The purpose of this CXTech Week 15 2020 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

8X8 buys Callstats.io

I missed this one between TADHack Phoenix and TADHack Orlando. There wasn’t a formal PR, rather a mention in 8X8’s earnings call, see below. Callstats.io as you’d expect from the name focuses on WebRTC call quality measurements.

We also recently purchased WebRTC quality monitoring and analytics technology from Callstats.io. Callstats has been a long-term technology partner. And with this acquisition, these strategic capabilities become part of our integrated X Series platform.

8X8 Earnings Call

Callstats.io which is the company we just bought, which is de minimis actually no revenue, but a very interesting technologies for WebRTC, it analyzes all call stats and flows for our — for WebRTC endpoints, so it ensures that we had end to end analytics. So that’s something that’s core to what we did. And now we’ve added Callstats.io to add that to WebRTC as well.

8X8 Earnings Call

Like many WebRTC technology companies, e.g. Vidyo and Temasys, they were struggling to productize some neat WebRTC technology as part of a professional services business. Likely if the measurements themselves were across all channels, not just WebRTC ones, and had some unique analytics; productization may have been easier.

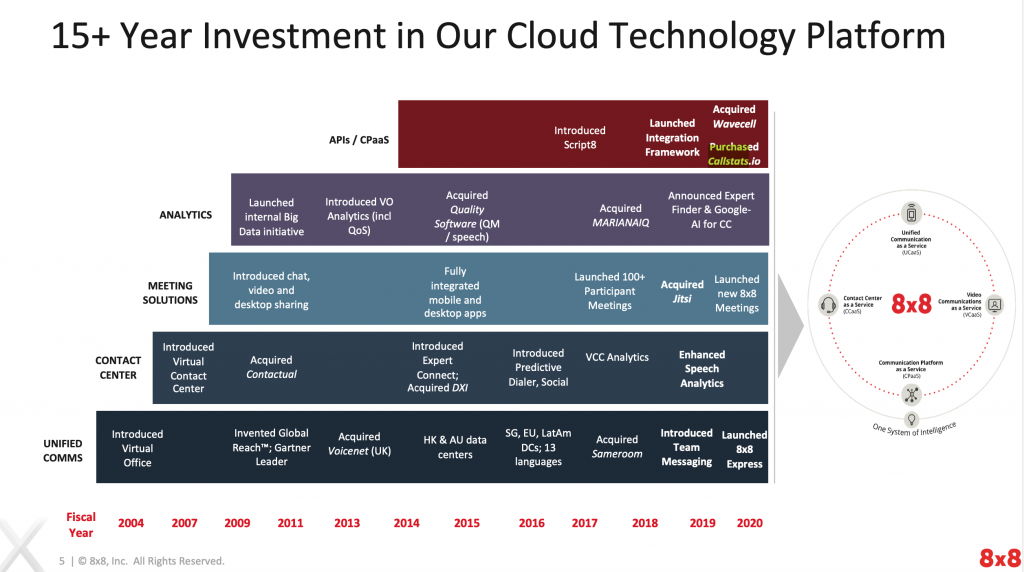

Below are the acquisitions and investments 8X8 have made over the years. With Wavecell and Callstats.io being the most recent.

TADSummit Asia 2020 Agenda, through May (online)

It’s been a busy start to the year with TADHack Phoenix in February and TADHack Orlando Online in March. In those events it’s been impressive to see how programmable telecoms / communications (CXTech) is becoming mainstream with developers; and how rich the CXTech stack has become, for example including bot frameworks. All of the hacks in Phoenix, and over half in Orlando included intelligent assistants (bots).

Coming up through the month of May is TADSummit Asia (Online). We’ve just released the TADSummit Asia agenda (draft, lots more to add); where you can see all the new, innovative and original content. All content is the latest thinking, experiences and results focused on programmable communications / telecoms (CXTech).

Thanks to Sangoma, Asterisk and VoIP Innovations (Apidaze) for sponsoring TADSummit Asia. And hot off the press (today) Telesign are the latest sponsor!

Online has been part of TADHack and TADSummit since their founding in 2014 and 2013 respectively. It’s challenging to get the best people together in one place, so we’ve always enabled those who can not make it in person to take part remotely.

Last year we discovered with TADSummit Asia 2019 the interest in programmable communications / CXTech across Asia is not significant enough to support one physical location. So we made the event online, which turned out quite well. So the plan for TADSummit Asia 2020 was always online, this is not a reaction to COVID-19.

Anyway, check out the TADSummit Asia agenda, we’re adding lots of great sessions. TADSummit is the CXTech event since 2013, plus we have an explicitly stated no BS policy. You’ll find the content well worth your time.

Bandwidth: Stay Away Until The Price Drops Further

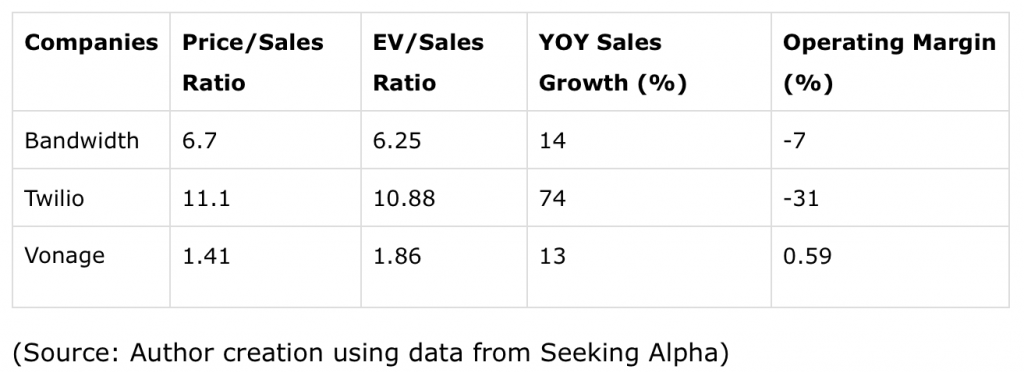

Solid analysis in that compared to other peers, Bandwidth’s pricing isn’t particularly exciting. Bandwidth is priced cheaper than Twilio but has a lower growth profile with better-operating margins. However, Bandwidth is more expensive than Vonage despite Vonage having similar growth and better-operating margins.

This reflects the discussion we had at TADSummit Americas 2019 in the panel: “Closing the Gap with Twilio, What CPaaS Providers Need To Do”.

Yes, This Is An Unpopular Opinion: Twilio Is Overvalued

Interesting analysis on the impact of the global recession on Twilio. Its usage, not subscription, revenues; and the travel industry (Uber, Lyft, Airbnb) has been hit hard.

Let’s see if Twilio can maintain momentum in parts of its business related to enterprise WFH and collaboration. Contact center is a tough one, as many of the established contact center as a service (CCaaS) providers have made-out in helping more traditional call centers manage the rapid move to WFH. As I mentioned in my discussions with GoContact in CXTech Week 13 2020. While Twilio is still working on its channel development in contact center.

Twilio is extremely unlikely to meet its own guidance for 2020. Even though Twilio’s valuation has declined more than 25% this past month, a significantly bigger decline awaits the stock once Twilio updates its guidance during its Q1 2020 results. Keep an eye open for 5th May.

Michael Wiggins De Oliveira

Investors are still paying close to 10x trailing sales for a business that will be unprofitable in 2020, with $55 million in net losses or more, and likely to grow its revenues significantly slower than present investor expectations.

Michael Wiggins De Oliveira

This isn’t a prediction, its a statement of the bleeding obvious: “We’re going to see quite a few roll-ups and consolidation through 2020 H2 and into 2021 in CXTech.”

People, Gossip, and Frivolous Stuff

In November 2019 Jonathan Grant, CEO Babl.biz and CEO Speakserve gave an impressive TADSummit EMEA keynote on “A Perspective on the Past, Present and Future of Programmable Telecoms.” The alternative title was, “How not to build a Unicorn – a Beginners Guide.” Well, Babl.biz are hiring, check out their opennings.

Congratulations to Simo Isomäki who is now Engineering Director at Smartly.io. I’ve known Simo for over a decade. Something he has in common with my son in being an aspiring saxophonist

Well done to Gordon Rawling who is now Head BSS and OSS Marketing at Ericsson. Previously he was with Huawei, and some of the silly marketing nonsense he had to publish, took all my self-control not to react. I’ve known Gordon since 2008, when he’d just moved from Amdocs to Oracle.

Warren Levitan is now SVP and GM Platform at Zendesk. He joined Zendesk when they bought his messaging aggregator business Smooch.

Dominik Blanckenstein is now Head of Program Management at KONUX – transforming the railway operations for a sustainable future. Previously, he was with tyntec. A roll-up of the A2P SMS players has to be on the cards. With WhatsApp (complete PITA for A2P), RCS (waiting one more year for greatness), overall A2P messaging traffic growth but margins are getting squeezed, and the value increasingly residing in the business messaging services not the aggregation.

Martin Groundsell is now Head of Programme Controls, MDU, New Dev & PIA PMO – Project Lightning at Virgin Media

Ashok Sankaran is now Director – Partner & Alliances at Uniphore

Yousef Abssi is now Principal Engineer at T-Mobile.

Rajesh Suseelan is now Senior Director- Strategic Business Development at ST Engineering iDirect.