The purpose of this CXTech Week 31 2020 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Growth+Sales: The New Era of Enterprise Go-to-Market

It’s an interesting analysis, a little BABS-centric, and simplifies some of the examples. But the overall analysis is correct, though copying the examples as described in the analysis will generally result in failure.

Defining “growth+sales”: bottom-up growth (consumer-like viral engagement) eventually layered with top-down sales (enterprise sales). From my perspective the consumerization of enterprise technology / service sales, then backfilling with inbound sales once the product is just there in organizations to win the big accounts and high margin incremental sales around the viral product.

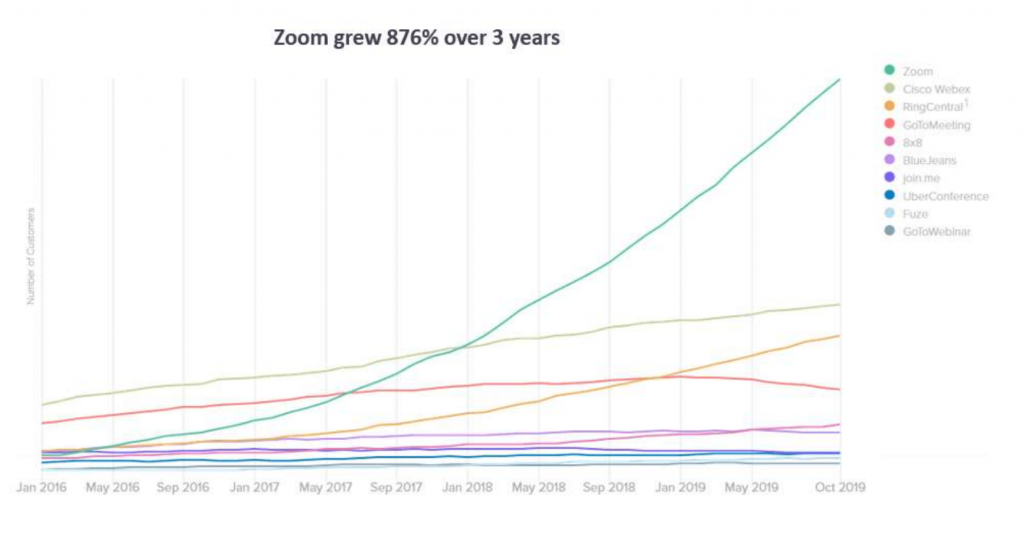

Zoom is a great example, a conferencing service that just worked relatively reliably, while the traditional products like Webex were ‘maximally complex” using the phrase in the analysis. That is complex enough to create a significant barrier from the competition, and cover the arse of the IT buying department in meeting the needs of just about everyone in the organization at the expense of ease of use.

I like the hidden traps, choosing the out-of-the-box value proposition to the end user sufficiently compelling for them to adopt on their own. Without any organizational dependencies. With Zoom, conferencing is generally standalone for most industries. And then they can add phone systems as a more traditional sale to their large enterprise accounts where there are dependencies. It also leaves the growth product relatively independent from sales.

The next trap is not sparking love. Twilio is given as the example in engaging developers, which it has done well. We have an invited keynote from Steven Goodwin at TADSummit EMEA / Americas on engaging developers.

But they overplay its stickiness as developers will use what the customer asks for. Also the lock-in is not so much love, it does help, rather its features in the API get used which makes switching costs enough to defer making a decision until the pain is great enough.

Talkdesk is an example of a company that moved off Twilio, it was a strategic decision, as Twilio was competing with them. Others like big web companies have enough volume to easily create the business case, as well as large enterprises that see enough usage. While for many companies, they know they are overpaying, but it’s not enough to warrant action yet. Love is sometimes not enough.

I wholeheartedly support the third trap, consumer metrics are critical, not just the traditional enterprise ones: track active user growth (MAUs, WAUs, DAUs), engagement (session length, days active in a given work week), active user retention, and funnel conversion points throughout the user journey.

The fourth is challenging and easy to judge in retrospect, that is, when to add in sales than just viral growth. That is you’re racing up the hockey stick, and let the growth momentum play out, while focusing the sales pitch to the enterprise buyer, while critically avoiding sales hampering growth.

Fifth I see in open source often, organic user presence doesn’t actually reinforce sales, regardless of how hard you try. Perhaps the growth motion doesn’t actually connect you to the right buyer. At TADSummit EMEA / Americas Dan Jenkins will be giving an interesting presentation on this topic, I’m still waiting on his outline, but we’ve discussed the topic.

The last point of forgetting growth in preference to sales is what happened to Webex, once it was great. Cisco bought them, then it became big-corporate, and the team that built Webex built Zoom. I think we have a few cycles left as I see start-ups rapidly becoming big-corporate as they hire in the middle-managers. Repeating Cisco’s evolution over years, not decades.

Infobip raises $200M

Once upon a time raising $10M or $20M was considered a reasonably good amount. Over the past couple of months 9 figures seems to be the norm. See last week’s CXTech news about Payfone and BigID.

Infobip has raised over $200 million from private equity firm One Equity Partners at valuation of over $1 billion. The claimed objective is to expand in the US market to better compete with Twilio.

The CXTech Landscape shows a number of potential targets, but they are not necessarily in the same league as Twilio, hence why I have an invited keynote from Steven Goodwin at TADSummit EMEA / Americas on engaging developers. Its going to be an interesting time in CPaaS through 2020, any acquisition will need some work to move Infobip into a position to compete head-on. Better I think is to focus on part of Twilio’s business, like TeleSign does on identity verification. Which is not a growth+sales product. Rather a sales product, where trusted customer relationships and access to data are critical.

Payfone is now Prove, recently raised $100M, and buys Early Warning Services, mobile authentication lines of business

In last week’s CXTech news we mentioned the WSJ article on the activity around identity verification with Payfone and BigID. And now Payfone is Prove Identity. The Payfone name when back a long way to when carriers sold mobile games, it also reminded my of the public pay phones.

Early Warning Services is a consortium owned by seven of the US’s largest banks. The acquisition includes Early Warning’s mobile authentication business, Early Warning’s multi-factor authentication and orchestration solutions, and the Authentify line of business. Given Prove’s dominance in the US banking segment this consolidated makes sense.

BICS (and TeleSign) up for Sale, could be another 9 figure investment in the offing?

Proximus confirms that the shareholders of its international subsidiary BICS are considering selling control of the company, with the Belgian operator wishing to retain 49%. BICS (Belgacom International Carrier Services) is in discussions with “potential investors”, but it is too early to know whether they will succeed.

L’Echo points out that 25% of global roaming passes through BICS’ infrastructure, 57.6% of which is owned by Proximus, 22.4% by Swisscom and 20% by MTN. BICS could be valued at between €755 million and €1.05 billion, according to the Belgian business daily.

Given the 9 figure investments in BigID (general enterprise), Prove (banking and insurance) around identity verification / intelligence. Will TeleSign (global web properties) follow the same path? It’s complicated as the dominant by revenue part of the business is legacy interconnect. It could be treated as 2 separate investment strategies within the same entity. There are some synergies for phone number intelligence.

Perhaps we’ll see another 9 figure investment soon, as TeleSign are already globally dominant in one segment around identity verification. While banking and insurance are regional, and enterprise sales (without the growth+sales potential) is about time and money.

Amazon Met With Startups About Investing, Then Launched Competing Products

If it looks like a monopoly, and behaves like a monopoly, then it’s quite likely a monopoly. I do recommend start-ups talk with big corporates, even monopolies, in general terms to build relationships as you never know. And if they do not want to talk with you unless you share details, ignore them and stick it too them by being successful. Until there’s a term sheet with walk-away protections, keep your secrets safe – even the go to market ones.

Juniper Research claims CPaaS (Communications-Platform-as-a-Service) market will reach $25 billion in 2025

A new study from Juniper Research has found the total value of the CPaaS (Communications-Platform-as-a-Service) market will reach $25 billion in 2025; rising from $7 billion this year. CPaaS platforms provide a centralized management service for outbound communications including SMS, OTT business messaging, RCS and voice services.

The study identified the ability to make payments over services such as RCS (Rich Communication Services) and OTT messaging as a key future driver of global CPaaS revenue over the next five years. Oh dear! Needless to say I disagree with their model, they must have built it during the WhatsApp payments hype in Brazil that was cancelled. As discussed in CXTech Week 26 2020.

Bandwidth Second Quarter 2020 Results

Total second quarter revenue of $76.8 million, up 35% year-over-year.

CPaaS second quarter revenue of $67.1 million, up 40% year-over-year. Some of this is Zoom, but the rise in CPaaS customers shows growth is broader based.

Active CPaaS customers of 1,900, up 30% year-over-year.

Raises end of year guidance given H2 pipeline.

While results are mixed across the CXTech landscape, the US CPaaS market appears to be doing particularly well.

TADHack Chicago / North America 2020

TADHack Chicago / North America run by the Illinois Institute of Technology Real Time Communications Labs has been part of TADHack since the beginning in 2014. The Chicago dev community and the area’s students (both high school and university) have generated year-on-year world-class hacks.

We’re hoping to have both in-person, and most definitely remote hacking at TADHack Chicago / North America. The physical location will be the Ed Kaplan Family Institute For Innovation and Tech Entrepreneurship, it’s a massive venue, there will be no problem social distancing. And finally hand sanitizer is widely available.

As remote entry is part of every TADHack location this year because of COVID-19, the catchment area for TADHack Chicago will be anyone in North America who would like to take part remotely, so please register here.

For this year, an additional to the Global Sponsors: Simwood, Sangoma and Avaya; we have two Chicago location sponsor Intelepeer and Symbl.ai. You can see all their resources for Chicago / North America here. Check out the weblog to see all the winners over the years.

People, Gossip, and Frivolous Stuff

Congratulations to TADHack Uruguay winner Andres Canabarro Sica who is now a Software Development Engineer at Amazon.

Well done to Thomas Quintana who is now Director of Next Generation Technologies at Inteliquent.

Rodger Desai is now the CEO at Prove Identity, it’s just a name change from Payfone, discussed above.

Falk Mueller-Veerse is now Partner & Head of DACH at Bryan, Garnier & Co.

Irackli Akhvlediani for starting a new position as Founder and Co-CEO at Horizon Strategy. We met back in his telecom consulting days at KAE.

You can sign up here to receive the CXTech News and Analysis by email.