The purpose of this CXTech Week 16 2020 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Verizon buying BlueJeans Networks

Back in CXTech Week 5 2020 we analyzed the motivation of Comcast’s acquisition of Blueface (UCaaS). And whether it was the start of a trend in telco’s buying up enterprise communication services to own the technologies rather reselling the usual suspects to improve their margins.

This week is another example of a telco buying up a CXTech service, with Verizon buying BlueJeans Networks for about $500M (about $100M in revenues and 500 people). BlueJeans Network was founded in 2009, initially raising 23.5M. With their commercial launch in 2011, and Deutsche Telekom as an early channel, I used BlueJeans a few times, it was OK.

Then in 2014 they raised $100M and they seemed to fall into a ‘me-too’ role in the collaboration market. Never standing out as forcefully as at launch. They didn’t follow Zoom with a freemium model. They always seemed to be a little behind the curve on feature sets, focusing on interop with other services. And there were rumors on profitability issues, with the latest news confirming they are now profitable.

However, they did focus on their channels’ needs; which included security and encryption. We’ll discuss this topic later given the excellent article from Olle E Johansson.

But back to Verizon, clearly this is a conferencing service built for telco needs, given the long involvement of Desutche Telekom. Verizon has spent billions on IMS (IP MultiMedia Subsystem) a service platform that was supposed to make creating services like BlueJeans easy. Clearly it did not.

What this does herald is a trend of telcos in large or multinational markets buying CXTech companies to enable them to compete where their legacy supply chain can not. Execution is always an issue as telcos have a habit of “meeting to death” the acquired company. But if kept at arms-length, and a product well-aligned to enterprise customers that would buy from Verizon. This could possibly work.

Zooming Out

This is an excellent article from Olle E Johansson on the systemic issues that result in the security and privacy problems facing Zoom. History is repeating itself, Zoom is definitely not the first to hit these issues, look at Facebook’s almost annual problems in this domain, and Webex has also had its hiccups.

Why do these issues keep happening? A software product that is widely used is discovered to have a lot of issues with security and privacy that affects a large user base. How do we avoid this in our own development projects?

I really like this insight:

Security is rarely part of the development from start. – Simply because security in many cases doesn’t deliver enough features on the product sheet. The rush to meet the deadline makes the project cut corners, and the cuttings is way too often basic security features.

Olle E Johansson

Facebook has not suffered in the long term for all its privacy indiscretions, but they are a consumer business. Zoom appeared to be getting away with it, here is another issue Zoom faced from last year.

However, that no longer appears to be the case. Zoom are busy applying the bandaids like they did last year. Is this the last security and privacy issue Zoom will face? No. Why? Because security and privacy was not baked in from the start. Will this be the end of Zoom? No. Just a blip along its growth curve to where a Telco buys them in the future.

Vonage: A Cheaper Way To Enter The CPaaS Space

This is an interesting article, as the recommendation is sort of correct, but the analysis is wrong. Firstly, CPaaS is a dumbass category. Twilio is a programmable communications enabler focused on enabling its ecosystem wherever programmable communications has a role. Vonage is an enterprise focused telco, with its own sales force, and a growing channel business.

The above is a subtle distinction, but sets the culture and approach to the market of these competitors, I’ve discussed this distinction before in these newsletters. With the coming recession, the strength for Vonage is most of its revenue is subscription. While Twilio is usage. The down turn could impact Twilio more than Vonage. Which will make Vonage a more interesting programmable communications investment if you act now.

Updated TADSummit EMEA / Americas 2020 Plan

Given the COVID-19 situation and a vaccine will not be available and widely distributed until 2021. I simply can not risk anyone’s health, or more importantly their relatives’ health, in having an in-person event in 2020.

While TADHack generally has smaller groups and social distancing is easier; a focus of TADSummit is networking, reconnecting, and spending time together over several days. The larger group size and social focus makes the risk too high. So TADSummit EMEA / Americas will be combined and run online through November.

The largest market in programmable telecoms is North America. In 2019 we finally brought TADSummit to the Americas. You can see a summary of the event here. Within the first week some of the videos were viewed over 200 times.

Similarly TADSummit EMEA 2019 was an amazing event with world-class content in programmable telecoms, you can see a summary of the event here.

We plan to run an online event covering both regions, where an invited group of experts will give presentations / workshops and have an insightful and stimulating discussion on topics relevant to EMEA / Americas in programmable telecoms / communications.

TADSummit Asia 2020 Updates

We’re updting the TADSummit Asia agenda almost daily at the moment. And working with the presenters on their content. I’m really excited at what we’re going to share through the month of May.

The latest update is:

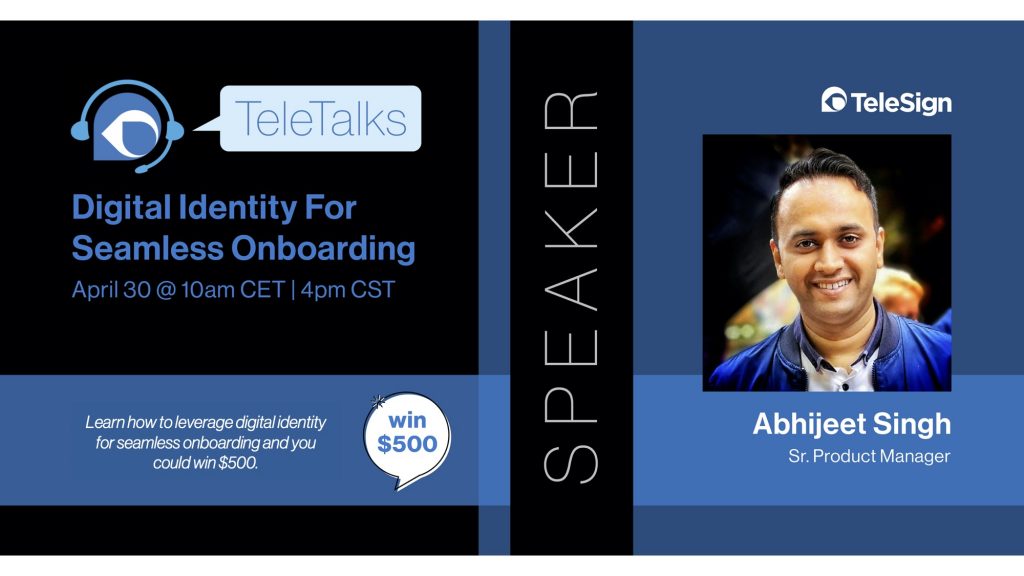

Digital Identity For Seamless Onboarding

Abhijeet Singh, Senior Product Manager. Abhijeet has 14 years of experience helping customers address fraud across multiple industries and leads TeleSign’s Mobile Identity initiatives for the International market.

- Today, a phone number has become a universally acceptable link to connect to an individual, business or service.

- At TeleSign, the phone number is at the center of everything and drives our digital Identity initiatives. We use it as a trust anchor to provide a secure, seamless onboarding experience; increasing sign ups while reducing fraud.

Join this interactive webinar to learn how a phone number can provide actionable insights throughout the customer journey. By leveraging a global data consortium and data science, TeleSign is able to strengthen the verification process, reduce fake accounts, reduce payment fraud and identify good users while improving conversion. Join us to learn how your business can benefit from TeleSign solutions by generating more revenue while maintaining a more secure platform. As an added bonus, a prize will be raffled off at the end of the session.

Digital Identity For Seamless Onboarding April 30 @ 10am CET I 4pm CST

People, Gossip, and Frivolous Stuff

Ross Garrett has left Cloud Elements, as part of their effort to survive the downturn. I’ve known Ross for over a decade, since his time in Apeona, through Layer 7 (which was sold to CA Technologies), and most recently Cloud Elements. I’m sure Ross is going to continue to do amazing things.

Keith Ajmani is now VP, Platform Engineering & Transformation at Interac Corp. I’ve known Keith since 2006, time flies.

Chiew Tze Eng is now CTO, Digital Platforms at UST Global. I’ve known Tze Eng since his time at SingTel.

Michael Tessler has started a new role as Board Advisor at ReFirm Labs, Inc.

You can sign up here to receive the CXTech News and Analysis by email