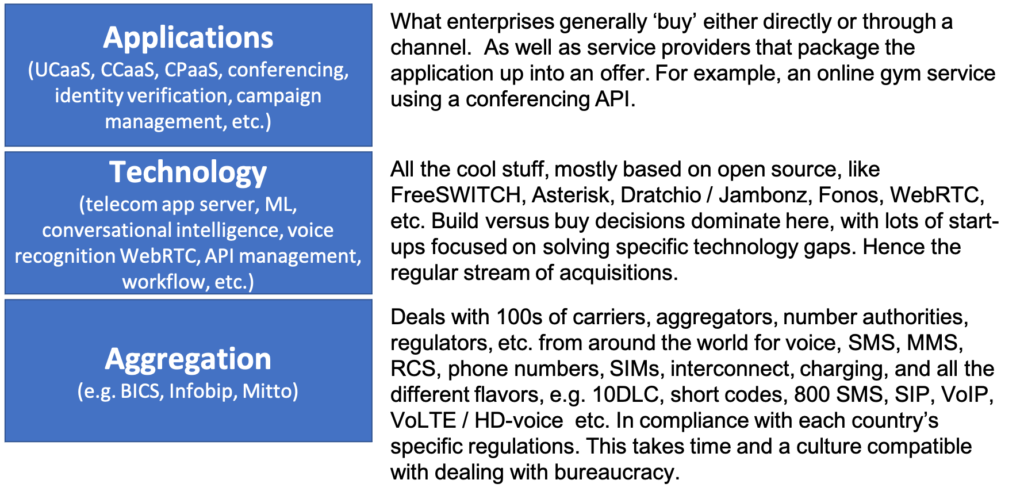

The purpose of this article is to explain a simple model to understand the programmable communications market. I divide the market into 3 domains: Aggregation, Technology, and Applications.

I’ve shown a number of similar frameworks in the past, see this one from TADSummit 2018 given during the State of the Union presentation.

The reason I segment the market this way is because ‘span of control’ has a significant impact on where an organization is strongest, and hence most competitive.

Aggregation

Aggregation underlies the whole programmable communications business, it defines a significant part of the cost base, either absorbed by the business or passed through to the enterprise. A false assumption is all CPaaS providers do this equally; they do not. Also the PSTN voice and PSTN messaging aggregation businesses are quite different.

I’m going to belabor this domain as it’s the least understood by those focused on the applications side of the business. And hence the misconceptions I see in many articles, as mentioned in CXTech Week 6 2021 News and Analysis.

Internet aggregation is included for completeness in this model, it covers WhatsApp, Viber, Facebook Messenger, Telegram, and many other comms applications. And it also includes WebRTC-based applications where the service provider is also the aggregator, like Twilio’s programmable video. BUT the focus of this article will be on the PSTN aggregation, as today that is where the bulk of the business / money resides.

The Aggregation business involves deals with 100s of carriers, aggregators, number authorities, and approvals from regulatory bodies from all around the world for voice, SMS, MMS, RCS, phone numbers, SIMs, interconnect, charging; and all the different flavors in those acronyms, e.g. 10DLC, short codes, 800 SMS, SIP, VoIP, VoLTE / HD-voice etc. This is long run-on sentence for effect – its complex!

And it’s not static, today in the US the 10DLC situation is not yet fixed. There is continuous technology evolution and regulatory developments. Aggregation sets a significant part of the base costs of the industry, its dependent on the traffic type, geography, volumes, time of day, quality of service required, etc. This is not like communications over the internet.

Building an aggregation business takes time and a culture compatible with dealing with bureaucracy. Some aggregators have a regional focus, some focus on multiple qualities of service around the world, and some on grey routes – cheap and not necessarily fully Kosher ways of getting messages or voice calls into a country. There are many routes to get traffic into a country, the performance of those routes is not static, and the compliance of a few of those routes are, well, a bit dodgy. Routing is going through an automation phase, thanks to improvements in machine learning, but routing managers are not going away as in the limit its about relationships between people.

Nexmo when it began was focused on cutting direct carrier deals in messaging to differentiate from Twilio, as well as working with aggregators to fill all the gaps, as it takes time and money to build out the aggregation business. So for example delivery receipts and delivery stats were real, and this resulting in improved campaign performance. Often cash deposits and volume commitments are required with direct carrier deals. Twilio has generally worked with aggregators, it has attempted to build out a broader set of direct carrier deals, but its culture is not compatible with bureaucracy, hence its focus is on applications. This is an example of the span of control. Twilio is not an aggregator, it does a some, but that is not the focus of its business.

Generally, the aggregators do deals with Application Providers, Telcos and other aggregators. There are aggregators focused on messaging (Mitto), aggregators focused on voice (BICS), and others on DIDs (Voxbone). DID is Direct Inward Dial(ing), phone numbers that can be called or messaged. You’ll see some aggregators claim they do it all, often there is a core competence as history plays a role.

It’s not black and white on the services offered either, for example BICS offers SIP trunking, as does Twilio. But their offers and target customers are different. SMS aggregators are increasingly targeting enterprises directly (especially those enterprises with big volumes, global requirements, and multiple QoS needs). We see omni-channel dashboards from Mitto and Infobip, but it’s not CCaaS like Twilio Flex.

Span of control will limit how far these two sides of the programmable communications market can merge. Aggregation can squeeze some CPaaS deals, the some CPaaS can end up living on a small margin between the aggregator and what the customer will pay. Hence the focus on VAS over the past decade, not only vanilla voice / SMS (which are good to drive volume, and hence lower costs from the Aggregators).

Technology

Open source software has enabled an explosion of innovation in programmable communications in the past 20 years. It covers telecom app server (FreeSWITCH, Asterisk, Dratchio / Jambonz, Fonos, etc.), ML / conversational intelligence (bot) platforms, WebRTC, API management, workflow management, etc.

It’s all the build versus buy decisions faced by the application providers as they grow their business. I’m not going to expand this section to keep this article short. It does impact span of control, but to a smaller extent than Aggregation and Applications.

Applications

This is generally what enterprises ‘buy’ either directly from the provider or through a channel. Channel is growing increasingly important as programmable communications goes mainstream, beyond customers like web companies and enterprise accounts with technology experts.

Other service providers also package up the programmable communication applications into their offers, for example, an online gym using a conferencing API as part of their virtual gym service that connects instructors with clients wanting a work-out remotely.

The applications include: UCaaS, CCaaS, CPaaS, conferencing, identity verification, campaign management, etc.

A local pizza restaurant could implement a CCaaS or UCaaS platform, but they have one phone number, and lots of part-time delivery people with their own mobile phones. Number masking is an easy way for the delivery person to be able to call the customer when they are having difficulty finding the address without either person’s privacy being lost. CPaaS solves this specific business problem.

A small specialized online retailer based in Serbia delivers through the mail around Europe. They want to add SMS notifications. They do not want or need a CCaaS, it’s just one person who does all that ‘customer’ stuff in their business. They need a way for customers to receive an SMS when their order is on its way from their warehouse, and when their mail carrier notifies them the order will be delivered that day. CPaaS solves this problem.

In the above cases if the firm has an existing UCaaS or CCaaS or even legacy system that’s programmable, then today such features are often just a web configuration away, though 5 years ago they were not available with such platforms.

Hopefully this explanation helps you understand the overlap between CPaaS and UCaaS/CCaaS – it depends on the customers’ needs / situation. And the vast real-world complexity faced by the application providers and the channels they use to reach businesses all around the world as programmable communications goes mainstream.

Conclusion

Span of control is a significant issue, Twilio focused on the applications, Sinch focuses on the aggregation (hence why it bought SDI for $250M, Wavy for $72M in 2020, and the BIG one Inteliquent for $1.14B). Twilio and Sinch are not the same. Labelling both as CPaaS is incorrect. CPaaS one of a number of technologies used in their business. They are both in programmable communications, and each business has a different focus: applications or aggregation. Though it’s not clear cut, that’s the real world.

CPaaS has had to focus on VAS (Value Added Service) from the beginning. Even Uber number masking is a VAS. Customers want solutions to specific business problems. What is changing in programmable communications is packaging: building simple easy to understand and sell programmable communication solutions to business problems as the programmable communications business goes mainstream.

This VAS problem was the challenge telcos faced when they offered telecom APIs in the 20 noughties; and solved by Twilio, Nexmo, Tropo and the many innovators in programmable communications in the 20 teens. And the UCaaS and CPaaS providers have built out VAS on their platforms and in their marketplaces to solve specific industry vertical business problems over the past 5 years.

I’ve been saying this for a few decades now, it’s all about the services. No one business spans applications and aggregation equally, they focus on one or the other. Though the line is not clear cut as geography, history, business focus, etc. all impact that line.