The purpose of this CXTech Week 27 2024 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email or by my Substack. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Podcast 77: Truth in Telecoms, The Real John Wick

- Podcast 78: TADSummit Innovators, Voxist Whitepaper

- Ericsson $6.2B Vonage takeover now looks like its worst deal ever

- Jim Cramer on Twilio

- Deutsche Telekom Selects LotusFlare to Advance its API Capabilities

- People, Gossip, and Frivolous Stuff

Podcast 77: Truth in Telecoms, The Real John Wick

Johnny was busy posting on Linkedin over the weekend on the roaming issue experienced by the US carriers, here are a few examples, post 1, post 2, post 3.

The roaming problem ran from June 26th to June 29th. On June 27th the US experienced its busiest travel day in 15 years, with 32 million people travelling on 54,000 flights. Internationally some of the top destinations were London, Paris, Cancun (I hope people return before Hurricane Beryl hits), and the Dominican Republic.

For cheapskates like me, there’s always the refuge of WiFi at the place you’re staying. However, likely the majority of people had bought a package of roaming days that were not working between 26-29 June.

The angle Johnny took to this situation makes sense, given his extensive experience with Syniverse. Remember Johnny took Syniverse to court and won, when he was CEO of Iris Wireless. His position is Syniverse is the most critical US telecom infrastructure. Carlyle group continues to drawn out cash from Syniverse which hinders investment.

Two points johnny makes is the need for national investment in public education on spam sms and robocalling. Given the ability of RCS to imitate the look of brands on the internet, SMS spam is going to get more effective. The roaming problem is another example of what under investment can lead to. There is no other company in the telecom ecosystem that can bring all US carriers to their knees at the same time.

Johnny calls out ‘The Real John Wick,’ as the leader that can drive the investment necessarily to solve critical infrastructure issues with Syniverse. Here is the link to Johnny’s post on the Warren Buffet’s negative view of Private Equity.

Johnny posits someone needs to free Syniverse from the PE folks, buy them, so it can start investing again. The 26-29 June roaming outage, the lack of action on spam SMS and robocalling, are just 2 recent examples of the continued lack of investment in the most critical infrastructure in US telecoms.

There is no point playing the blame game, rather identify the root cause of the lack of investment, and take urgent action.

Podcast 78: TADSummit Innovators, Voxist Whitepaper

It’s great to have Karel back on the podcast. He’s building a whitepaper, Real Time Enterprise AI, and is asking the TADS community to help him refine it, as well as review the ideas contained within.

Please reach out to Karel (karel.bourgois@voxist.com) if you’d like to review his whitepaper, he’ll send it to you. You can provide feedback directly, and he will also run a live review session to gather feedback on Thursday 11th July at 11:30AM ET. 8:30AM PT, 5:30PM CET.

Karel gives an excellent review of the current ‘era of AI’ and the challenges it faces.

- Technology is moving fast, who would have thought 3 years ago Microsoft would lead over Google in AI? What will happen next year? However, Microsoft / Nuance do not move fast. Barriers take time to build, and Voxist wins in the gaps.

- LLMs are still hallucinating, RAG (Retrieval-Augmented Generation, think a PDF with stock answers, like an FAQ) has not solved that problem. There’s a battle between letting OpenAI freely answer and risk hallucinations, prompt engineering, and constraining answers with RAG. Often RAG is removed to deliver better answers.

- Massive investment race without a clear end point in sight. Spending on raw processing power to achieve close to real time, yet performance gaps remain. Enterprise economics are not yet clear, experimenting is a luxury few SMB enterprises can afford.

- Over 80% of companies and virtually all SMEs are watching AI, without a

clear plan. There’s a massive opportunity. Microsoft will dominate with the large corporations. Yet the bulk of the market is available, $18B in 2023, $110B in 2032 (source market.us)

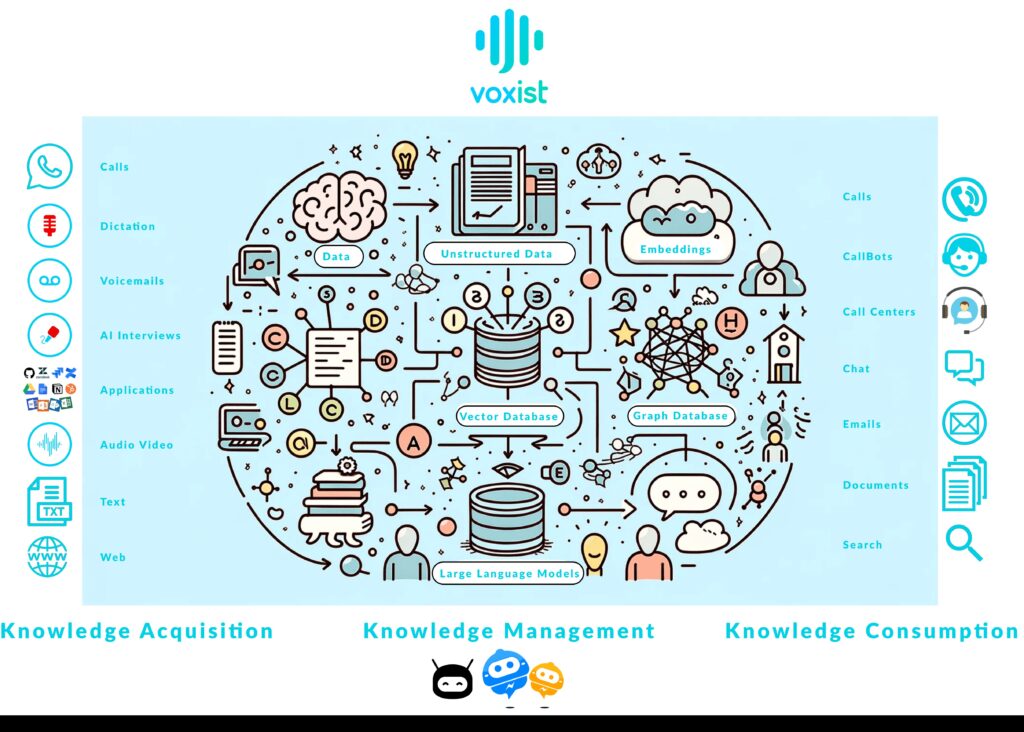

Based on Voxist’s real-time focus, throughout its 8 year history, they have created the real-time enterprise AI (RT-AI), see diagram below. They collect the bulk of untapped enterprise knowledge through voice, that is customer, partner, employee conversations, voice mail, dictations, conference calls that are happening everyday. Corporations are facing a 30k year knowledge deficit as baby boomers retire. Capturing that knowledge through voice is by far the most efficient, and is urgently required.

The knowledge can be used across the organization, that is employees, customers, HR, and even partners. So rather than creating multiple implementations, gather once and reuse across the organization.

The whitepaper reviews a number of use cases and solutions. Voxist’s cutting-edge real-time enterprise AI harnesses the power of voice to capture and utilize crucial enterprise knowledge, bridging the gap left by traditional AI solutions. Voxist is perfectly positioned to capture this new market, transforming enterprise efficiency and responsiveness in an era of rapid technological advancement.

To the TADS community, please help Karel refine his ideas and whitepaper to grow his business and achieve his next funding milestone.

Johnny wraps up on the uniqueness of what Karel has created, and its importance across the industry. Voxist is winning business from large AI companies because he remains ahead of the game. While some talk about RAG to solve hallucinations, Voxist did that 2 years ago, and realized its limitations. Please help Voxist, thank you.

Ericsson $6.2B Vonage takeover now looks like its worst deal ever

Back in November 2021 I explained why Ericsson buying Vonage was a bad deal. https://alanquayle.com/2021/11/cxtech-week-47-2021/

Vonage is a telco, UCaaS, CCaaS, and a CPast (the old Nexmo bit which did grow well). Ericsson was buying a competitor to its customers (telcos). The multiple right downs reflect this simple fact.

The current Network API fetish is irrelevant to the few developers left in Vonage’s community. Never mind the multi-decade history of failure in real-time QoS APIs, while a simple NaaS (Network as a Service) approach works.

The acquisition: “This is an exit deal for Jana Partners and Vonage, not for Ericsson or its telco customers.”

Ericsson, you need to find experts in the programmable telecoms / communications industry. Not marketeers / analysts repeating nonsense from their sponsors.

CPast is legacy, look at the success of RingCentral in telcos reselling their integrated programmable communication offers, while continuing to drive usage of the telcos’ PSTN services. Enterprises want solutions, not APIs.

Back in Week 30 2020, I reviewed the challenges Vonage face on go to market, in response to a Seeking Alpha article on the change in CEO.

Vonage’s business categorization I feel suffers from using fashionable words, cloud communications mean little. They are an enterprise focused communications provider / telco: phone system, contact center, and communication enabled workflows (CPaaS). But they struggle compared to RingCentral in positioning. RC makes it simple: business communications and customer service by business size, industry segment and need. All bases covered in 2 drop-downs.

The comparison to RingCentral in the analysis is good, and RingCentral has been winning lots of resale deals: Avaya, Atos, etc. While Vonage has come from a direct sales model, and is building out its channel sales, as discussed in CXTech 28 2020. Which will hopefully help lower high sales and marketing costs.

I’ve pointed out in previous newsletters that Vonage is a business focused telco, with a direct sales model, and an emerging channel model. And this is a potential weakness compared to the more diverse channel / enabler model Twilio adopts, which supports a greater diversity of channels.

Tokbox provides the video capabilities, but it’s not platforms enterprises want, they want services like Vonage Meetings. But that is more of an add-on sale to a phone system sale. Hence the relative success of Zoom compared to Vonage Meetings.

At this point I think Vonage has a solid and modern communications platform. Though it’s now 2024, so the platform is rather old. Its the market communications / positioning makes its sales more high-touch, than self-service or channel based. Hence, I disagree with the analysis to some extent, it’s not an integration problem, it’s a go-to-market problem.

Jim Cramer on Twilio

What’s driving Cramer to be bearish, “I still can’t recommend Twilio Inc (NYSE:TWLO)” Is it just the revenue slowdown?

Twilio had revenue of $4.19B in the twelve months ending March 31, 2024, with 5.99% growth year-over-year. Revenue in the quarter ending March 31, 2024 was $1.05B with 4.02% year-over-year growth. In the year 2023, Twilio had annual revenue of $4.15B with 8.56% growth.

Growth is significantly down from the pandemic numbers. Twilio’s revenue for 2021 was $2.84 billion, which was a 61.31% increase from 2020. This growth was driven by a combination of organic growth and contributions from Twilio Segment and Zipwhip. Twilio’s organic revenue grew 42% year-over-year, and 44% when excluding political traffic revenue.

Their investment of $1.6B in SMS aggregation (Syniverse and Zipwhip) changed the mix and growth. The push to GAAP, prepayments are not marketing costs. Large web brands have moved away from SMS because of fraud and new/old technologies. Enterprises want business solutions not SMS solutions, see Robert Vis podcast, https://blog.tadsummit.com/2024/02/02/robert-vis/.

I did laugh when an analyst referred to CPaaS as legacy, at least someone is listening. It’s about the business solutions, and the flexibility to move away from the past.

The programmable communications / telecoms market is changing. I’m reminded of the excellent podcast we did with Karim Zaki from Unifonic in September last year. Unifonic have built a strong business in the region, with communication solutions for enterprises across many sectors, and in compliance with each countries’ regulations. It’s a well defended moat to outside competition. One of the reasons DT won VirtualQ from Twilio is the their platform runs in DT, in-country.

Deutsche Telekom Selects LotusFlare to Advance its API Capabilities

LotusFlare, announced that it has signed an agreement with Deutsche Telekom to provide the underpinning platform for the advancement of Deutsche Telekom’s API capability for its Group companies.

Deutsche Telekom will employ LotusFlare DNO™ Cloud as the cloud-native commerce and monetization engine to enable the onboarding of developers, publication of API products, their purchase, metering, and billing.

The partnership will enable Deutsche Telekom to deploy advanced monetization capabilities for the MagentaBusiness API service. This will allow developers and business customers to embed communication functions like video, voice, messaging and other capabilities into their products, applications, and workflows.

LotusFlare is expensive API Management. The margins are not there for such software. DT will realize too late.

People, Gossip, and Frivolous Stuff

Bridgette Bigmore is now the first permanent CTO of UKTL established by the Department for Science, Innovation and Technology (DSIT) and operated by NPL I’ve known Bridgette for well over 20 years, she is a great example of the importance of summer student projects, which led to her being hired into BT.

Jose Valles is now Managing Director – Spain at SAP. I’ve known Jose all the way back to BlueVia at Telefonica, 16 years ago.

Dominic Arena is now Chief Executive Officer of Fetch TV. I’ve known Dominic since his time at Value Partners, over 12 years ago.

Alex Salamon is now Chief Revenue Officer (CRO) at AirWireless.io. I’ve known Alex nearly 20 years.

Liara Ibrahim is now Head of Marketing at Ascentis Group. We met when she worked with Apigate.

Raymond Flynn is now a Senior Account Client Engineer at Oracle. I’ve known Ray for over one decade, since his time at Openmind Networks.

Israel Palacios is now South Europe Head of Sales , Nokia Defense International. Known for over one decade.

Maurizio Marcelli ICT Risk Management! in Fibercop. I’ve known Maurizio about one decade, when he was with TIM,

Plabon Alam is now Carrier Sourcing Manager at CM.com.

Umer Saeed is now Senior Voip Software Engineer at Expertflow – livechat, video, callcenter SW.

You can sign up here to receive the CXTech News and Analysis by email or by my Substack.