I’ve noticed some common mistakes from analysts when they review the CPaaS, UCaaS, and CCaaS market(s). Or the enterprise communications market (employee and customer) to take a customer-centric view.

The mistakes stem from several sources:

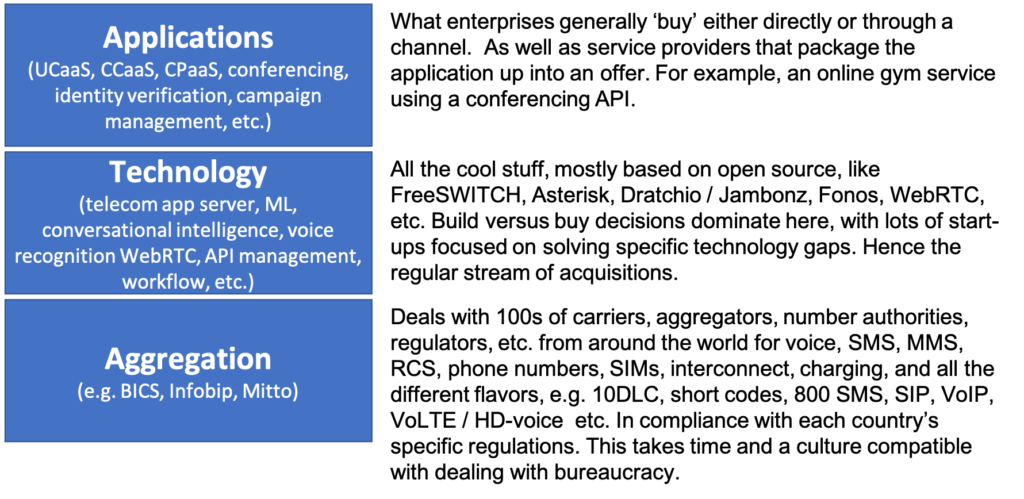

- Grouping aggregators and CPaaS together as ‘CPaaS’ providers, it’s a bifurcated market, as explained in the simple programmable communications model, between aggregators and application providers. Syniverse (aggregator) is a supplier to Twilio (telecom/communication applications of which CPaaS is one), they are not CPaaS competitors, the overlap is slight. Twilio recently invested $750M in Syniverse, they wouldn’t do that if they were direct CPaaS competitors. Their customers are different, their offers are different; yes they offer communications APIs, but that’s the same as saying they both use software.

- The ‘CPaaS’ business is much more than voice, video, messaging, and phone number APIs. Twilio is one of the largest SIP trunking providers in North America, and even today the traditional carriers have not achieved a competitive reply. This failure to catch up is an interesting case study linked to owning the technology and roadmap. The telco community are re-evaluating whether they can become a techco. At TADSummit we’ve discussed this throughout its 10 years history, here’s some examples from Play in Poland and Airtel IQ in India; and we will discuss again in this year’s TADSummit agenda. Bottom-line, when it’s kept under the radar, yes a telco can own its technology and roadmap. However, as Gustavo Grodnitzky says, culture trumps everything, and if that business gets noticed, history repeats itself.

- The programmable communications market is constantly evolving, and faster than enterprise communications has in the past. Twilio tends to be a first mover on the M&A front e.g. customer data (bought Segment in 2020), email (bought SendGrid in 2018), security (bought Authy in 2016 and Boku (which bought Danal) in 2022), IP messaging, industry vertical solutions/workflows/services, regionalization (bought Zipwhip in 2021 after it gave up suing them), storage (keep an eye on Telnyx), vCon (check out the vCon workshop summary), Twilio FLEX (opening up a new channel to market for CCaaS through small integrators / resellers, Blacc Spot Media is an example), and the broader move to services as in the limit that’s what enterprises buy, not APIs. Here’s a fun article on the Great API Con. We’ve also seen lots of conversation intelligence and chatbot M&A from the UCaaS and CCaaS providers, generally acquihires, as there’s still much work to do in this space, as covered in the TADSummit 2022 agenda.

- The SMS aggregation business has a checkered past, remember pSMS and the dodgy business practices? Some aggregators have knowledge of what mobile phone numbers may respond to campaigns, and those that have never. They could avoid sending 33% of the messages for a campaign with little difference in response rate, yet charge the customer for all of them, perhaps that’s why the margins look so razor thin / negative for some routes? There are other revenue ‘opportunities’ on settlements, termination rates, and carrier revenue shares in the SMS aggregation game. This specialized industry has lots of backroom deals yet seems to often get labelled CPaaS by the aggregators, because they want the valuation multiples of Twilio (which is a special case in CPaaS).

- There is a common technology core for most of the platforms, generally built on open source telecom/communication application servers, though Twilio has built its own, an exception to the rule. The integrations, services, and applications built on top of this common core are diverse. For a UCaaS to build a CPaaS is not difficult, they already have the APIs, it’s just a matter of exposing them to their customers. But the UCaaS provider focuses on augmenting their core offer with services their enterprise customers need. What a UCaaS offers to existing customers, is quite different to what a CPaaS offers. Claims of one being more innovative than the other make little sense. Generally, an enterprise buys employee comms/collab system, then adds integrations, adds workflows, adds some customer comms, and may even expand to a full contact center. It’s a staircase of commitment.

- The types of customers across programmable communications are varied. Some serve other aggregators because they have access to countries others generally do not, e.g. regional SMS aggregators. Some CPaaS enterprise customers have a legacy call enter or PBX that the CPaaS augments for marketing or operational workflows. Some leverage their existing customer base with the addition of programmability, or composability to avoid it sounding too geeky. Its generally incremental services with usage or subscription pricing on their platform.

- Selling enterprise comms is a complex businesses, it’s not green field. Local channels, resellers and integrators are important. Its an evolving battlefield, RingCentral is squeezing out Cisco in the telco channel for enterprise employee communications (PBX and Collab). While some telcos build out SME solutions, see Play in Poland above.

- The following is a statement of the obvious: the present and future are shaped by the past. Any analysis of an organization must include its history, as today is temporary, it’s simply a stepping stone to tomorrow. When Twilio began, I would be asked about their revenue composition, many thought it was 90%+ SMS, they’d underestimated SIP trunking and programmable voice. Web-centric voice and SMS APIs were how Twilio got going in a time when the alternatives were too complex and specialized. Today Twilio delivers a number of industry focused solutions / workflows across marketing, operations, customer care; and yes they have some plain vanilla SMS APIs if you want them. But that is not the focus of their business. They are much more than a CPaaS.

- Don’t believe the hype (i.e. what marketing / AR say, or is on their website). For example, if an aggregator (predominantly SMS aggregation business, 95% revenue), claims to be a CPaaS because it also offers a voice API. Quantify the actual revenue through their voice APIs, and compare the voice functionality. Generally, it’s a simple add-on for existing aggregator customers, they cannot compete with say Telnyx or Twilio for just that voice API.

- CPaaS, UCaaS, CCaaS came about when cloud was cool. Today it’s simply expected. You’re using someone else’s computer, and depending on workload and scale it may or may not make business sense. It’s all about enterprise communications between employees or customers. We need to move away from tech acronyms and focus on market needs and situations as that defines which vendors are appropriate in programmable communications.

My recommendation for analysts is focus on specific customer market segments or capabilities rather than which technology acronyms you assign to a vendor. It’s all just programmable comms and the enterprise situation defines which vendor they select more than who is in what magic shape across UCaaS, CCaaS, and CPaaS. Is it a team augmenting customer communications as working with the legacy contact center is too difficult / expensive in North America? Or is it a soup to nuts enterprise-wide communications consolidation in Asia?

As a buyer, have a clear statement on what you’re looking for, why, and what existing vendors are not being replaced any time soon, as some could be extended to meet your need. But organizational politics also play an important role, the e-commerce team may simply want to avoid any legacy deals because of legacy pricing, slow response, and lack of control.

If you’re in Finance, looking for a Collections and Recovery solution, there are a number of specialist solutions as well as workflows within broader platform offers. If you’re looking to migrate from a legacy hosted PBX provided by your carrier; there are a number of employee communication solutions available both direct and potentially through your carrier. The enterprise’s need and situation define what parts of programmable communications make sense to fulfil their needs.

The programmable communications market is diverse, consolidating, and evolving faster than enterprise communications has in the past. It’s at the intersection of web-speed and telecom-speed; hence why the telecom/communication application side of the business evolves faster than the traditional telecoms business. BUT whenever enterprise are involved, remember, don’t fix what isn’t broke is the philosophy of about half the market. That’s why there are still dusty old on-premise PBX in basements.