The purpose of this CXTech Week 31 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Following advice, I’m including a small pitch for my consulting services in this newsletter, many readers are unaware I consult. I’m an Engineer who’s been independently consulting for a couple of decades, “I know stuff and people” 😉 The financial analysts are relatively independent, they’re regulated, and the numbers are the numbers. While for industry analysts, it’s a much more complex relationship. I bring a diversity in my business model and breadth of industries covered that enables perhaps a broader less vested view.

Covered this week:

- Avaya: Guidance Down 20% on Revenue / 66% on EBITDA and Change in CEO

- RTCSec Newsletter July 2022

- Two IoT presentations from Tobias Goebel for TADSummit

- 5 ways Machine Learning is detecting and preventing identity fraud

- Statement of the Obvious: VCs Squandered Billions On Scooter Startups

- Matter is yet another smart home standard. But will it matter?

- Enabld raises $1.4 million in a seed funding round

- TADHack Memories: Telepaper created by Jared Ashcraft and David Sikes

- People, Gossip, and Frivolous Stuff

Avaya: Guidance Down 20% on Revenue / 66% on EBITDA and Change in CEO

On the revenue:

- Revenue will likely be between $575 million and $580 million — lower than the company’s original guidance $685 million to $700 million.

- Adjusted EBITDA will likely be between $50 million and $55 million, compared to previous guidance of $140 million to $150 million.

Alan Masarek (previously Vonage) will replace the current CEO.

At the end of 2020 and again in 2021 I gave presentations and articles reviewing the programmable communications market through the pandemic. One point I highlighted is how the pandemic has forced many businesses to adopt XaaS / programmable communications as a bandaid to support WFH (Work From Home).

This did several things: companies realized XaaS or programable communications is reliable, significantly cheaper than their legacy platform(s), flexible (integrates with many of their IT services, supports a range of deployment architectures), and simply works.

Through 2021, the prolonged pandemic, many businesses realized WFH is here to stay, at least 3 days of the week. So rather than migrate back to their legacy platforms, they are migrating to programmable communications after a couple of years of successful operations.

This is the source of Avaya’s revenue shortfall, customers are moving away, it takes time to migrate and for that to hit legacy platform revenues. There are a few other issues, for example reselling RingCentral left customers on legacy Avaya platforms feeling abandoned. The term OneCloud applied to all products left customers feeling the portfolio was cloud-washed. While the pricing and business models were slow to catch up given all the usual legacy issues. Genesys, Five9, and many other CCaaS have been making hay at Avaya’s expense through the pandemic.

The revenue guidance gap is not a one-off issue, it’s a systematic trend, so another bankruptcy is likely given the massive debt burden.

There is much spin on Vonage. I’ve explained what Vonage is last year when Ericsson offered to buy them, and when the deal closed in CXTech Week 30 2022. Alan architected Vonage to own its technology (improve margin and customer focus) and become a more diverse business moving away from predominantly consumer and SMB VoIP to included business VoIP / VAS (UC, CC and CPaaS), and SMS aggregation.

Rory replaced Alan at Vonage as they needed more revenue growth and an exit given the success of Alan’s transformation of Vonage. Rory delivered the exit.

Alan will have a technology plan for Avaya, that is clear. However, the financial engineering required is going to be interesting as he needs to change the engine while staying in the race.

The big question is what of the existing revenue can be maintained? This is a soft issue, based on relationships not technology, the technology must change. On technology how can Alan get the cost basis of the company and products to best in the business as fast as possible? It’s a reset, not a migration.

Owning your tech is critical, as Alan did at Vonage. Alan could be opportunistic on acquisitions given the downturn, but that’s not a plan. RingCentral is dominant in UC, it has significant barriers in integrations, applications, and channels. Avaya’s contact center is challenged on both pricing and tech. A reset is required, for example, they could buy Broadvoice / GoContact as its core tech across UC and CC. This would deliver a new cost basis and pricing model, and then focus on migration services where its customers’ get to keep their customer data.

This is not about marketing, this it not about analyst events to appear in magic shapes that are largely irrelevant to most customers. It’s a fundamental reset on the technology and business models to be competitive for their customers. Avaya must help its customers migrate to a modern, open-source based, programmable communications platform. To meet the disparate needs of its customers, cloud is not the only answer, it is one of the answers. Some of those customers would like to stay on legacy Avaya hardware for the next decade because of their specific needs; it works, don’t touch it!

Expect another bankruptcy, expect some aggressive M&A to move the technology base to be modern and low cost, expect a strong customer focus to help the existing base migrate with their customer data intact. All while fighting fires on bankruptcy, legal challenges (their lenders are not happy), channel challenges, and surgically removing the politicians while keeping the good workers; Avaya has some excellent people in my experience. Alan’s chances of success at this point are 25% in my opinion, this is going to be a tough wholesale change. It’s a bit like IBM’s reset in the 1990s, triage then reset the business.

RTCSec Newsletter July 2022

Always a good read for RTC security issues. Covered this month:

- Our TADSummit talk and SIPVicious PRO details

- FreePBX exploitation and confusing reports

- Remote coverage of the talks at the Dutch hacker camp

- CVE-2022-2294 – the vulnerability in the WebRTC project

- Vulnerabilities in Matrix, BigBlueButton, JunOS and more

- Tweet of the month on VoIP phone hardware hacking

Two IoT presentations from Tobias Goebel for TADSummit

The TADSummit 2022 agenda is coming together nicely, there’s still much to add. Tobias Goebel suggested a couple of IoT presentations, both were so good, I asked if we could have both!

How a Multi-IMSI architecture makes global cellular IoT deployments manageable

Tobias Goebel, Principal Product Marketing Manager, IoT, Twilio

- Fragmented landscape of IoT connectivity

- Challenges of cross-border cellular connectivity

- Pros and cons of the different SIM deployment architectures that exist today

- How Multi-IMSI SIM profiles on eSIMs simplify interregional and international deployments

What makes a cellular IoT API great?

Tobias Goebel, Principal Product Marketing Manager, IoT, Twilio

- Why IoT SIMs need an API in the first place

- The core functions needed in a cellular IoT API: SIM activation and deactivation, SIM status queries, Network access configuration, Pulling billing information and usage records, Troubleshooting, Device reachability

- What matters in a good API (any API)

- 10 tips and tricks for how to find a good IoT SIM with a strong API

5 ways Machine Learning is detecting and preventing identity fraud

Experian, Ikata, Kount, LexisNexis Risk Solutions, Telesign, Prove, etc. all share the common attributes of relying on decades of data to train models and assigning trust scores by a transaction. We’ll be hearing from both Telesign and Prove at TADSummit 2022.

The key quote in the article is:

The goal is to better train supervised machine learning algorithms to identify anomalies not visible with existing fraud detection techniques while supplementing them with unsupervised machine learning exploring data for new patterns. Combining supervised and unsupervised machine learning in the same AI platform differentiates the most advanced vendors in this market.

Matter is yet another smart home standard. But will it matter?

I’ve seen much more buzz around Matter of late. Matter, formerly Project Connected Home over IP (CHIP), is a royalty-free home automation connectivity standard, with manufacturers only incurring certification costs. It was founded by Amazon, Apple, Google, Samsung SmartThings and the Zigbee Alliance in 2019.

The vision is: buy a gadget, plug it in, and it will work with the rest of your smart home. Set up that new device with your favorite smart home app, and control it with your voice assistant of choice, no matter who made it.

Talking with IoT experts like Tim Panton, its an indicator of direction of the connected home. For example, it’s interesting because it bridges the Apple and Android ecosystems. It supports auth at the edge, so devices can run without cloud dependencies. But there is no Matter standard for cameras or microphones.

For the real-time communications folks, keep an eye on Matter, but don’t bet the company on it yet.

Statement of the Obvious: VCs Squandered Billions On Scooter Startups

Good article covering the first growth/crash phase of electric scooters, they will be back. And its a chance for me to have a rant 😉 Here in NJ I’m seeing scooters pop up as an alternative to the bicycle for personal ownership. The key quote below highlights the personal economics, which presupposes an integrated transport system. This is not the case everywhere, particularly here in the US.

Today, a scooter rental ride hardly seems like a bargain. At typical rates, which include an upfront and per-minute fee, a 20-minute ride would cost about $6. That’s more than a quick bus or subway ride in places that offer those options.

However, the article does not highlight a critical missing piece through the scooter boom and bust, education on how to use the device safely. When my son was little he was knocked over in Paris by a self-focused idiot riding a scooter on the pavement/sidewalk. The gap between all the heads was a child, not a space for them. None of the start-ups addressed this during the growth phase, and it will limit their future growth. Many countries need to educate the whole population on road use given the growing diversity of road users . Here in the US, it’s a mess of behaviours and expectations, bicycles/scooters riding on sidewalks/pavements, bicycles/scooters on the road but going against the direction of traffic, and car drivers assuming only they are allowed to use the roads.

The rules are simple. Scooterists like bicycles use the road or dedicated lanes and follow the highway code like other road users. Cyclists / scooterists respect pedestrians. Motorists remember to give cyclists / scooterists as much room as you would to pass a car, 2 cycling abreast is for their safety, e.g. a parent and a child, blasting your horn at them may shock the child to fall off. And if you find there are too many bikes / scooters, inform your local government on the need for dedicated bike lanes for the safety of all road users.

Electric scooters, bicycles, and electric bikes are only going to increase in personal use. Every country needs to educate their population on how to coexist safely on the road as more people travel outside the car. Some countries will need more education than others.

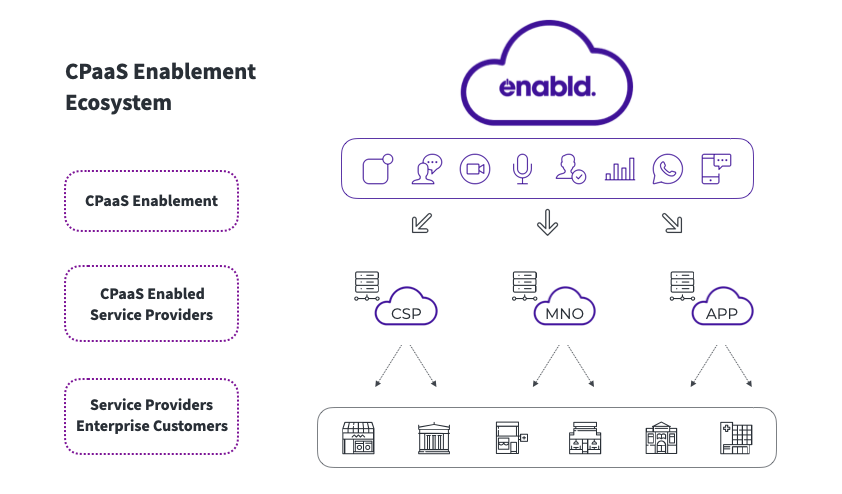

Enabld raises $1.4 million in a seed funding round

Brussels-operating and Moldova-staffed Enabld has closed a $1.4 million seed funding round. The company operates in the Communications Platform as a Service (CPaaS) sector as a messaging aggregator. The new funding is aimed at enabling the startup to develop its product lineup, including, “new tools to support communication service providers, telcos, and enterprises.”

TADHack Memories: Telepaper created by Jared Ashcraft and David Sikes

At TADHack-mini Orlando at Avaya ENGAGE in Dec 2021, Jared Ashcraft and David Sikes created the hack Telepaper using Avaya Spaces, Subspace, and Red Hat. It solved the real-world problem Jared faced with remote education. Being able to write on a common piece of paper between the student and teacher.

Jared and David want to turn Telepaper from a hack into a product. Their need motivated me to create TADHack Founders Academy to help hacks become deployed services that change people’s lives.

Please register for TADHack Global 2022,

Thank you to Radisys, STROLID, jambonz, and Telnyx for sponsoring TADHack Global 2022.

People, Gossip, and Frivolous Stuff

Eric Horesnyi is now Chief Executive Officer at Matrix Requirements. Previously he was the CEO of streamdata.io that was acquired by Axway.

Vasco Elvas is now Senior Solution Architect (Pre-Sales) – UK at OutSystems. I’ve known Vasco since his time in Vodafone Portugal 15 years ago. OutSystems are a low-code / no-code enterprise development platform.

Rob Hubbell is now Senior Vice President Of Sales at STROLID, Inc – Strong Process. Solid Results. Strolid are a sponsor of both TADHack Global and TADSummit.

Taher Behbehani is now CVP & GM SW/SaaS GTM & Sales at Intel.

You can sign up here to receive the CXTech News and Analysis by email