The purpose of this CXTech Week 7 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Symbl.ai at TADHack, Developer-First Conversation Intelligence

- TURN 101: A Subspace Guide to NAT Traversal

- Syniverse IPO though SPAC Cancelled

- Broadvoice to Officially Roll Out GoContact BPO Offering

- US to add more than 100 million Streaming Subscribers

- For those heading to MWC22, a Blast from the Past, MWC14

- People, Gossip, and Frivolous Stuff

Symbl.ai at TADHack, Developer-First Conversation Intelligence

Excellent testimony from developers at TADHack Global 2021 and 2020 on what they achieved with Symbl.ai, developer-first conversation intelligence.

I do want to give a shout-out to the creativity and talent of all the hackers that take part in TADHack, especially: Adela Bootha, Talhah Patelia, Lily Madar, Steven Goodwin, Solange Ormeno, Massi Escano, Haritha Diraneyya, German Gamboa, Mike Groff, Hunter Henry, Ebtesam Al Haque, Doug Moore, Amy Sliwinski, Muntaser Syed, Vincent Tang, Davindra Tulsi, Chris Woodle, Mike and Elias Cairns, Muhammad Hamza Nasir and Justin Williams. Well done and thanks for the quotes 🙂

TURN 101: A Subspace Guide to NAT Traversal

My 12 year old son’s been keeping online tabs on me. He sees me standing at my desk, swearing at my laptop. But he knows I must do more than that to earn a living. So he searches online to see what I’m upto.

This week he asked out of the blue, “what’s turn?” My dad-response was, “I need more context, turn can mean many things.” We’re at that development stage where if a question can be reduced to one word, it will. But he was ready for my question, “Traversal, Relays and something else”.

My explanation didn’t cut it, he looked confused and a little annoyed. He was asking as he’d seen the article I wrote on “Subspace WebRTC-CDN Experiences. Where is Subspace taking us?” He understands what WebRTC does in principle, enables devices to do video comms over the internet, like his Zoom calls.

But this network stuff was just gobbledygook. This was hard, I didn’t want to snuff out his interest with a poor explanation. Fortunately the diagrams in the Subspace article, “TURN 101: A Subspace Guide to NAT Traversal” provided excellent visual aids. Another shout-out, this time to Giacomo Vacca for his excellent work in this article for helping me explain enough of TURN that my son phrased it as “a computer on the internet that sees both parties when one of them is blocked by NAT, and it uses all the TURN protocol stuff <waves his hand back and forth for the message flows he saw with no interest in remembering>.”

Then more questions came, but dinner was over, and he had his saxophone practice to complete.

Broadvoice to Officially Roll Out GoContact BPO Offering

We covered the acquisition of GoContact by Broadvoice in CXTech Week 29 2021. And why is made much more sense than Zoom buying Five9, which ended up being cancelled.

Broadvoice, a provider of hosted voice, unified communications (UC) and SIP Trunking services for businesses, will showcase its new contact center solution for the business process outsourcing (BPO) vertical at the Call & Contact Center Expo US (16-17 March). The new product is offered through Broadvoice’s merger with GoContact.

Syniverse IPO though SPAC Cancelled

Given the uncertainties in outlook with the Fed trying to get inflation under control, a potential war in the Ukraine, murmurs about recession, and too many SPACs chasing too few deals. Cash with earned interest has become preferred for the SPAC investors rather than growth stocks. There are at least 6 SPACs that have cancelled plans this year, so it’s nothing to do with Syniverse’s business, rather financial fashion and timing.

We covered the SPAC plan for Syniverse in CXTech Week 33 2021, with Twilio investing upto $750M. I covered the span of control issue limiting Twilio’s interest in owning such a telco-centric asset.

Syniverse has over $1B in debt. Carlyle group will be looking to cash out soon on Syniverse, they’ve been holding it since 2010. It’s not in the same category as Twilio, it’s unlikely to see much more appreciation in value given carriers’ A2P price rises.

Time is on Twilio’s side, but to ensure stability of a significant cost (SMS A2P termination in the US), Twilio does need to ensure Syniverse continues. It could buy Syniverse and keep it at arms length, but culturally they’re quite different. It will be interesting to see how this one plays out, Carlyle will be the driving force, realizing the value of its investment from 2010. The clock is ticking…

US to add more than 100 million Streaming Subscribers

This one surprised me, I wasn’t expecting such growth. I’m seeing streaming subscription fatigue across many segments of the payTV market. We’re going to see some rationalization in a post-pandemic world as people look to contain rapidly rising household costs. Also YouTube continues to improve its TV experience at the bottom-end of the streaming market with ad-supported content. Current favs are the Great Canadian Baking Show and SORTEDfood (UK), not sure why, just fun and easy viewing; than something hardcore like All of Us are Dead on Netflix.

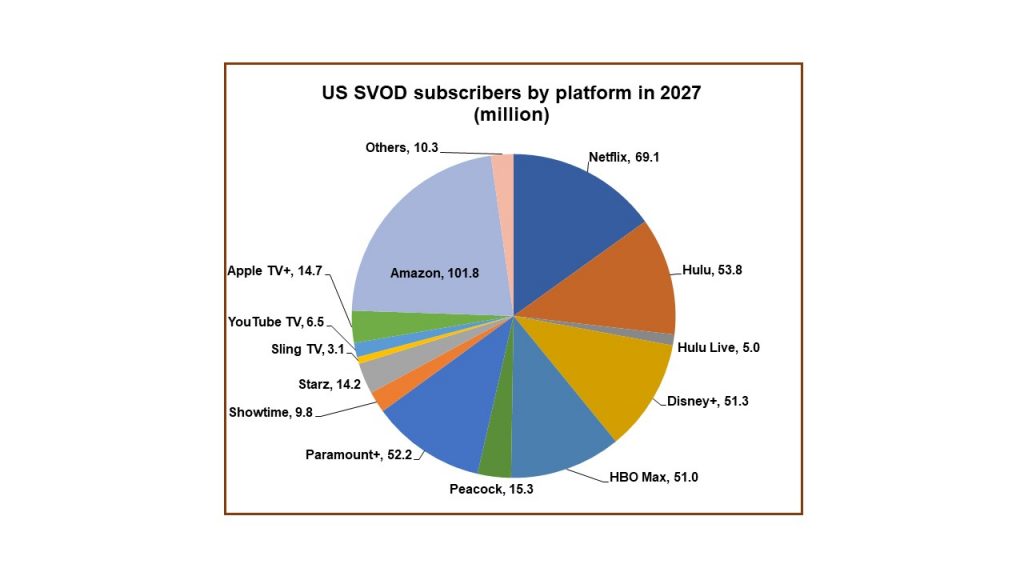

In CXTech Week 6 2022 we reviewed US PayTV would dip below 50% by 2026. Cable dropping from 64.5M (2010) to 41M (2027), satellite from 33M to 14M, and IPTV from 7M to 4.4M.

According to Digital TV Research, gross streaming subscriptions in the US will climb from 354 million at the end of 2021 to 458 million in 2027.

In terms of saturation, about 86% of TV households will subscribe to at least one Streaming service by 2027. The average streaming household will pay for 4.37 services by 2027. We pay for 1.5 Netflix and the Amazon Prime. If there is something we really want, we occasionally buy that content, as its more economic than yet another subscription.

Netflix is predicted to only add 2 million subscribers between 2021 and 2027, which is close to my model (3M). Newer platforms Disney+, Paramount+ and HBO Max are predicted to add 12 million, 26 million and 31 million subscribers respectively. The Paramount+ number surprised me, I have it closer to 15M.

My assumption is by the middle of this decade the streaming services will have worked out which content works for their customer base, Netflix is already quite good at that. There are ‘segments’, for example, Disney+ just does not appeal to us, enough with all he MCU and Star Wars rehashes. We’ll see some entrenchment around those ‘segments’, and possibly towards the end of the decade consolidation as streaming becomes the primary content distribution platform. That is 458 million streaming subscriptions versus 60 million payTV, 7.5 times the number of subscriptions, though revenues are quite different.

For those heading to MWC22, a Blast from the Past, MWC14

It looks like MWC22 will see a return to the good old days, I see quite a few people planning on being there.

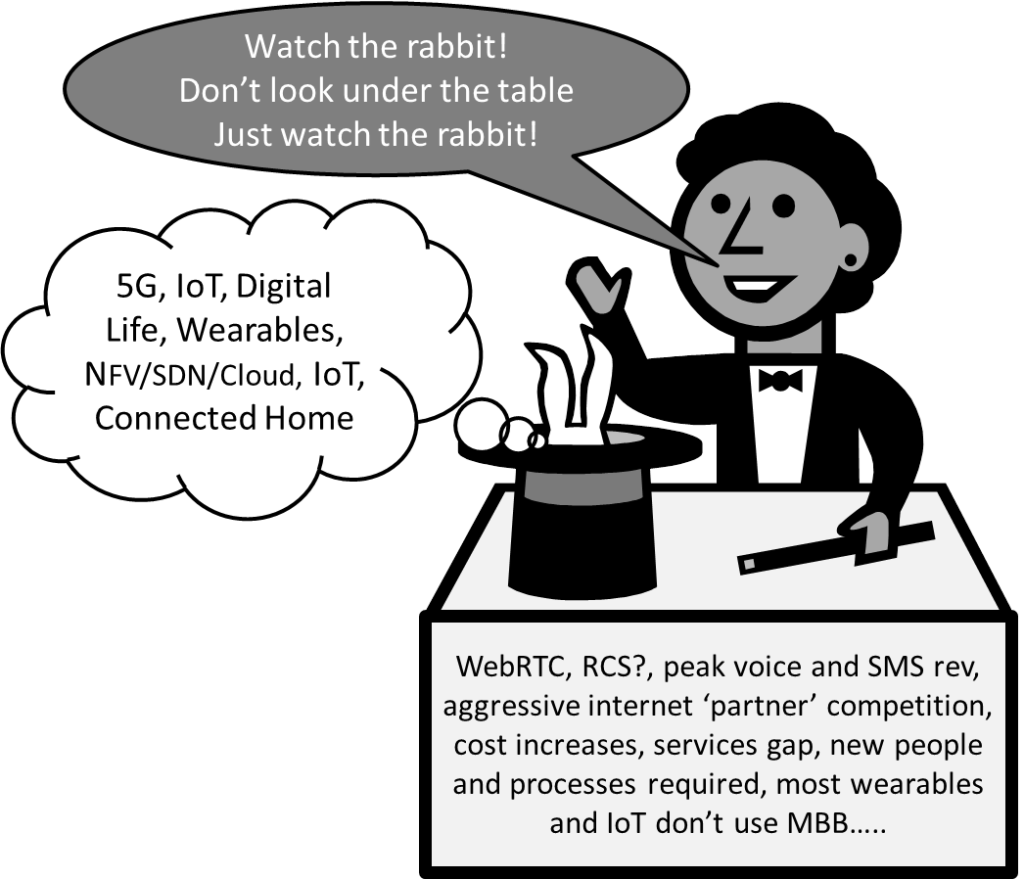

In the picture below from MWC14 all we need to change is 5G to 6G, add in some fashionable 5G flavors (e.g. private 5G) given 5G did not increase revenues like 4G, add in metaverse, and it will be close to MWC22. Examining what has happened in the past 8 years:

- Google now controls RCS through Android Messages so telcos are principally legacy comms providers of last resort;

- All the cloud comms providers used WebRTC to dominate enterprise comms so telcos now resell them to their large enterprise base (and those cloud comms providers like RingCentral also sells direct to that base as well);

- IoT for telco is principally phone numbers;

- The new people (cloud skilled) didn’t hang around as the processes and culture stifled them. The same is going to happen with the thousands of good software people some telcos are planning to hire.

- I could go, the fundamental issues if the organizational trinity: people, process, and technology. That’s why it’s important we keep an eye on Gamma and Mission Labs, if they can make that work…

People, Gossip, and Frivolous Stuff

Dave Evans is now Chief Technology Officer at pawaPay, payment API focused on Africa. I’ve known Dave since his SurfKitchen days.

Shawn Edmunds added a role as Advisor at Rev Leaders. He’s currently CRO at LumenVox, I’ve known him since his time at Inteliquent (now Sinch).

Lin Shu Fen added a position as Mentor | Advisor at Only Insure. I’ve known ShuFen since her time at Starhub over a decade ago.

Gunter Reiss is now CMO of DZS.

Kampamba Chanda has joined Coinhaven as a Front-end Developer. Back in 2016 Kampamba was a winner at TADHack Zambia.

Tom Sharkey is now Telecommunications Consultant – Director at ATOMIX. Tom was the CTO of Partionware, and lives on the Isle of Man where I was born and raised.

Ajay Sunder is now Head – Strategy & Planning at Safaricom Telecommunications Ethiopia.

You can sign up here to receive the CXTech News and Analysis by email.