The purpose of this CXTech Week 6 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

FOSDEM 2021 – An Impressive Matrix-based Show

Not all the videos are posted. I’ll review more once they become available, they’ve stimulated quite a few discussions and lots of testing across different device, conferencing app, network configurations (but more an that next week). It was an excellent event, though I did miss some of the earlier presentations (the event runs on CET) as I slept in – a long story involving lots of snow shovelling and a car crashing into my garage door.

Matrix were the platform of FOSDEM 2021, it worked well especially given the scale of the event. Demonstrating the power of Matrix, and perhap the inflated valuation of apps like Hopin.

The rooms were much more lively than any other online event I’d attended. In part because of the people, most in the RTC group already use Matrix and knew each other. I’m hoping to use what Element created for the online part of TADSummit EMEA / Americas in November – yes we’re still hoping for in-person as well.

Below is the session Matthew Hodgson gave on “Building massive virtual communities in Matrix”. He explained all the features they’ve been adding to let Matrix scale to support massive virtual communities such as FOSDEM itself, Mozilla, KDE and others. This includes Spaces: the ability to group rooms into a hierarchy, for ease of discovery and management; Widgets: the ability to add arbitrary webapps to chatrooms to provide dashboards of additional functionality (e.g. the FOSDEM livestreams and video conferences); Threading: the ability (at last!) to support threaded conversations in Matrix; and Decentralised Reputation – the ability to empower users to tune out content they dislike on their own terms.

Their goal is to ensure no open source project ever uses Slack / Discord / Telegram to collaborate ever again 🙂 Finally, they gave a quick tour of the FOSDEM-specific work they’d done in order to run FOSDEM 2021 on Matrix! Its impressive, check it out.

Dialpad Achieves AI Milestone Analyzing More Than One Billion Minutes of Voice

Dialpad’s Voice Intelligence (Vi) combines automated speech recognition (ASR) and natural language processing to deliver real-time business optimization, including call coaching, automated note-taking, sentiment tracking, and transcription analysis.

After years of updates and more than one billion minutes of voice calls analyzed, benchmarking tests show Dialpad’s transcription model has now surpassed major competitors, including Google’s enhanced telephony model, for both keyword and general accuracy for their customers’ calls.

Dialpad’s CCaaS solution incorporates Vi to deliver real-time coaching, helping sales reps recommend solutions during calls while simultaneously letting managers monitor sentiment and uncover trends. If a customer asks about refunds, Dialpad’s platform will immediately bring up that information so that a support team isn’t scrambling to find details.

At the same time, the company’s automated speech recognition can recognize when sentiment turns negative during a call and will alert a manager who can step in and save the sale. Dialpad’s calling and conferencing products also leverage Vi to help keep track of conversations by eliminating tedious tasks like note-taking, so everyone can get the most out of every call.

I remember at Tropo this was part of the Ameche pitch, see below for some use case examples. 8 years later it’s nice to see its realization.

Man Loses $27,000 in Bitcoin to SIM Swap Scam

A 48-year-old man from Daly City, CA, claims to have lost approximately $27,000 of Bitcoin in a SIM swapping crypto scam.

He received a text from a person purporting to represent mobile carrier T-Mobile, who said his account was frozen after multiple attempts were made to change his password.

He later received a call from a blocked number. The caller identified himself as an operator for Ledger, the crypto wallet hardware company that held the man’s Bitcoin, informing him that his account had been compromised. The caller extracted his passcode and anonymous account identification numbers.

That was all the information the hacker needed to get into the man’s crypto wallet. When he checked his Ledger account, the man later saw that all of his funds (about $27,000 in BTC) were gone.

SIM swap is on the rise globally, we’ll be discussing this at TADSummit Asia in May (online). You can see last year’s TADSummit Asia presentations here.

Networks like AT&T, T-Mobile and Verizon offer the ability to add a PIN code to your wireless account, giving you an extra layer of security. Also, try to limit the amount of data you share online, as scammers use social media data to convince carriers they are the rightful account holder.

Proximus Acquires BICS and TeleSign

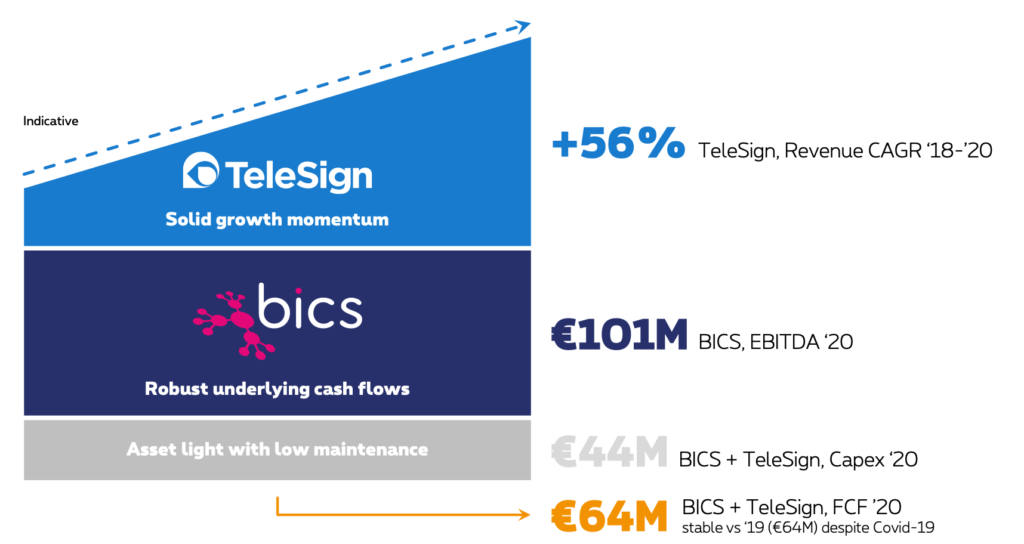

In CXTech Week 31 2020 I covered that BICS and TeleSign were up for sale. Proximus has acquired MTN and Swisscom’s shares in BICS (20% and 22.4% of issued shares respectively) for a total transaction value of €569 million, making Proximus the sole shareholder of BICS and TeleSign, with a relatively sweet deal for Proximus.

I think the mixed asset of BICS (telco interconnect) and TeleSign (Identity Verification and CPaaS) was tough for most investors to get their head around. With Proximus in control they can structure the two business to help TeleSign achieve its potential and investment in Identity Verification.

This link explains the deal and structure of the 2 businesses. And the picture below summarizes why the 2 assets are quite different, yet linked because of all the transaction data from BICS interconnect. As mentioned in the Dialpad article lots of data helps improve machine learning. Though it’s not that simple, as David Curran has shared at TADSummit since 2019, check out his first TADSummit presentation below on Designing and Deploying Chatbots from 2019.

TADSummit Asia 2021 Call for Presentations

I’m putting the agenda together for TADSummit Asia 2021, we’ll have the usual programmable communications focus (APIs); and we have special themes on conversational AI, identity, and fraud.

You can see what we did in 2020:

- TADSummit EMEA Americas (Nov 2020) – https://www.tadsummit.com/2020/emea_americas/agenda-emea-americas/; and

- TADSummit Asia (May 2020) – https://www.tadsummit.com/2020/asia/agenda/.

Its pre-recorded presentations, with Q&A online. Get in touch if you’d like to present.

On the TADSummit pitch to marketing:

TADSummit has run since 2013. It is the definitive programmable communications event. We’ve helped build the category, help many companies launch, grow, and be acquired. Its sister event TADHack is the largest global hackathon focused on programmable communications since 2014.

For TADSummit Asia 2020 (same format in 2021 because of the pandemic), some videos had 300+ views, many in the range 150-300, and some in the 80-150 views. Web page views were much higher, but I find video views are a more reliable metric as people are investing their time watching a video.

- Audience geography was Asia centric, about 80%, with India and Singapore #1 and #2, then a long tail of other countries.

- Breakdown across industries 20% telco, 20% enterprise, 40% programmable comms, 20% developers.

- Breakdown across roles CxO 35%, VP 30%, Director/Manager/developers 35%.

Chinese Programmable Comms provider Cloopen Group Raises $320M

While Vidyo was bought for $40M with $60M in annual revenue by Enghouse in 2019, and a similar Chinese company Agora raised $360M in a 2020 IPO, with 2019 revenues of $64M. Following that trend a CPaaS/CCaaS/UCaaS (enterprise comms) provider Cloopen has raised $320M on about $110M revenue, giving it a valuation of $2.4B. The Chinese market is definitely hot. I’m not convinced on the international growth potential of Cloopen, but it is and will continue to do well in the SMB Chinese market, regulation dependent.

Softbank-Backed Sinch Is A Screaming Buy

After reading this article I realized I need to do a more detailed post on what’s happening in the programmable comms market. There are several partially understood concepts from which incorrect conclusions are drawn.

There’s the classic, “Twilio focuses on developers and they win the lion’s share of new developers.” Which is true, but it’s a means to an end. Twilio also won the lion’s share of web companies, one account with global coverage, like Uber. Because they look and feel like a web company, not a legacy telecom aggregator.

Now Sinch has also focused on those global web account and inserted itself, displacing some of Twilio’s business, e.g. Uber. But the value add there is slim. Uber is a technology company with large volumes of comms traffic and understands the wholesale telecom business. Note most of the large UCaaS / CCaaS providers cut wholesale interconnect deals, not CPaaS deals. Those that initially did not, e.g. Talkdesk, now have; note they grew from an CCaaS built on Twilio, which is now a competitor with FLEX.

Sinch, as was reported in the review of 2020, has been busy buying up competitors, like SDI (SAP Digital Interconnect) for $250M. This move is also known as consolidation in messaging aggregation, volumes up, costs down (hopefully) and hence margins up. Now the impact of this consolidation will be slowly felt in the market because of people, processes and technology – all 3 need to change for change to happen. That is, legacy businesses change slowly, but they do change.

Unrelated to this article, but is also pushing me to write a post is the jabber in the press that the CPaaS business is moving into value added services in 2021. Away from atomic APIs like calling and messaging. Just look at Twilio or Vonage’s business to see they’ve been way more than CPaaS for years. The focus of TADSummit has been on those VAS since 2013. Companies like TeleSign, started on VAS (2FA) and grew into the programmable communications business. SMS aggregators like Infobip have omnichannel messaging VAS for contact centers. So the VAS focus, is not new. Anyway, I must take a deep breath, and get to that post sometime soon.

People, Gossip, and Frivolous Stuff

Well done to Pratama Putra who is now Head Of Technology at ProSparkID. He was part of a winning team at TADHack-mini Japan back in 2016 with home bot. It’s always great to see the progress of TADHack winners.

Congratulations to Karen (Bruce) Rohrkemper who has an additional position as Director – Board Of Directors at Warriors4Wireless. I worked with Karen when she was with Cincinnati Bell.

Paul Took is now Regional Sales Director at AppDynamics. I’ve known Paul since his days at Red Hat focused on the telecom vertical.

Izet Ahmetovic is now Scrum Master at Swisscom. I’ve known Izet back when Swisscom were working out their API plans, expose versus consume internally.

Mikhail Nekorystnov is now VP of Engineering at ServiceChannel. I’ve known Mikhail since he headed up network operations at Five9.

David Vigar is now Director, Alliance Partnerships at Twilio. I’ve known David since his Nexmo days back in the UK. He stayed with Vonage after the acquisition, was at Google in the messaging business, and is now with Twilio.

Philip Stanfield is now Business Development Director at Aspect Software. We have BT in common, but we first met when he was at SLA Digital.

You can sign up here to receive the CXTech News and Analysis by email.