The purpose of this CXTech Week 23 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Open Source Telecom Software Survey 2021

- Sinch buys MessageMedia for $1.2B

- Webio receives €500k investment from Finch Capital

- A Trillion Dollar Paradox

- People, Gossip, and Frivolous Stuff

Open Source Telecom Software Survey 2021

The purpose of this survey is to gather your experiences and opinions in using Open Source Telecom Software, and share an anonymized aggregate result with those that compete the survey, likely in August. I’ll also present a summary of the results at TADSummit EMEA / Americas in November 2021.

Thank you for your support in completing the surveys.

Deadline to complete the surveys is July 7th.

This survey follows on from the surveys run in 2020 and 2019, with the results presented here: 2020 and 2019. Thank you for your continued support.

Please complete this general survey, and then choose the specific project surveys (separate forms) you want to provide feedback. If any question is not relevant or you have no opinion, just skip it. All the links are in this weblog.

Covered in the general survey this year are: Security, Serverless, STIR/SHAKEN, barriers and benefits of OSS, telcos and OSS, Training, IoT, and general geographic / category info. The project specific surveys follow the format of previous years with some customizations to make them more relevant to the specific projects.

Sinch buys MessageMedia for $1.2B

Last week in CXTech Week 22 2021 we mentioned Sinch had raised another $1.1B. Well it didn’t take them long to spend it. It wasn’t Clickatell, rather MessageMedia. Over the past couple of years MessageMedia had solid revenue growth of 22% yoy (in my CXTech landscape I had it at 25%).

In the twelve months ending June 30, 2021, MessageMedia expects to make $151 million in revenue, gross profit of USD 94 million, and adjusted EBITDA of USD 51 million.

MessageMedia are solidly SMS/MMS campaign focused. A business Sinch has been in for years. Last year they bought Wavy to consolidate their LATAM business messaging position, as reported in CXTech Week 14 2020.

The multiple here surprised me, EV/Gross profit multiple of 13.8x, and an EV/EBITDA multiple of 25.4x. This calculation is based on an enterprise value of USD 1.3 billion and anticipated earnings for the 12 months ending June 30, 2021. It’s ‘mobile marketing’ packaged in a easy to use SaaS model, with the usual integrations into hubspot, etc.

Some of the 2020 and 2021 growth will be pandemic related, telcos are raising their A2P rates putting a squeeze on this segment. It’s a good business and they are performing well. But 25.4X….

Also the analysts and commentators hyping this up as Sinch is now competing with Twilio are wrong. In business messaging Sinch has competed with Twilio for a long time. While in voice Twilio are more a customer. Voice and messaging aggregation are 2 quite different worlds, though they are converging.

Webio receives €500k investment from Finch Capital

Congratulations to Webio, a Conversation Intelligence specialists in the credit, collections and payments industry, has announced that it has received €500k investment from Finch Capital to complete €1.5m in pre-series A funding.

I admire the approach Webio is taking of finding a problem, and focusing their technology on solving that specific pain point. Once they’ve found the recipe what works, and have the data around the business impact; they can quickly dominate this segment, and move onto similar problems in the same and adjacent industries. Achieving a well-quantified business impact, is something missing in many bot deployments. Keep an eye on Weibo.

Webio is on a mission to rebalance the credit, collections, and payment ecosystem by shifting the balance of power back in the favour of the consumer. Giving them more control in how they engage with their lenders. By removing the unnecessary stresses and strains, it is now possible to deliver a more empathetic experience that customers really respond to.

The jewel in the crown is Webio’s ability to ‘move the needle’ in predicting conversation outcomes by analysing what is said and how it is said. Identifying characteristics such as a person’s potential vulnerability early and accurately, and then guiding that customer conversations through a range of best next steps dynamically is an example of a critical capability in this market. Webio clients can manage their collections conversations so they can know faster, act sooner, and do so with confidence.

A Trillion Dollar Paradox

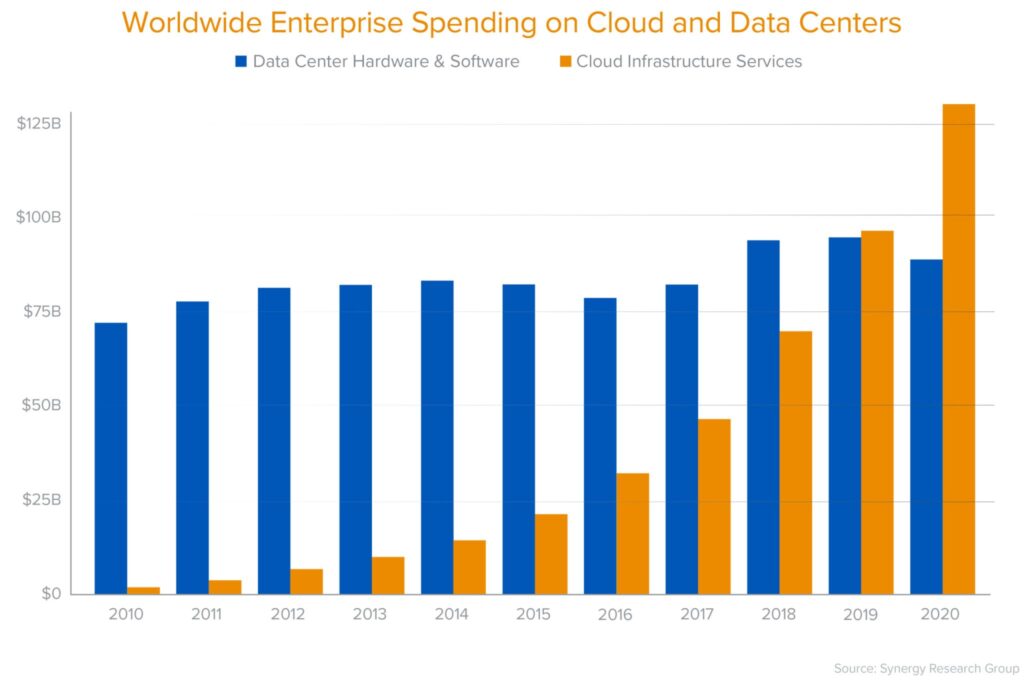

When you own your technology (you’re a technology company rather than an operations company), you own your roadmap, your customer experience, and your cost of operations.

Cloud delivers on its promise early in a company’s journey (growth phase), however, it puts pressure on margins as a company scales and growth slows. We’ve seen this through many examples such as Dropbox.

But the situation is more dynamic as the underlying projects (many of which are open source) evolve and improve, systems and processes become more efficient as optimization becomes more of a focus than managing growth. Also “the cloud” services and pricing evolves. New ‘integrated’ services can significantly impact architecture and economics.

I remember with Netflix’s device strategy moving from API-centric to building the apps themselves to better control end user experience. From an initial growth problem of how to we get on every device fast, to how do we give the best experience everywhere. While the pendulum likely only swung once for Netflix. For most businesses there’s a more complex balance between bare metal, containers, and bursting into the public cloud.

For operations company, e.g. telcos, Mark Newman posted on which IT workloads to move to the public cloud and when, reference the a16z analysis, on the longer term implications of reliance on public cloud makes.

We covered the workload issue at TADSummit EMEA Americas 2020 with a panel discussion “Serverless and RTC” across traditional telco (Sebastian Schumann), next gen telco (Simon Woodhead), developers from both communications (Tim Panton) and web (Jason Berryman), and programmable comms (João Camarate). This panel came about from the FinTech guys at TADSummit 2019 accusing the RTC guys of ‘yak shaving’.

Some workloads are ideal for serverless, particularly in development and testing. Also for workloads like data analysis, machine learning, transcription. Serverless is being adopted in comms, just not for the RTC core.

A hybrid approach seems state of the art, across bare metal, containers, and bursting into the public cloud. Telcos are taking an incremental approach, in part limited by their planning cycles. And open source telecom projects are moving into containers as well. Containerization should be considered BAU.

People, Gossip, and Frivolous Stuff

Congratulations to Frank Geck who is now Director of Advanced Solutions and AI at Five9. I’ve known Frank since his time at Tropo that was bought by Cisco. He’s a supporter and contributor to TADHack and TADSummit over the years.

Stuart Newstead added a position as Director at Good Food Oxford. I’ve known Stuart for a couple of decades, since his O2 days. Good Food Oxford is a network of over 140 businesses, charities and community groups working together for a healthier, fairer and more sustainable food system for Oxford.

Harry Behrens is now Founder, Chairman and CTO at bloXmove. Daimler Mobility blockchain platform.

Amr Adelawad is now Product Manager at Dsquares, loyalty programs. We first met when he was with Cequens.

Kojiro Hirate is now Founder and CEO at digifa. We first got in contact when I was putting TADHack Japan together.

Nick Read is now Head of Security Operations at 2degrees.

Natan Tiefenbrun is now Head of European Equities at Cboe Global Markets, we first met back in 2006 when he was running XConnect.

Dr. Brenda Connor is now Chief Architect, Mission Critical Private Networks at Ericsson.

Manish Mangal is now Global Business Head – Network Services at Tech Mahindra.

You can sign up here to receive the CXTech News and Analysis by email.