The purpose of this CXTech Week 10 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Okta buys Auth0 for $6.5B

- TADSummit Asia 2021

- Save the Date: TADHack Global, 25-26 September

- Dialpad and T-Mobile Announce a New Collaboration

- Twilio closes down its Fax API

- Gamma buys Mission Labs

- Just Add AI

- To leave 5G on or off on smartphones?

- NetNumber Acquires SiRRAN Communications and TD-Mobile

- 12M US homes eliminated their fixed broadband

- Zoom Revenue up 369% year-on-year

- Google’s ‘Privacy-First Web’ Is Really a Google-First Web

- People, Gossip, and Frivolous Stuff

Okta buys Auth0 for $6.5B

We’ve covered the identity authentication space for a few years. Mainly from a programmable comms perspective, beginning with 2FA, and expanding into insights like TeleSign’s Score and Smartnumber’s Protect. As the importance of these services grow, they start to run into broader IAM (Identity and Access Management) solutions.

Okta is one of them. It provides software that helps companies manage and secure user authentication into applications, and for developers to build identity controls into applications, website web services and devices. It was founded in 2009 and had its initial public offering in 2017, being valued at over $6 billion. 2020 revenues were $600M. Auth0 revenue was expected to be about $200M in 2021.

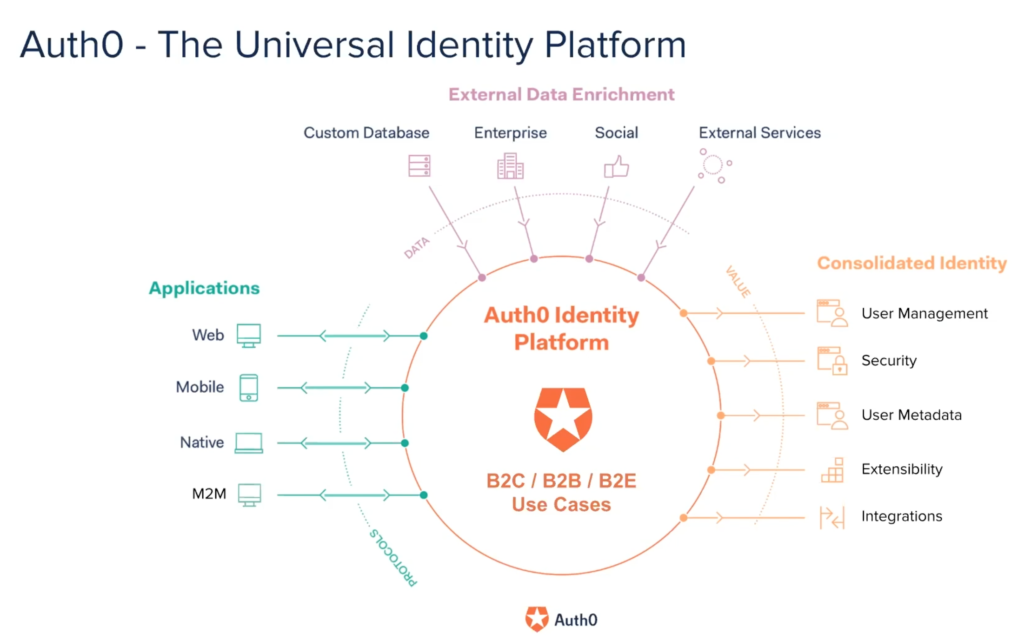

With Auth0 (pronounced Auth Zero), Okta gets a cloud identity company that helps developers embed identity management into applications. The diagram below shows its platform. It provides a load of APIs, SDKs, and integrations across the identity space. Of which TeleSign’s Score and Smartnumber’s Protect can integrate as External Services.

TADSummit Asia 2021 (online through May)

We have a session focused on “Identity and Fraud” at TADSummit Asia 2021, which I hope will include TeleSign. It’s a hot area, though getting people’s time is tough.

We have loads of world-class presentations to add to the agenda through March and April.

I’m particularly proud of the recently added keynote: Accelerating Women Tech inclusion with effective usage of Telco API, by Sammani Kusaladharma, Senior Executive at Ideamart, Dialog Axiata. The successful process Sammani and her team have developed has delivered: boosting Ideamart female community by 4x , aiding 30 new startups and created 4 millionaires.

Save the Date: TADHack Global, 25-26 September

- Thank you to Symbl.ai for being our first TADHack Global sponsor of 2021.

- TADHack Global 2020 ran through the pandemic, and we’re doing the same for TADHack Global 2021! We hope to have some in-person locations this time, as well as online. I’m going to be at the Orlando location – it will be in-person!

- We’re running the weekend before Enterprise Connect 2021. Some of the TADHack winners will present at Enterprise Connect on Monday 27th September, it’s the largest enterprise communications trade show in the world. Having hacks created from around the world over one weekend will demonstrate how easy it is to use the sponsors’ platforms to build the solutions enterprises need.

- We use https://tadhack.riot.im for communications, sign up if you do not already have an account. Here is the group for General TADHack Discussions

- Video collaboration will be provided by Simwood Meet. Location leaders will send out the URL for their location closer to the event via email and on riot chat.

Dialpad and T-Mobile Announce a New Collaboration

In Europe, mobile operators are one of the popular PBX providers to small and medium business with mobile PBX services. The desk phone legacy was not significant in Europe. So as mobile phones boomed in the ’90s, mobile PBX was an easy addon service, and has been relatively successful in the Nordic countries and Spain. The Dialpad / TMO deal reminded me of that proven success.

T-Mobile has selected Dialpad for its Business voice, conferencing, and contact center offer. T-Mobile will also become one of Dialpad’s largest customers, as the exclusive UCaaS platform internally for its employees. This is good in TMO using the service they sell, eating their own dog food.

While AT&T resells RingCentral, Verizon bought Bluejeans and Comcast bought Blueface. They also resell a number of providers to different business segments. But it does highlight the issue facing telcos on whether to own the technology or resell. Currently there’s enough margin and additional VAS to make resale work in the US.

Twilio closes down its Fax API

This one surprised me. Fax is an Application, not a network service. It’s definitely in the space where Twilio is strong, see this simple programmable communication model.

However Fax is a PITA (Pain in the A^$e). It’s a great litmus test of whether someone knows the telecoms business. If they laugh and say ‘who uses fax these days’, then they’re a lightweight. If they roll their eyes and go ‘Fax is a PITA’, they know the business. Given this PITA factor, I was a little surprised at Twilio’s Fax API business model, I assumed they had some smarts to reduce the PITA factor.

Check out this excellent presentation from Howard Avner from Voyant (who bought Phaxio, Howard was the founder / CEO, and also a TADHack sponsor) at TADSummit EMEA Americas 2019. Fax is like the postal mail, just faster and easier. To the Twilio fax API refugees, I strongly recommend you contact Howard, he’ll sort you out with a fax API that works, and stops it being a PITA for you.

Imagine a corner store, where people have limited computer skills or where a computer would go missing within hours. A fax machine can cost as little as $10-15, and just works. Its legally baked into lots of business processes. It’s part of social etiquette, where writing by hand to someone is considered more respectful than an email. In emergency management, it just works in many situations. Fax will remain in surprisingly rude health for some time, the challenge is for it not to be a PITA.

Gamma buys Mission Labs

Following on from the above discussion on TMO and Dialpad, Gamma has moved from reselling to owning the technology with the acquisition of Mission Labs, a well established UCaaS/CCaaS technology business which has built a reputation for creating technologically advanced solutions and delivering great service to its customers and partners. Previously Gamma resold Broadsoft, which given the UCaaS pricing points in Europe and Cisco pricing, made profits slim. Others like Telecom Italia have similar struggles, compounded by the fact they often use a channel for fulfilment, so payback can take years.

There’s a hefty multiple in this deal. Revenues were £3.4m in the year to 31 March 2020. Gamma Communications has acquired the business for £40.2m, with an additional £6m of deferred consideration payable over the next three years. That’s 13.6X ’20 revenue. Though likely 2020 accelerated their revenue, it could still be a 6-7X, which for a non-US transaction in the telecom sector is very good.

Just Add AI

This is a nice review of the edge AI landscape, specially around media processing, from DIGITS TO DOLLARS. Microsoft recently announced Azure Percept, its hardware and software platform for bringing more of its Azure AI services to the edge. That is embedding AI into cameras and other IoT devices.

The reason for edge AI is to limit the volume of data going into the cloud, and process it at the enterprise site. Or for security to keep the data onsite, or performance in making a decision in sub one second. It’s not necessarily all local processing; like Alexa, some decisions can be processed locally, and some can be sent to the cloud / offsite when the local uncertainty is too great.

The upshot of the analysis is the large hardware makers and buyers (e.g. Apple, Amazon, Samsung, etc.) are now all building their own chips with an AI focus, limiting innovation.

We see it across cloud based AI as well, not just edge AI. The big providers now have access to vast data sets. It enables them to create, no matter how specialized, engines that have a trained on enough industry and context specific data. It’s not about stuffing a convolutional neural net with terabytes of data, the GIGO paradigm applies. Rather the skill in training on enough appropriate data. As Dave Curran has discussed at TADSummit EMEA in 2019.

To leave 5G on or off on smartphones?

With every new G, the early chipsets are power hungry, it’s the first version. We had this with 3G and 4G in the early days. Today my 4G phone is, well, pretty good, it just works. My little Nokia phone would last almost one week on 2G, but with 3G enabled when it was launched it could be as little as 1 to 2 days! Remember those days of battery life! But by the mid noughties, things were good.

Verizon customer support tweeted over the weekend that if subscribers found their 5G smartphone batteries were “draining faster than normal” they should try switching their phones to LTE to save battery life.

A T-Mobile website suggests toggling between LTE and 5G to save battery life on Samsung Galaxy S20 5G phones.

This situation is normal, experts are ignored my most people, compared to slick 5G adverts. Which creates this dichotomy. But by 2023 things will be better.

NetNumber Acquires SiRRAN Communications and TD-Mobile

NetNumber has built a strong foothold in the private LTE network space with these 2 acquisitions, the defense and national security sectors are key to building out into many other industry sectors. Its signalling products and services are extensively used by telcos.

NetNumber Data Services are uses for global inter-carrier routing, roaming, voice and messaging. NetNumber multi-protocol signaling firewall, fraud-detection, and robocalling solutions help secure telecom networks.

SiRRAN offers a small footprint virtual EPC and a flexible, lightweight and programmable private core network software. NetCore is suited for use in a decentralized network model, and is deployed around the globe in tactical comms environments in support of defense and national security; public safety; and mining, oil and gas, and maritime industries.

TD-Mobile AG is an MVNO that enables subscribers to securely roam between private networks and a global network of more than 1,500 MNOs. This is an ideal solution for government and military agencies as well as enterprises operating in foreign countries that need to secure voice and data communications from the local mobile operator’s network.

12M US homes eliminated their fixed broadband

Fixed and mobile broadband products being separate has more to do with history than customer satisfaction. Fixed broadband came first, generally from the incumbent phone provider. Mobile broadband came later either from a different division of the incumbent, or one of the other mobile license holders in that country.

The main difference between 4G broadband and fixed home BB today is mobile has a low data cap (50GB), while fixed is ‘notionally’ >1TB. Though some claim you need to be closer to 2TB. My home consumption is in the hundreds of GB, but the info is no longer readily available from my ISP.

On performance, my 4G is twice download (200 mbps) and a quarter of the upload (25 Mbps) of fixed. Once 5G is rolled out then the performance for upload will be similar, though I’d still need to test out if it’s solid enough for running my business and reliable movie watching.

However, the data cap remains the main issue. That is a matter of time. I remember when data caps kicked in at 100s of MB in the early days of consumer fixed broadband. Cutting the cord for broadband, like pay TV will grow for those households / individuals whose broadband consumption is <50GB per month, or whatever the mobile data cap increased to over time.

Zoom Revenue up 369% year-on-year

The big question for investors, however, is whether Zoom can keep up its rapid growth. The company’s founder and CEO, Eric Yuan, pleased the markets Monday by saying it could.

“As we enter FY2022, we believe we are well positioned for strong growth with our innovative video communications platform,” he said in a statement to accompany the earnings.

Zoom said it expected total revenue for the financial year ending in early 2022 to be $3.76 billion to $3.78 billion, above Wall Street estimates.

Despite the bullish forecasts and rising stock price, Zoom’s shares remain well below their October high of more than $560. That reflects investors’ expectations that the reopening of economies will pull people away from the technologies that have become central to their lives. Also Eric recently transferred $6B of Zoom stock, as part of his estate planning. While many billionaires have done so this year, it would indicate the stock price may have reached a peak.

Google’s ‘Privacy-First Web’ Is Really a Google-First Web

Google has been planning for a while to phase out third-party tracking cookies in its Chrome browser, deprecating those bits of code that track and tattle on your browsing history for the sake of targeted advertising. It promised in January 2020 that they’d be gone by 2022.

We’ve known since 2019 that it was working on less-intrusive ways to target ads. Such as Federated Learning of Cohorts – where you advertise to a group to protect individual anonymity. Likely re-targeting is not going away as its effective, by a factor of 10. Because it takes 7 interactions to move a prospect to a customer. Though I do wish they’d close off retargeting once you’ve done a purchase. I moved to Mint Mobile, I do not need to see anymore Mint Mobile adverts. They do it so I talk about it – like this weblog, damn!

Across Google’s properties they know you quite well, just like Amazon and Apple do. The big guys win.

People, Gossip, and Frivolous Stuff

Michael Lauricella is now Director Of Partnerships at Nobl9, software reliability. I’ve known Michael since his time at Plivo.

Andrew Hamlett is now Director of Global Partnerships at MedFlow Clinical Ltd.

David Ferry is now Principal Software Engineer at Microsoft. He was the co-founder of OpenCloud (a TADHack and TADSummit sponsor), one of the first open source telecom software projects. OpenCloud was bought by Metaswitch, which was bought by Microsoft.

Tom Shnarr is now Product Management, Telecommunications, Media, Technology at ServiceNow. We’ve known eachother since his time at Sigma Systems.

Giacomo Vacca is now a Senior Voice Engineer at Subspace, which was founded by Bayan and William from Flowroute after Intrado bought them. I have a sneaky suspicion they’re going to give Agora some competition. It’s a real-time, latency-free internet connection for gaming, so parents do not need to hear the refrain “I’m lagging” all the time. We’ve known each other through his time at Truphone, Nexmo, and RTCSoft. Here is a great piece Giacomo wrote about TADHack Paris in 2015.

Torrey Searle is now Software Development Director – R&D International at Bandwidth. And a TADHack winner!

Phil Parfitt is now. Director, International Manufacturer Relations at Keyloop. I’ve known Phil since his Forum Nokia days.

Giles Corbett is now Co-founder, CEO at cloudshelf, in-store e-commerce to help independent retailers sell more and stock less. I’ve known him since his Orange Libon days.

Miguel Martin is now Head of Americas at Consultia Global.

Aaron Cole is now Vice President of Sales, Strategic and Cloud Initiatives at Alcatel-Lucent Enterprise.

Brian McNiff is now Transportation Principal at Faneuil, business process outsourcing. I’ve known Brian since Signalsoft / Openwave nearly 2 decades ago.

You can sign up here to receive the CXTech News and Analysis by email.