The purpose of this CXTech Week 30 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Following advice, I’m including a small pitch for my consulting services in this newsletter, many readers are unaware I consult. I’m an Engineer who’s been independently consulting for a couple of decades, “I know stuff and people” 😉 An aspect of my work is understanding regional differences. I work for clients around the world. I’ve spent months at a time in Asia, the Middle East, and Europe (where I grew up); while I’m based in North America. Programmable communications and telecom are diversifying. How you built a successful business with product X in market A, does not necessarily apply to market B. An understanding is required of both markets to work out the best path.

Covered this week:

- Radisys Engage Sponsors TADHack Global 2022

- Ericsson Completes the Acquisition of Vonage

- Reassessment of historical Cost of Goods Sold to affect Sinch’s Q2 2022 profit by SEK 162 million

- Internet Traffic Tax: Why Telcos Should Tell EU Lawmakers What They Tell Their Investors

- BlueVia is Back!

- Amazon pays $3.9B to buy One Medical

- Text scams increase and FCC is finally cracking down on the phone providers behind an egregious robocall scam.

- TADHack Memories: 2014

- People, Gossip, and Frivolous Stuff

Radisys Engage Sponsors TADHack Global 2022

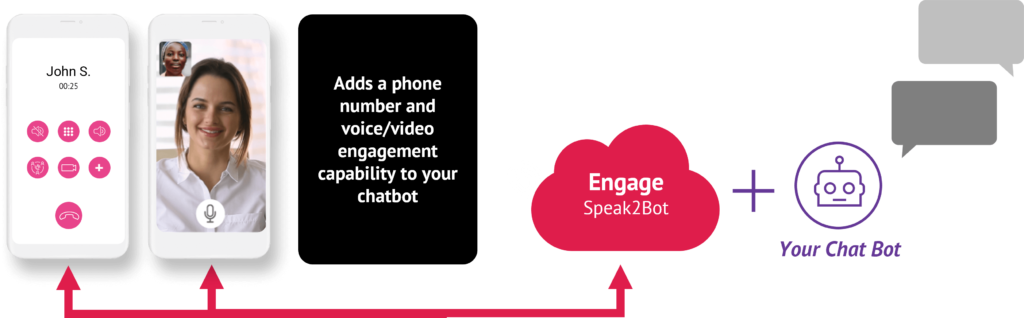

Radisys Engage Digital Platform is an open communication platform that enables anyone to create new machine learning enhanced engagement services and help TADHackers solve problems that matter to them.

Engage Digital Platform opens communication networks (exposing voice, SMS, video) and enables them to be mashed up with advanced services across machine learning, speech analytics, and computer vision; such as intelligent IVR (Interactive Voice Response), conversational video bots, and in-call assistants. Imagine being on a call with a friend and a whisper only you can hear reminds you it’s your friend’s birthday next week or a surveillance video camera calling a security guard to check a suspicious person.

All these capabilities are programmable through APIs/SDKs and a visual interface (low / no code) that easily assembles the components and logic to create winning world-class hacks.

Radisys is a sponsor of Network X, TADHack Global is the pre-event hackathon for Network X. Hacks built using Radisys have a chance to be showcased to the thousands of Network X attendees. This provides amazing exposure to TADHackers from around the world.

That is not all, Radisys wants to showcase the hacks created using Engage Digital Platform to their customers and prospects. They hope some of the hacks can be turned into deployed services that change the way people connect, interact, and engage.

Ericsson Completed the Acquisition of Vonage

My summary of the acquisition in CXTech Week 47 2021 remains the same:

“Ericsson is trying to buy a telco, Vonage, $300M consumer VoIP / $1B Enterprise VoIP & VAS. People keep claiming the enterprise VoIP is all UC, it is not.

Telcos today resell RingCentral for their large enterprise accounts, and use open source for small and medium sized businesses (SMB). Some mobile operators still sell Ericsson’s mobile PBX, 20+ year old IN VAS (Intelligent Network Value Added Service).

Vonage was growing, just not as fast as Twilio / RingCentral. Rory Read, the Vonage CEO, needed an exit, and Ericsson needed to show it was not asleep at the wheel, as Jana Partners (4% owner of Vonage) did its activist investor stuff.

Sinch would have made more sense as Ericsson are now in competition with their customers for enterprise VoIP. Sinch has achieved impressive consolidation across voice and messaging aggregation, and has moved further into the enterprise workflow stack with email (Pathwire). But I think there was likely some Swedish rivalry going on between Ericsson and Sinch. (Sinch has seen its EV drop to $3B on $2.5B rev, while Vonage was bought for $6B on $1.4B rev, and Sinch is less competitive to Ericson’s telco customers. Hindsight is always 20:20, but I did point out the better acquisition target last year, and the mistake the market was making on its valuation for several years.)

The industry chatter tends to be on the technology, CPaaS, UCaaS and CCaaS. However, some of the Vonage acquisitions are from 2016, e.g. Nexmo, and there are few of the original people left. People, process and technology make business success. Not some aged software.

Vonage has integrated all the platforms, as was mentioned at TADSummit EMEA in 2019. https://blog.tadsummit.com/2019/11/20/tadsummit-emea-2019-19th-nov-morning-session/. Also open source has developed, e.g. Jambonz now offers an open source CPaaS. The programmable communications business continues to evolve fast.

CPaaS can be tackled from so many different angles. Ericsson did have its own Parlay Gateway (think prehistoric CPaaS). All the reasons it walked away from selling CPaaS to telcos are still there. The enterprise customer access angle keeps being resurrected, but that’s simply not in Ericsson’s DNA.

This is an exit deal for Jana Partners and Vonage, not for Ericsson or its telco customers.”

Reassessment of historical Cost of Goods Sold to affect Sinch’s Q2 2022 profit by SEK 162 million

From a peak of 200 SEK to 25 SEK. This has been a rough year for Sinch. The story is similar to that of Link Mobility’s drop from 60 to 12 NOK covered in CXTech Week 19 2022. Analysts are finally waking up to the fact aggregators are not CPaaS, most CPaaS are not Twilio, and Twilio is evolving. It’s all just programmable telecoms/communications, you can not be lazy and look at the category, you have to look at the business.

Sinch’s reassessment of Cost of Goods Sold has been completed as part of the process to finalize financial reporting for Q2 2022. This was done in response to a share price drop on July 11. The reassessment of historical COGS relates to SMS messaging costs for 2021. A detailed review of supplier invoices has concluded that aggregated received invoicing exceeds the aggregate level of COGS accruals for this period by SEK 162 million.

The SMS aggregation business is complex, with pricing changing in real time. Sinch has acquired many companies over the years, and it takes time to consolidate all the deals to achieve better economies of scale. They connect through multiple entities in each country, and the pricing is not a simple X per SMS. There’s settlements, quality of service, volume, route, kick-backs, etc. We’ve been here before with other SMS aggregators on their legacy deals catching up with them.

Internet Traffic Tax: Why Telcos Should Tell EU Lawmakers What They Tell Their Investors

In a recent letter to European politicians and lawmakers, the CEOs of Telefónica, Deutsche Telekom, Vodafone, and Orange, claimed that online players should contribute financially to network upgrades if Europe still wants to reach its ambitious connectivity goals. This ignores the fact that tech companies are in fact already investing heavily in infrastructure, think for example of Google’s subsea cables or Netflix’s investments in Open Connect CDN.

But is increasing internet traffic growth really the insurmountable problem that telcos claim it is? A recent study by Communications Chambers found otherwise; arguing that demand for internet traffic actually drives telcos’ revenues, e.g. through fixed lines, including fibre cables, and tiered mobile data tariffs.

This might explain why telcos are trying to attract data-hungry customers by using streaming services to promote their own offerings. If data traffic really is that unmanageable or undesirable for them, surely telcos wouldn’t be actively targeting this specific customer segment?

Telefónica reported that it “has accelerated its growth in the first quarter of 2022, reporting an increase in revenues in all the markets of the company in reported terms, and a net income of €706 million.” Meanwhile, Orange said that it continues to “reap the benefits of our European fibre and 5G network leadership with a 2% rise in our retail sales growth in these first three months”.

Similarly, following the strong financial year 2021, Deutsche Telekom continued its growth in the first three months of 2022. Revenue increased by 6.2 percent to €28 billion, with service revenues growing even faster at 10%, Germany’s incumbent operator boasted. Its 2021 net profit were €5.9 billion. “We are continuing to grow on an organic basis and are therefore in a position to raise our guidance for 2022,” Deutsche Telekom CFO Christian Illek said when presenting the quarterly figures.

European politicians and lawmakers need to read the investor relations pages of the telcos and see if their story adds up. As an industry such egregious misrepresentation to the EU representatives should be a source of shame to telcos and illegal.

BlueVia is Back!

BlueVia was once the CPaaS arm of Telefonica. Below is a presentation from Jose Valles the head of BlueVia presented at the SDP Global Summit in September 2011. It’s a fun read, and still true today.

11 years later, Telefónica Group, the consortium Crédit Agricole Assurances, and Vauban Infrastructure Partners are resurrecting the Bluevia name. This time it will be a neutral wholesale FTTH operator with Telefónica España an anchor client.

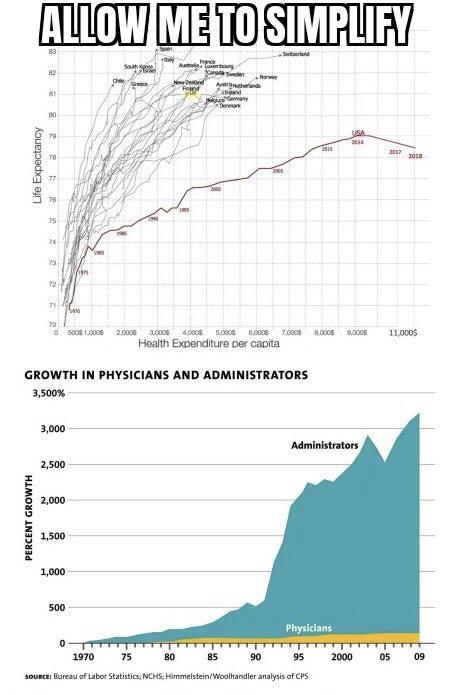

Amazon pays $3.9B to buy One Medical

US healthcare has a problem, middlemen. The diagram below from Reddit sums is up nicely.

Here’s a nice quote from Mike McSherry, CEO of Xealth. This is a long game in the removal of middlemen. BTW Mike was the founder of both Boost and Amp’d Mobile.

‘Healthcare is “fragmented” with middlemen, from pharmacy benefit managers to insurance companies, said McSherry.

And Amazon is really good at eliminating the middleman, he said. “Take a look at the 25-year arc of Amazon. They now man their own airplanes and their own shipping, they go increasingly full stack vertical.”

“I don’t know how long it’s going to take for Amazon to meaningfully take on some of these incumbent positions in healthcare. But we all know the inefficiencies. And Amazon has proven to be the most effective company over the last 25 years at removing marketplace inefficiencies,” he said.’

Xealth CEO Mike McSherry

Text scams increase and FCC is finally cracking down on the phone providers behind an egregious robocall scam.

Robotexts have increased in the past year, from about 1 billion to 12 billion per month, according to RoboKiller. Con artists and identity thieves are taking advantages of loopholes in the scam robocall law. Robotexts are claimed to be the next generation of scams, which we’ve known about for years and the industry as not reacted. We’ve covered this many times over the years, even back in 2017 when tyntec proposed How to fixed the US long code A2P SMS.

The auto warranty robocall scam has generated billions of calls. Auto warranties are a scam in the US, so this is a scam on a scam. However, it became a political issue. So the FCC has issued cease-and-desist letters to eight providers: Call Pipe, Fugle Telecom, Geist Telecom, Global Lynks, Mobi Telecom, SipKonnect, South Dakota Telecom, and Virtual Telecom. Finally naming names!

It’s all so painfully slow, and done with the regulator and industry patting themselves on their back for actually doing something. But the problem could have been addressed years ago, and the cat and mouse game continues. While making the PSTN less and less attractive to use for communications. The telecoms industry are letting the PSTN asset wither on the vine.

TADHack Memories: 2014

In 2014 one of our first winners showed the importance of team diversity. It was Famous4Money by Natalia Camacho Soguero, Jairo Canales Alfonso, Francisco Martínez Sánchez, Sergio López Arias, and Mar a humanitarian app using communications to help celebrities raise cash for causes.

People, Gossip, and Frivolous Stuff

Lokdeep Singh is now CEO of Talkwalker. I’ve known Lokdeep sinc his time at MACH.

Bennett Gamel is now Head of Program Management (PMO) at Pepper

You can sign up here to receive the CXTech News and Analysis by email.