The purpose of this CXTech Week 44 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- TADHack-mini Orlando at Avaya ENGAGE 2021, 11th-12th Dec 2021

- TADSummit EMEA Americas 2021 Starts on Monday 8th November

- Infobip buys Peerless Network and Raises $500m

- Vonage and Etisalat Digital Partner for CPaaS

- Bandwidth is down 45% in 2021, Most of the Press seem to think it’s going to Soar

- IntelePeer Launches Reputation Management

- People, Gossip, and Frivolous Stuff

TADHack-mini Orlando at Avaya ENGAGE 2021

We had so much fun in Orlando at the end of September with TADHack Global, we’re back on the 11-12th December for TADHack-mini Orlando at Avaya ENGAGE. As always with TADHack, it’s a hybrid hackathon, so you can join us in-person or from the comfort of your own home.

We have more than $15,000 in prizes and other goodies, great food, access to the Avaya ENGAGE Welcome Party at Walt Disney World Dolphin Resort Beach & Cabana Pool on Sunday (free food, drink and fun). Plus winners can present their hack to the 16,000 strong Avaya ENGAGE community on Monday 13th.

Register here. Let’s make TADHack-mini Orlando at Avaya ENGAGE a success to help the Orlando economy get back to normal.

TADSummit EMEA Americas 2021 Starts on Monday 8th November

TADSummit is the event for programmable communications since 2013. All presentations, workshops, and panel discussions will be given from 8th November 2021 to 8th December 2021.

Thank you to our sponsors for making this possible: AWA Network, Automat Berlin, STROLID, Radisys, GoContact, Broadvoice and Telnyx.

We’re going to be virtual again (prolonged pandemic) with a mixture of live and pre-recorded sessions. We plan on 7th and 8th Dec being the core of the live sessions running from 3-5PM CET / 9-11 ET, for keynotes and hot topics so we can gather in real time. Around that we will have live workshops and pre-recorded sessions.

Our first presentation on Monday 8th November will be from Jesus Cruz Manjavacas, PLAY: “Is Mobile Identity still an opportunity for telcos?” Its an excellent review of mobile identity, covering many use cases, and a frank review of how to make money and the challenges telcos face. Remember the “No BS” policy of TADSummit! You get insights you can build a business or strategy around, not wishful thinking and marketing spin.

Infobip buys Peerless Network and Raises $500m

Following Sinch buying Inteliquent, Infobip has bought Peerless Network a US focused business VoIP provider, with a suite of voice, UCaaS, SIP, Messaging, APIs, MS Teams integration, and other collaboration products and services.

With its own nationwide voice network, Peerless Network’s customers / partners include enterprises, Fortune 500 companies, MVNOs and IXCs, and the nation’s largest CLECs.

The aggregation game is scale (buying other SMS aggregators) and scope (buying voice aggregators). Though Peerless is more service provider than aggregator.

Vonage and Etisalat Digital Partner for CPaaS

I think of this as Etisalat reselling Vonage Communications Platform (VCP) messaging, voice, and video communications solutions. With a VCP instance running in Etisalat and connected to the Etisalat network with some rules of where traffic flows (Etisalat or Vonage).

While some larger telcos may want to own the technology, e.g. buy and implement a CPaaS from say Mavenir (Telestax). I think this option is much cheaper and delivers a broad offer immediately. Twilio crafted a deal with KDDI (Japan) in 2012, KDDI are local delivery partner for Twilio, and the deal is still in operation today.

Bandwidth is down 45% in 2021, Most of the Press seem to think it’s going to Soar

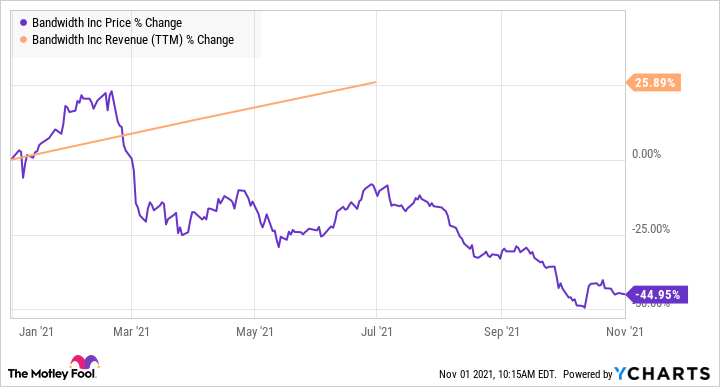

Bandwidth have been generating solid results through this year, but the stock is down 45%. Then in the past week lots of financial press start talking about the stock soaring, hmmm, seems like someone’s working a PR campaign 😉

Most of the chatter seems to be the realization that Bandwidth and Twilio are not the same type of companies, see this article that does capture some of the differences. We pointed this out at TADSummit Americas 2019. See video below, where Tony Jamous clearly makes the point.

The company’s third-quarter revenue will be impacted to the tune of $0.7 million due to a recent distributed denial of service (DDoS) cyberattack that led it to offer credits to customers and caused a loss in transaction volumes.

Bandwidth points out that the DDoS attack is likely to affect its full-year CPaaS revenue in a range of $9 million to $12 million, including the third-quarter impact mentioned above.

Bandwidth was expecting full-year revenue of $484.8 million to $486.8 million as per its second-quarter earnings report, which would have translated into 41.5% growth over 2020’s revenue of $343.1 million. It is worth noting that the company’s original full-year revenue guidance that was issued in February this year had called for revenue between $460.4 million to $464.4 million.

Zoom is one of Bandwidth’s larger customers, the prolonged pandemic has kept Zoom and other Zoom-like customers of Bandwidth’s business brisk. So it may not be as similar to Twilio as investors thought, but it’s doing OK.

IntelePeer Launches Reputation Management

Similar to TeleSign’s Score, Reputation Management provides, through IntelePeer Insights, advanced analytics and a dashboard for on-demand reporting of call reputation and performance, and the ability to create alerts for changes in reputation. It alleviates the time and resources needed to manage multiple carrier relationships and phone number updates.

People, Gossip, and Frivolous Stuff

Simo Isomäki is now Chief Product Officer at VividWorks, 3D design-to-purchase SaaS platform. I met Simo at CompTel, he was one of the few that understood the vision I presented on programmable communications was going to become reality.

After leading Buddy4Study for over four years, see his Innovator Interview at TADSummit Asia, Manjeet Singh is moving to his passion of Holistic Health. FlexifyMe (https://www.flexifyme.com/) where the entire team get up in the morning with only one goal “To inspire people to live a Healthy and Happy Life”

Daria Shileaeva is now Account Manager at Cegeka.

Hunter Blankenbaker is now Head Of Investor Relations at Justworks. Previously Vonage, and also a neighbor, our kids went to the same pre-K school.

Stephen Mureithi is now Product Manager – SME and Cloud at Safaricom Telecommunications Ethiopia

Paul Cardenal is now Senior IT Operations Director, Head of Applications & Multi Cloud Services at Fujitsu Spain

Jason Spencer Knox is now Chief Operating Officer at Traffic Tech

You can sign up here to receive the CXTech News and Analysis by email.