The purpose of this CXTech Week 20 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Following advice, I’m including a small pitch for my consulting services in this newsletter, many readers are unaware I consult. I’ve helped larger clients with innovation workshops, simply bring real customers into their offices, listening to their problems, and discuss ways those problems could be solved. Most problems have nothing to do with telecoms, but for the few that do it’s amazing the see the energy created in the room as we craft hacks. I’m an Engineer who’s been independently consulting for a couple of decades, “I know stuff and people” 😉 Contact me here.

Covered this week:

- TADHack Global 2022 Registration Open

- LINK Mobility Update

- 5G, Napoleon, and Acceptance

- Bankers, brokers and City managers have WhatsApp ‘blind spot’ despite £160m fine for JPMorgan

- Comfone powers Stacuity’s global programmable network for IoT

- And Another Conversation Intelligence Acquisition, Zoom buys Solvvy

- Twilio Invests $750m in Syniverse

- People, Gossip, and Frivolous Stuff

TADHack Global 2022 Registration Open

TADHack registration is open!

Check out ‘Choose your location’ on the TADHack landing page. Click on the location you can attend, and then on that specific location page click on the register button. You’re now on the TADHack Global 2022 list. The Location page contains the address, schedule, and other important information about the specific location. If there is no location close by, you can take part in the Global Remote.

We hope to have the sponsors finalized soon. And some of the location pages need an update, but we’re good enough to make registration open 🙂

Plans for TADHack Global 2022

TADHack is the largest global hackathon focused on programmable communications since 2014. This year we are partnering with Network X (Broadband World Forum, 5G World, and Telco Cloud) as the pre-event hackathon. This is similar to what we do before Enterprise Connect with TADHack-mini Orlando in March. On 18th October we’ll have an opportunity for some of the TADHack winners to present at Network X to leaders from large multinational corporations to exciting start-ups from around the world.

STROLID is a new sponsor for 2022. They are leading the creation of vCon, an open standard for sharing conversation data. This new will enable some powerful hacks!

At TADHack Global 2021 Symbl.ai achieved an amazing result, 21 hacks, and Telnyx was even more impressive with 30 hacks; all created over one weekend by developers from around the world.

The locations we anticipate running are: Chicago, Tampa, Colombia, South Africa, Berlin, UK, Sri Lanka, Amsterdam, France, and remote (anywhere in the world). We are adding new locations, e.g. TADHack France (run by Le Voice Lab), and Amsterdam as we are the pre-event hackathon to Network X.

We had great success with TADHack Teens in Sri Lanka in 2021 thanks to hSenid Mobile and Ideamart, and plan to expand this initiative to South Africa and the US. We’re training the next generation of programmable communications engineers and entrepreneurs, as well as excellent summer interns!

We have two additional initiatives for 2022:

- Accessibility / Inclusivity prize with judges Chris Lewis of Lewis Insight and Manisha Amin, CEO of The Centre for Inclusive Design. Check out their resources to help your hacks.

- TADHack Founders Academy to help hacks build product/market fit, seed financing, and preparing for series A using the experience of everyone involved in TADHack.

In 2022 TADHack Global will be bigger and more impactful than ever! TADHack is for everyone, wherever you are in the world. Join us on 15-16th October to learn lots, have fun, perhaps win some of the cash prizes, and make a difference.

LINK Mobility Update

Last week we covered their stock drop in CXTech Week 19 2022. We’ve also covered some of Link Mobility’s acquisitions in the CXTech newsletters, here you can see how busy they’ve been on the M&A front. They’re sort of a roll-up of roll-ups.

This week the CEO stepped down, no surprise. The question is how they will resolve the integration head ache during a possible downturn? The confusion between Applications (Twilio) and Aggregation (Link Mobility) remains, I pointed this out in the Simple Programmable Communications Model. In the press release above they conflate A2P aggregation and CPaaS. That’s partially behind the stock drop.

Below is another company in the Aggregation / CPaaS gap, Bandwidth, we’ve mentioned this in several of the newsletters over the years. They do not have the integration headache of LINK Mobility, so are in a better position.

5G, Napoleon, and Acceptance

I was reading this quite sensible article from William Webb on 5G. And that got me thinking about why we have such a dichotomy between the 5G hype (often belief-based with little in the way of rational analysis) and counter arguments (generally based on rational arguments referencing history); same with mobile edge compute (not edge compute, that’s something different, yet conflated); same with ORAN (latest positioning is you’ll spend the same, saving are in operations <sniggers at the old chestnut to avoid impacting network revenues>), the list goes on.

So I wrote an article on Acceptance and TADHack Founder Academy. I reviewed how the industry is behaving rationally given the mutual dependency between carriers and their strategic network vendors. However, there are gaps in this mutual dependence, the network vendors are focused on network solutions. Communication services have become impoverished cousins over the past two decades.

I titled this article Acceptance, as the telco:network vendor mutual dependence is not going to change, it’s decades old. Accept it.

Over the past decade the budgets for service innovation have all but collapsed. I see so many service innovation projects never get going because there’s no cash, while millions get spent on network related stories that haven’t even proved customers will buy. There is no easy answer to this situation, there are success cases, such as Ideamart. But they are few and far between.

The point of the weblog:

- Accept the mutual dependence of telcos and their network vendors. Rational analysis will not change their belief-based strategy, the network invoices must continue to be paid.

- Focus on helping service innovation, one example is TADHack Founder Academy, it’s a work in progress and we’ll have more on this soon.

- For the Telco execs, set aside funding that is considered spent right from the start of the year so it does not disappear. Support service innovation with local innovators who are solving local problems that matter using the proven start-up innovation model.

Bankers, brokers and City managers have WhatsApp ‘blind spot’ despite £160m fine for JPMorgan

We’ve been here before with AIM (AOL Instant Messenger), it was once popular with traders. Then the regulators woke up to the information being shared over AIM, then an ecosystem of companies emerged to monitor the messages shared over a ‘trader’ instance of AIM. AIM died in 2017, and traders had moved onto SMS, iMessage, and other social media messaging apps including WhatsApp.

A poll of 100 investment banks, brokers, and investment managers, found that just 14 per cent actively carry out effective supervision or surveillance over WhatsApp. These findings come following JPMorgan’s $200m fine, or £160m, for failing to monitor their employees use of WhatsApp and attempting to rely on an outdated policy of prohibition.

AIM provides a template, though I doubt Facebook will be as compliant. Matrix provides an ideal solution for bridging. Back in 2019 they did a nice weblog on it.

Comfone powers Stacuity’s global programmable network for IoT

We’ve covered several of Stacuity’s recent announcements, such as Stacuity and JT IoT partnering. They’ll also be presenting at TADSummit 2022 in November, “Time to ditch the ‘dumb-pipe’ – reinventing the core mobile network, to put developers first.” TADSummit website is coming soon.

Comfone has been providing roaming services to mobile operators, MVNOs, MVNEs, OTT web services, IoTs and M2M customers worldwide for 25 years. Comfone offers its customers all required services to establish roaming connections from a unique ecosystem, the Key2roam Platform (IPX, Data and Financial Clearing, Hub, DMS).

Comfone enable Stacuity to launch and scale our global, programmable mobile network for IoT and enterprise applications.

Netflix Long Term Subscriber are churning

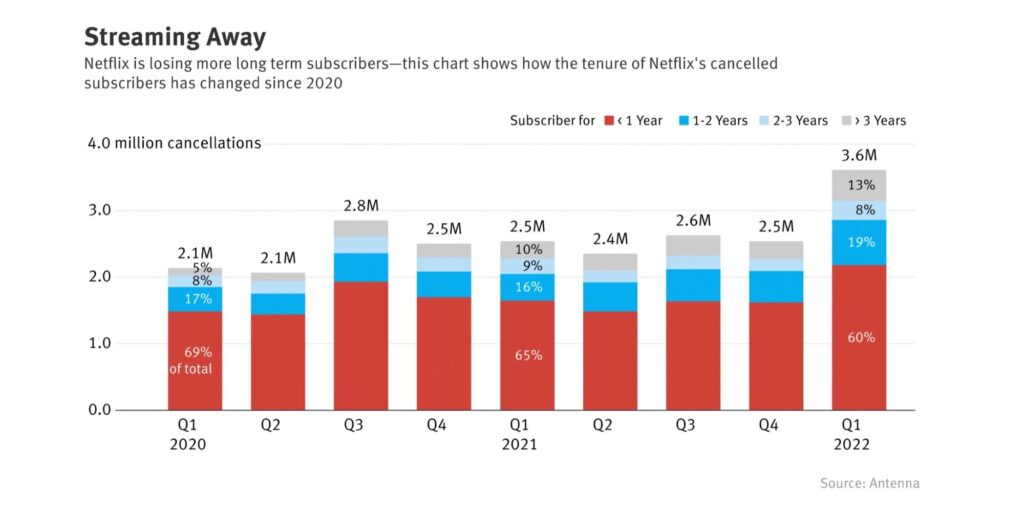

Data provided by the research firm Antenna shows that people who had been subscribers for more than three years accounted for just 5% of total cancelations at the start of 2022, while it hit 13% in the first quarter of 2022. While Q3 2021 was a similar figure, historically long term subscriber churn has been surprisingly low.

Series 3 of Love Death and Robots is now on Netflix, yeah! While we wrap up Outer Range on Prime. And in June there’s season 3 of The Boys on Prime – for all those that find MCU formulaic and a bit creepy. Seriously, the world is not divided between good (people you agree with) and bad (people you disagree with). Below is an excellent video from John Cleese on extremism.

And Another Conversation Intelligence Acquisition, Zoom buys Solvvy

Solvvy will broaden Zoom Contact Center’s offering with scalable self-service and conversation AI. Zoom’s customers will benefit from an automated, integrated, and easy-to-deploy contact center, which will help answer end-customers’ questions and solve issues faster – improving the overall customer experience and driving operational savings.

Twilio Invests $750m in Syniverse

Back in CXTech Week 7 2022 we covered Syniverse IPO though SPAC was cancelled. And we mentioned Twilio could invest $750, and looks like they closed the deal before the possible recession hits. Likely maintaining a key supplier’s stability made more sense than trying to get an asset on the cheap.

People, Gossip, and Frivolous Stuff

Ayoub Cherkaoui is now Senior Product Manager Emerging Technologies at TELUS

Deniz Gokcen is VP of Product, Platform at Yapily. We first met in Turkey where she worked for Garanti BBVA Teknoloji.

Marc Abrams is now Senior Product Manager at Nextiva. We first met during his time at Telestax.

Dave Carnero is now VP Revenue at Padam Mobility

Yusuf İzzettin Horasanlı is now Client Engineer Solution Architect at IBM. I’ve known him for close to one decade, since his time in Turkcell.

Kasun Karunasekara is now Associate Software Engineer at Mitra Innovation!

Sachin Sharma is now Partner Sales Lead – NEP, APAC at Red Hat. I’ve known Sachin for over one decade, since he was with Comverse.

Francisco Camejo is now Salesforce Industries Solutions Architect at Arcsona. He was a winner at TADHack Uruguay, when he was 19 years old.

You can sign up here to receive the CXTech News and Analysis by email.