The purpose of this CXTech Week 38 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list, I also publish this on my weblog. And please let me know any CXTech news I should include.

Twilio: Undervalued With Some Risks

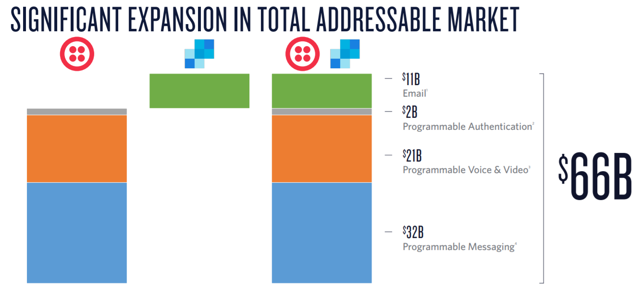

Interesting analysis, and a useful diagram on how Twilio positions its TAM (Total Addressable Market). Note it doesn’t position against CPaaS, which I support as its a contrived category. If we do roll-up those companies identifying as CPaaS (that do not fall into in-app messaging, business messaging, or private CPaaS) Twilio does skew the market given its size and growth rate.

Email marketing at $11B makes sense. Authentication at $2B is conservative, but Twilio does not play as actively in the trust and mobile identity like TeleSign and payfone.

I think the messaging TAM is overstated, even including business messaging revenues, in part because of the crazy figures quoted in A2P SMS over the years. While the voice and video TAM depends on how far they move up the application stack. UCaaS and CCaaS together are about $33B + $18B in 2021, but that number also includes channel margins, messaging services, and other lots of other services beyond voice and video.

We’ll be having a deeper dive into the market sizing and growth from a bottom-up build, that is taking the number from companies identifying in particular categories, at TADSummit Americas on 15-16 October in Chicago. In doing so we can also split out what is really cloud-based versus legacy, and how much revenue is earned from SIP trunking.

THE TRUTH BEHIND FREE CONFERENCE CALLS AND TRAFFIC PUMPING

Nice review of the impact of a 1996 ruling from the FCC that changed the rules regarding telephone access charges charged to long distance companies for delivering calls to rural areas. This rule change helped to subsidize rural telephone companies serving sparsely-populated areas in order that they could modernize their equipment and deliver broadband access.

The phone company in Battle Lake justified that hefty surcharge to the FCC based on the high cost of providing phone service to a rural farm town of 772 people. It has to maintain all those miles of pole line, operate the central office, pay for electricity, etc. If suddenly the population of Battle Lake all become uncensored party lines and receive millions of minutes of phone calls, then the rural telco in Battle Lake makes a hefty profit. That’s called Traffic Pumping.

Simwood are sponsoring TADHack Global 12-13 Oct

Simwood people are going to be present at the events in:

- Berlin 50% increase on last year’s registrations

- Chicago (150+ registrations and growing fast)

- Johannesburg (450+ registrations and still growing fast! – arghhhhh!)

- London (come on London forget about Brexit and show the world British Innovation!)

5 UCaaS Magic Quadrant Mysteries Examined

Nice review by Marty Parker of the latest Gartner UCaaS Magic Quadrant. The key points to remember in my opinion are: who pays them the most money has the most influence over their thinking, its generally biased to the needs of large North American enterprises, this MQ is not UC rather UCaaS.

Gartner estimates that 40% of new enterprise telephone purchases will be based on a cloud office suite – either Microsoft Office 365 or Google G Suite – by 2023. Microsoft Teams is on a roll, it’s growing faster than the competition. But what does new enterprise telephony “purchases” really mean?

It’s already clear that neither Microsoft nor Google is selling enterprise telephony as a separate product. The Microsoft Teams Phone System is an add-on feature to entry-level Office 365 licenses and is bundled in the top of the line E5 enterprise license. If an enterprise is buying the E5 license for other reasons, such as security and compliance features, analytics, or mobile device management, the Phone System license is essentially free.

Google G Suite raises similar questions. At this point, Google prices its voice service separately, but perhaps will soon bundle it into G Suite pricing with an add-on for various levels of public switched network telephone number access.

So, in either case, is there even a “new purchase?” Maybe, the statement should be “40% of all new enterprise telephony license activations in 2023?”

For over half the enterprise market that are small and medium enterprises around the world, without an IT department so local support from someone they trust matters, who do not care about long lists of features rather solutions that improve employee and customer experience while saving them money next quarter. I think you’ll get more relevant insight on the hybrid enterprise UC future at AstriCon 2019, where I’ll be giving a keynote. Hybrid matters!

The Season of Pay to Play Awards and Silly Market Estimates

CXTech is also used for Customer Experience Tech, but C can be used for so many other C-words, like communication, collaboration, conversation, connectivity as well as customer. This analysis shows boundaries are important in defining market sizes, else the numbers just get crazy. To the above UCaaS number it’s also including enterprise telephony. Perhaps a better label is employee communications, than some biased technology label. As most communications is never going to be truly unified, just like the unified messaging promise in the ’90s never happened.

Research and Market have CCaaS at $28.6 billion by 2025, with a compound growth rate of 23.8%. Again the number includes traditional contact centers, and likely all the VAS being added around customer communications. Perhaps using the term Customer Communications is a better category label, than pre-supposing cloud. Psst, I know several CCaaS providers that are technically hosted contact centers, but don’t tell anyone.

People, Gossip, and Frivolous Stuff

Congratulations to Sam Machin moving from Developer Advocate to Senior Product Manager at Vonage. I’m seeing this move more often in career progressions. Taking a tour of duty on the front lines where developers will tell you in no uncertain terms when something could be improved. There is no hiding when an API or its support does not compare to the competition. It’s also a great opportunity to understand future demand as often developers are working on the ‘what’s next’ technologies. Then taking all that hard won experience back into product management. Product Management can become detached from the market and wrapped up in analyst stoked competition, see current fashion on AI (AI doesn’t exist, machines do not learn, it’s all just statistics), that is mostly irrelevant to the customer.

Congratulations to Kin Lane, who is now Chief Evangelist at Postman, the collaboration platform for API development.

Well done Larry Baziw, who I’ve know for quite a long time (when telcos first looked at APIs), is now Senior Director Wireless Delivery and Device Certification at Rogers Communications.