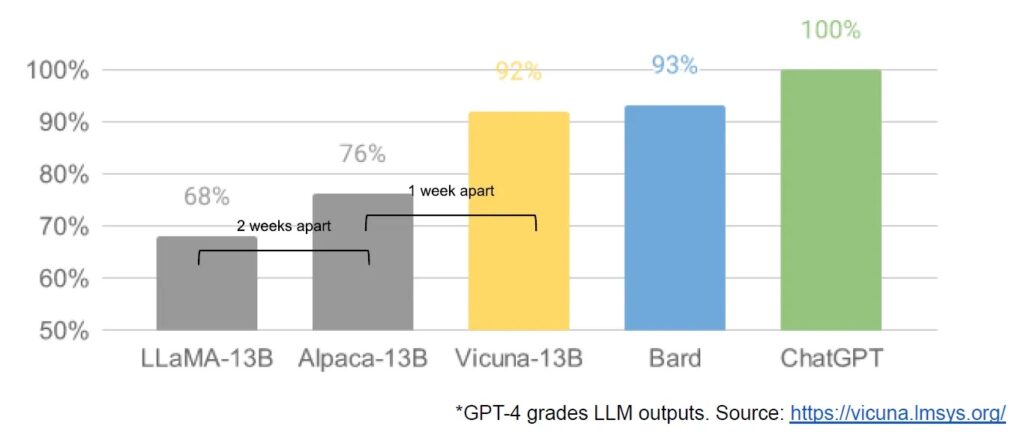

Directly Competing With Open Source Is a Losing Proposition

I like this quote from from a leaked Google report on AI. We Have No Moat

“Directly Competing With Open Source Is a Losing Proposition

This recent progress has direct, immediate implications for our business strategy. Who would pay for a Google product with usage restrictions if there is a free, high quality alternative without them?

And we should not expect to be able to catch up. The modern internet runs on open source for a reason. Open source has some significant advantages that we cannot replicate.”

At TADSummit we’re going to be exploring this theme for telecoms with companies such as jambonz, TelecomsXChange (TCXC), and stacuity. And the pipeline of innovations coming from mashing up open source AI and open source telecom software.

The Significance of Network APIs for the Telco Industry

Rolf Nafziger, SVP T-Global, wrote a piece on Network APIs. It prompted me to respond as its repeating the mistakes of the past.

“The Telco Industry has been here before with Network APIs: OneAPI (Parlay Gateway) and the cable companies’ trials with network QoS (turbo button).

Most video comms apps adapt to the network capacity available, where the app company has control and no network API costs.

The focus on standards helps make the claim that all carriers within a country can implement the same standard. However, voice, SMS/MMS/RCS, 2FA, PhoneID, silent verification, etc. all use standards, yet aggregators are required (e.g. Sinch, Telesign, Tru.ID etc.) to abstract the commercial, process, and technology differences.

I discuss the broader history of “Why has service innovation in programmable communications been difficult for carriers?” in this article https://alanquayle.com/2023/05/service-innovation-in-programmable-communications/.

Network equipment vendors are the right partners for network innovation with carriers, however, after several decades its clear for programmable communications, they are not the right partners. They walked away from their standardized Parlay gateways while Twilio, Syniverse, Vonage, MITTO, RingCentral, Telesign etc. built the programmable communications / aggregation business.”

I’m not saying, ‘go back to the drawing board.’ Rather recognise today’s and yesterday’s realities and focus where business is being made, rather than on technology-led wishful thinking. Meta made a miss step with the metaverse that cost it $700B in valuation. Big company’s make mistakes, just like small companies. Size and brand provide no protection.

Where’s Microsoft?

This was a fun article, where a question is asked, and the answer is known but not said. Working Group Two (WG2) is a company that spun out of Norway’s Telenor in 2017 to build a cloud-native mobile core that can be purchased by mobile operators.

Here are some of WG2’s TADSummit presentations from over the years:

- 2021: A multi sided marketplace platform for telco enabled products, Werner Eriksen

- 2020: Interview with, Erlend Prestgard, the CEO of WG2.

- 2019: Some (Surprising) Discoveries in Applying the as-a-service model in Running a Mobile Core Network, by Werner Eriksen, CTO Working Group Two (WG2).

- 2018: From Lego to Plasticine. Molding a platform for product development.

- 2016: A report from the kitchen; running a mobile core in the cloud, samples served.

- 2015: Building a Programmable Telco Core Network.

To date, WG2 has sold its mobile core to a few operators. Telenor uses it for its Vimla MVNO brand. The Hutchinson Group, which owns 11 MVNOs around the world, uses WG2’s technology. Recently the Hawaiian MVNO Mobi announced that it was using WG2 for its core network.

Asked who WG2’s competitors are, Erlend Prestgard said it’s the proprietary vendors such as Ericsson and Nokia along with younger vendors such as Mavenir.

In 2020 Microsoft bought Affirmed Networks, a company that did mobile core technology. And that same year it also bought Metaswitch, a company with an IMS stack as well as mobile core technology. I covered Microsoft’s plan in CXTech Week 3 2021, sell more Azure cloud.

Erlend said, “Microsoft would be our strongest competitor. And in theory it seems like they’re there. But we’re not seeing them in the market.”

Fierce Wireless reached out to Microsoft asking for a comment about what it’s doing with the Affirmed and Metaswitch technologies. Shawn Hakl, VP of Azure for Operators at Microsoft, sent this statement: “Microsoft products including Azure private multi-access edge compute (MEC), Azure Private 5G Core, Azure Operator 5G Core, and Azure Communications Gateway all foundationally leverage the technologies from our Metaswitch and Affirmed acquisitions, but are Microsoft first-party offerings scaled with Azure capabilities such as DevOps, security, analytics, and automation.”

Microsoft is selling Azure Cloud, they are chasing cloud infrastructure services spend. For the full-year 2022, it grew 29% to US$247.1 billion, up from US$191.7 billion in 2021, source Canalys. WG2’s open source adjunct core with a focus on service innovation is simply too small a market for Microsoft to care about. Microsoft knows carriers talk about service innovation, but spend on their network. Erlend knows this too 😉

YouMail: 78% of survey respondents were targeted by brand impersonation scams

Brand impersonation scams are on the rise according to research by YouMail. Brand impersonation schemes involve malicious actors deploying robocalls or text messages to impersonate a prominent company to scam the receiver into giving away personal data, account credentials, payments and more. The study found that scammers most frequently pose as financial institutions and package delivery companies.

More than three out of four of survey respondents (78%) said they have been the target of brand impersonation scams. This translates to well over 200 million people in the U.S. who have been targeted. The most common scams were financial services (51%), package delivery companies (49%), e-commerce sites and online stores (45%) and hospitality services (21%).

The brands I experience being impersonated (voicemails left from robocalls) are healthcare, telco, and cableco.

Agenda for TADSummit 19/20 Oct, Paris

TADSummit is the thought-leadership event in programmable communications for ten years. It runs on the 19th and 20th of October in Paris, France. We’ll be at Capgemini’s 5G Labs, Quai du Président Roosevelt 92130 Issy-les-Moulineaux.

The audience includes CxOs from many of the programmable communication companies, open source leaders, and telecom operators. It’s a strategic and technology event. Many of TADSummit’s sponsors go on to be acquired.

TADSummit remains the only place to get a no-BS (it’s in our policies) understanding of what’s working across technology, services, and go to market; and where things are going in programmable communications.

- Welcome

- Welcome to the Capgemini 5G Lab. Patrice Crutel, Technology & Platform strategy Director at Capgemini Invent

- Worlds Collide. The carriers try again with standardised APIs. Open source automates carrier wholesale, focusing on in-country wins. While one IoT door closes another opens, consolidation and innovation. Plus a quick review of the past years in programmable telecoms. Alan Quayle, Independent.

- Keynotes

- Telcos and Programmable Communications

- How TelecomsXChange is Transforming the CSP’s Wholesale Business. Ameed Jamous, Founder and CEO TelecomsXChange (TCXC).

- 2FA is (almost) dead, what’s next? Guillaume Bourcy, Founder Oofty.

- PaaS, the fastest growth and innovation catalyst for wholesale Telcos?Guillaume Bourcy, Co-Founder CIO Enabld.

- Review of the Capgemini 5G Lab, Use Cases, and Partner Opportunities. Patrice Crutel, Technology & Platform strategy Director at Capgemini Invent

- Open Source

- Open Source Telecom Software Survey 2023. Alan Quayle, Independent.

People, Gossip, and Frivolous Stuff

Maria Farooq is now Sr. DevOps Engineer at 1NCE. Joining Despina Ypsilanti, Henrique Rose, Fernando Mendioroz, and Jaime Casero.

Hugh Goldstein has joined WebTrit, as its first CEO. WebTrit is a software startup, developed by a talented team of innovators in Ukraine. I’ve known Hugh since his time in Voxbone.

Elayne Schulz id now Senior Manager, Program Management at Publicis Sapient. We first met when she was running marketing at BlueVia over a decade ago.

James Winter has joined Telescope Partners as their Head of Marketing. I’ve known James since his time at Nexmo.

Ingrid Ovaa-Jaspers is now Service Manager Service Point at the Ministry of Defence.

Brian Partridge is now Head of TMT Research at S&P Global.

Klaas Desot is now Sales Director at Backlight Streaming.

Normally it’s Twilio that’s advertising online in games, now Sangoma’s copying them.

You can sign up here to receive the CXTech News and Analysis by email, or by my Substack.