The purpose of this CXTech Week 25 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Following advice, I’m including a small pitch for my consulting services in this newsletter, many readers are unaware I consult. I’m an Engineer who’s been independently consulting for a couple of decades, “I know stuff and people” 😉 I provide unique marketing collateral that stands out from the crowd of group-think: white papers, weblogs, presentations, research notes, and market research. Many global brands in programmable communications have branded my work, and occasionally co-branded.

Covered this week:

- It’s All Just Programmable Communications, or Programmable Telecoms if you Prefer

- vCon White Paper is Available for Download

- What Working Group Two are Currently Working on

- What has Broadcom Become?

- Sangoma Announced a Share Buyback

- Airtel Business Now Offers Airtel IQ

- People, Gossip, and Frivolous Stuff

It’s All Just Programmable Communications, or Programmable Telecoms if you Prefer

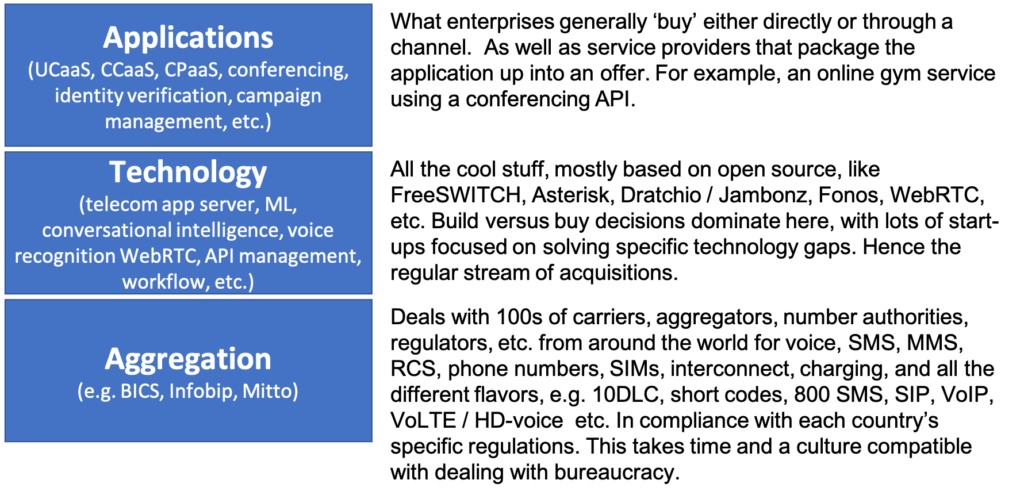

A review of why we need to move away from the CPaaS, UCaaS, and CCaaS acronyms. And instead focus on specific customer market segments or capabilities rather than which technology acronyms you assign to a vendor, it’s all just programmable comms and the customer situation defines which vendor they select more than who is in what magic shape.

The programmable communications market is diverse, consolidating, and evolving faster than enterprise communications has in the past. It’s at the intersection of web-speed and telecom-speed; hence why the telecom/communication application side of the business evolves faster than the traditional telecoms business.

vCon White Paper is Available for Download

An open standard for conversation data.

Yes, the vCon white paper is a little long, but we’re not making the mistake of only selling the vCon idea to other technologists. We’ve includes use cases, analogies, and industry impact to help convince marketing, product management, strategy, sales, and the management team of the importance of vCon to the whole communications industry.

Thanks you to everyone who has commented and supported vCon to get this far. Much work to do, it’s exciting to witness the birth of a new open standard in programmable communications. At TADSummit 2022, 8/9 Nov in Aveiro Portugal and online, we have a vCon Keynote from Thomas Howe, CTO of STROLID, and a workshop on the latest developments and implementations of vCon. And don’t forget vCon will also be part of TADHack Global 2022, STROLID is a global sponsor.

What Working Group Two are Currently Working on

A nice review of their development activities, and other news. Focusing on development:

- 5G Non-Standalone (5G NSA) is in production;

- Integrated Televox (UCaaS);

- Gy/Ro interfaces live for real-time online charging control;

- Content Filtering using Internet Content Adaptation Protocol (ICAP) for inspecting HTTP-based traffic and DNS-based filtering of data traffic;

It’s always funny hearing the incredulity from the telco establishment that a start-up can have an adjunct core. They stand on the shoulders of giants, open source, and have been at this for quite a few years. Here are some of WG2’s TADSummit presentations from over the years:

- 2021: A multi sided marketplace platform for telco enabled products, Werner Eriksen

- 2020: Interview with, Erlend Prestgard, the CEO of WG2.

- 2019: Some (Surprising) Discoveries in Applying the as-a-service model in Running a Mobile Core Network, by Werner Eriksen, CTO Working Group Two (WG2).

- 2018: From Lego to Plasticine. Molding a platform for product development.

- 2016: A report from the kitchen; running a mobile core in the cloud, samples served.

- 2015: Building a Programmable Telco Core Network.

What has Broadcom Become?

In CXTech Week 22 2022, we covered Broadcom buying VMWare for $69B. There we focused on the rationale for the deal and its similarities to when it bought CA Technologies. This piece by DIGITS TO DOLLARS presents a review og Broadcom’s history and its emergence as a private equity fund, neither a semiconductor nor software company.

Broadcom began its existence as a spin-off of a spin-off. Twenty years or so ago, Hewlett Packard began its process of miniaturization. First spinning off Agilent which contained a hodgepodge of businesses that were not related to PCs or printers. Agilent in turn split itself into several more pieces, one of which was HP’s one-time internal chip business, rechristened as Avago.

Avago came to life through private equity ownership, and as far as origin stories go, this was the key clue to what would happen next. Avago’s CEO Hock Tan realized something early on that most other semiconductor CEOs did not – semis had stopped being a growth industry.

So Avago went on a buying spree, driving the stock up 3,000% (three thousand per cent) in a decade and half. The secret to this success was a fairly straightforward. Buy companies which had leading positions in markets with few competitors. Then shed segments that sold into competitive sectors, slash management and corporate overhead, and drive cash flow – which allowed for more leverage and thus firepower for the next acquisition. And repeat.

Broadcom is not a semiconductor company. Nor is it a software company. It is a private equity fund, maximizing cash flow from an endless series of acquisitions.

Sangoma Announced a Share Buyback

Interesting move given the possibility of a recession. Perhaps strengthening the balance sheet in anticipation of fire-sale consolidation opportunities?

Sangoma may, during the 12-month period commencing June 23, 2022 and ending no later than June 22, 2023, purchase up to 1,071,981 Shares, representing 5% of the total number of 21,439,632 Shares outstanding.

Their view is the current market price of its Shares does not reflect the underlying value of its business and the buyback represents an appropriate and desirable use of the Company’s funds. So it’s in a stronger position for further M&A.

Airtel Business Now Offers Airtel IQ

We covered Airtel IQ at TADSummit Asia 2021, Airtel IQ: Transforming customer engagement by embedding real-time communications, Ankit Goel & Ishan Bansal. It’s great to see their progress into the business.

Airtel IQ is a great example of telcos being successful in taking control of their service and the successful use of open source. And also provides insight into the unique value telcos can provide beyond wholesale services or reselling other service providers who also go direct to the enterprise.

Ankit highlights the challenges in using cloud communication services from other than the telco:

- Deployment complexity due to physical telecom infrastructure integration

- High cost due to the need for third-party MSP (Managed Service Provider)

- Poor service quality due to cloud-telecom integration inconsistency

- Cumbersome troubleshooting during downtime due to multiple stakeholders

- Lack of a unified data protection framework that complies with stringent regulations

The 3 core propositions of Airtel IQ are: Robust, Intuitive, and Secure.

Ishan goes into detail on how they achieve a robust service describing how its architected and the advantages of being built in the network. Next he described the intuitive aspects in providing APIs, self-service and service components. Making it easy for businesses to create workflows and services for their specific needs. And finally Ishan walks through the main components of the platform’s security.

Ishan then described how airtel was able to create Airtel IQ. He reviews the product principles and iterative customer-led approach. This is the hardest aspect, successfully innovating within a telco.

Ankit reviews some of the customer benefits:

- Improved marketing with click to call, omni-channel, and analytics;

- Improved customer experience with personalized IVR, automations, and analytics;

- Improved operations with security, notifications, alerts, and of course analytics.

Ankit wraps with excellent case studies of Rapido, Swiggy and Justdial.

People, Gossip, and Frivolous Stuff

Mitch Lieberman is now Director of Product Management at Genesys

Nina Maricic is now Head of Revenue Management at Mitto

Kevin Kleinsmith is now Director of Private LTE with NRTC

Alexander Vlahopoulos is now Technical Account Executive at AccelByte

Tomasz Owczarek is now Regional Channel Sales Manager at Radware!

Kevin Chatow is now VP, Product Management – Collaboration Business at Jabra

Vlad Paiu is now Head of VoIP Engineering at Sipstatus Communications

You can sign up here to receive the CXTech News and Analysis by email.