Introduction

Businesses in LATAM are being subjected to 250%, 267%, and 6600% price increases for international A2P SMS as global aggregators squeeze out the local aggregators. And we’re seeing even local A2P SMS price increases of 1125%.

I’ve been hearing quite a few complaints about SMS pricing in Latin America from brands and local aggregators. I decided to have a chat with a few of my contacts in the past week to see what’s going on.

Corroborating data is linked at the end of this article. Data comes from regional brands, local aggregators, newspapers, local regulators, and National Economic Prosecutor’s Office show the situation is bad, and generally ignored by the regulators and industry bodies.

Summary of Issues and Dynamics in the LATAM A2P Messaging Market

Rising Market Potential with Heavy Pricing Barriers:

Mobile penetration in LATAM is expected to reach 74% by 2028, an estimated 518 million users will be reachable through A2P messaging, providing significant opportunities for business-to-customer engagement. However, the growth potential is limited by severe cost barriers created by exclusive A2P monetization strategies that increase SMS rates, particularly affecting small businesses and local aggregators who rely on cost-efficient messaging for customer outreach.

One theory being discussed is Meta and Google, through proxies such as messaging consultancies (ask them what % Meta/Google are of their revenues), are interfering with the market using short term greed to limit A2P SMS expansion in favor of WhatsApp and RCS. WhatsApp is popular (P2P) and is priced quite competitively in some LATAM markets for A2P messaging. To the telcos and GSMA: the demise of A2P SMS is being engineered in front of you.

Where is MEF in this terrible situation? Doing what its sponsors want. We should all be disgusted with the MEF’s inaction in the Great LATAM A2P SMS robbery.

Firewall Monetization and Exclusive Aggregator Deals

Global aggregators such as Infobip, VOX Solutions, and Tyntec are using firewall deals with LATAM mobile operators, creating exclusive control over SMS traffic segmentation. This segmentation inflates costs, as international A2P SMS traffic often incurs significantly higher rates. These exclusive deals prevent local aggregators from accessing competitive pricing and monopolize market access, contrary to fair business practices. We covered the Tyntec / Twilio deal here.

Significant Price Hikes Across LATAM

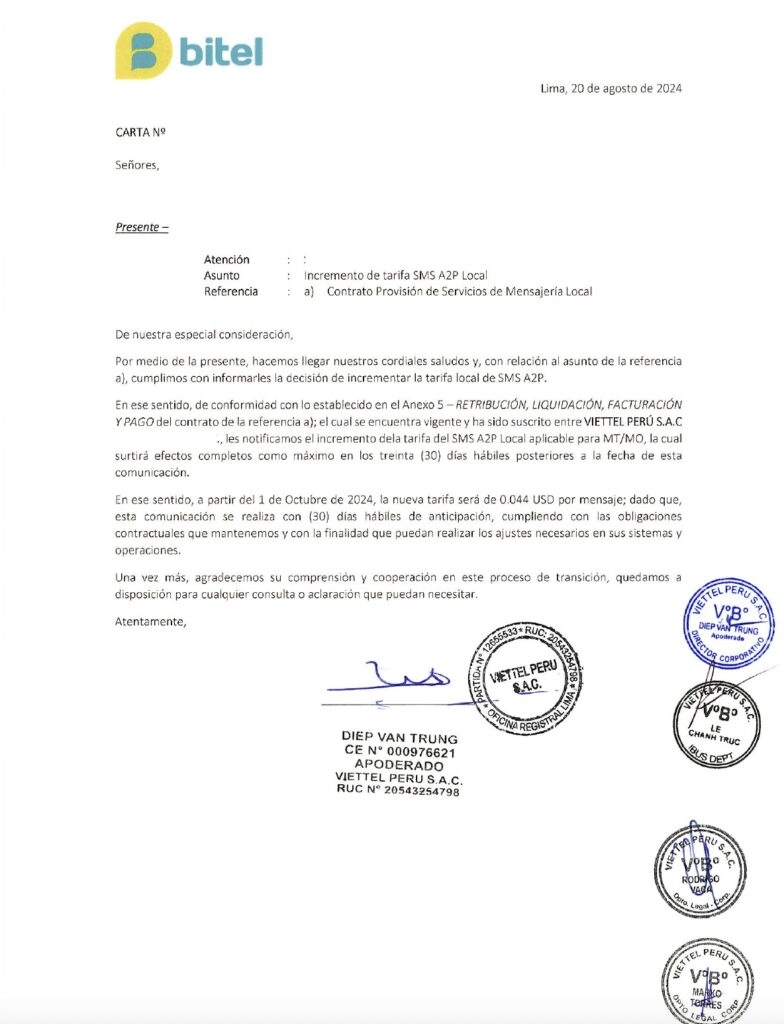

In countries like Mexico, Peru, and Guatemala, exclusive aggregator partnerships have led to drastic SMS rate increases. For instance, Bitel Peru’s partnership with Tyntec has seen local A2P SMS costs rise by over 1025%, while Tyntec’s exclusivity in Peru with Bitel has increased rates from a regulated 0.004 cents to 0.045 cents for the local A2P Market, not to mention international rates that are up to 18 cents.

However, aggregators such as Twilio enjoy preferred pricing with Tyntec due to the fact that Twilio prepays for volumes and has the capability to aggregate the traffic. Such pricing strategies, often not cost-justified, benefit larger aggregators and mobile operators, placing an unsustainable financial burden on smaller businesses and local telecom operators who cannot afford these rates.

Local Resistance and Regulatory Pushback

Some LATAM regulatory bodies, such as Chile’s National Economic Prosecutor’s Office (FNE), are beginning to respond to anti-competitive practices in the A2P SMS market. In Chile, FNE has challenged monopolistic pricing practices by mobile operators like WOM, highlighting the lack of cost-based justification for price increases. This pushback has fueled discussions around implementing regulatory frameworks to oversee A2P SMS pricing and prevent monopolistic practices that hinder market competition.

Fragmentation and Pressure on Local Aggregators

LATAM has a vibrant ecosystem of local aggregators crucial for regional business communications. However, exclusive deals held by large international aggregators are edging out these local players, diminishing their market presence. This trend limits options for small and medium-sized businesses, stifling innovation and competition in LATAM’s A2P market and threatening the diversity of service providers essential for a healthy market.

Need for Transparent, Competitive Market Standards

To fully harness LATAM’s mobile-first market potential, regulatory bodies and industry groups such as GSMA must establish transparent pricing standards and fair competition guidelines. A regulatory framework focused on balanced pricing and accessible market entry can counter monopolistic control, ensuring that LATAM’s A2P messaging remains affordable and competitive, benefiting businesses of all sizes.

Data Gathered so Far

Tyntec has an exclusive with Bitel (Peru), where they charge 0.18 cents (US) for International traffic. Bitel (Peru) has increased local SMS traffic from 0.004 USD to 0.045 USD. Over a factor of 10 increase (1,125%!!!). The local regulator must act, see the Chilean discussion in the next section.

In Peru brands and local aggregators lay the blame on Tyntec convincing the local telco, Bitel (Peru), the market can not sustain such price increases. The local regulator should be protecting consumers and businesses, and the GSMA should be intervening across the region. This is not good for the SMS business in Peru, WhatsApp is winning both the P2P and now A2P business.

Claro (Peru) has recently selected iBASIS as its A2P Monetization provider and the new rate is 0.089 Euro from 0.004 Euro (22,250%), https://ibasis.com/claro-peru-selects-ibasis-for-a2p-monetization/, in a Market where 3 of the four Operators (Entel, Bitel, Movistar) already had A2P monetization Firewalls in place and filtering SMS content to separate national from international. Peru has become a 100% A2P monetization market where the big operators decide who to give an exclusive deal.

Infobip lost its exclusive Firewall A2P monetization deal in Tigo (Guatemala), to VOX Solution.

Sinch lost its exclusive deal with Tigo (Honduras) to GMS. Both Infobip and Sinch are moving away from firewall / exclusive deals, in Infobip’s case, it is attempting to cleaning up its operations for an IPO.

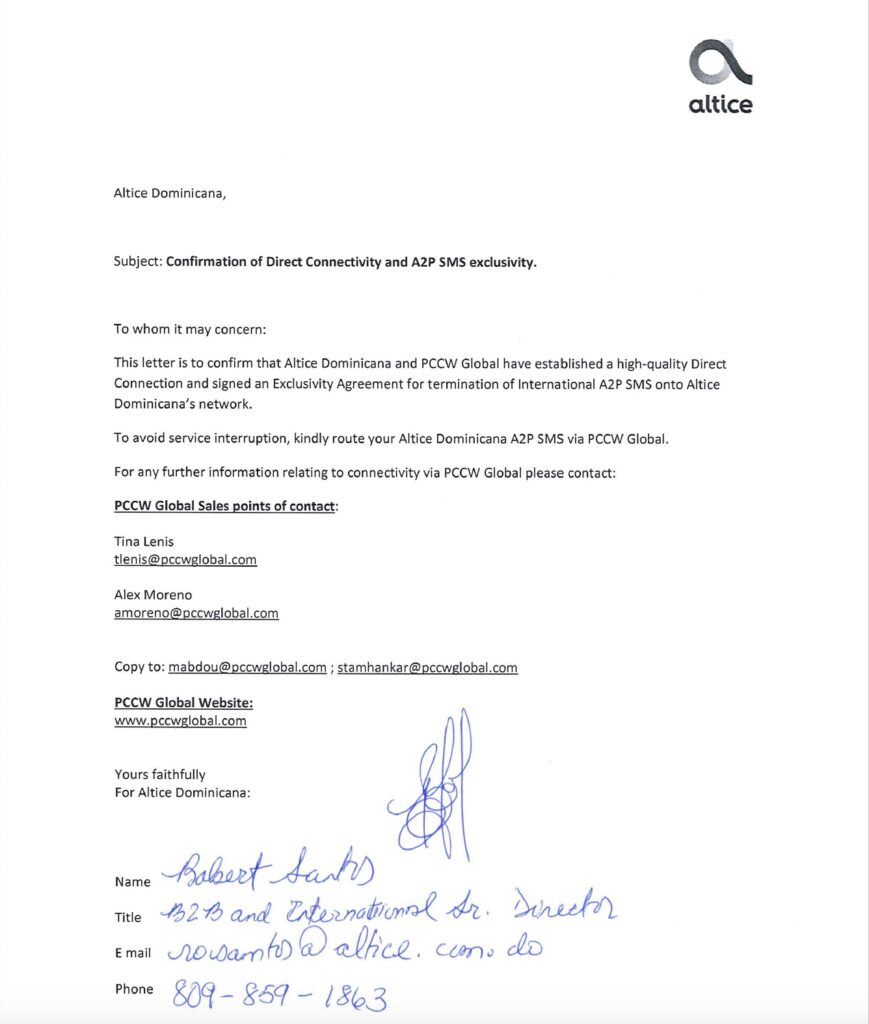

PCCW Global has been the exclusive gateway to Altice (Dominican Republic) for some time. Sinch was added as a preferred partner for traffic collection, while PCCW focused on SMS Firewall and protecting the MNO. Let’s see what happens to the pricing.

Vox Solutions now has a Firewall deal with Viva (Bolivia), Tigo (Bolivia) is with tyntec. I do not yet have pricing details.

iBASIS lost its exclusive A2P monetization deal in Claro (Ecuador) to Vox solutions where they deployed a Firewall. Back in September 2021 Claro Anounced iBasis https://www.gsma.com/get-involved/gsma-membership/gsma_resources/ibasis-becomes-the-authorized-carrier-of-claro-ecuador-for-the-monetization-of-all-a2p-sms-messaging-international-traffic/.

Claro (Ecuador) was 0.075 USD with iBasis and is now expected to raise pricing up 0.20 USD with VOX, a 267% increase. But keep in mind that with only 18 million inhabitants Ecuador is among the most expensive networks in LATAM, with its CNT (Ecuador) A2P is around 0.27 cents managed by SMSHighway.

Personal (Paraguay) is rumored to have Infobip taking over the A2P monetization deal. Local aggregators are desperately looking for alternatives.

Tigo (Guatemala) was 0.08 USD before Vox took over, and is now 0.20 USD, a 250% increase

It’s become so bad local brands are avoiding involvement in local events sponsored by some global firewall companies. They feel their country is being robbed by global aggregators.

A feature of the LATAM market are lots of local aggregators. I was doing some market analysis for a client a couple of years ago, and they asked, ‘Where do you find all these companies? We did a survey only months ago and did not find them.” Local aggregators matter in LATAM, small businesses could be relied upon to do what’s right for their country. The global aggregators (CPaaS) seem to be on a mission to remove these local companies, and I’m surprised the local telcos are complicit.

The emotion is extremely high in many LATAM countries at the moment.

The assumption is AIT (Artificially Inflated Traffic) is running rampant, any large brand sending 2FA in the region. Check your traffic carefully.

The GSMA and local regulators need to urgently educate the local telcos that robbing your customers (even if it’s by a proxy) is unacceptable behavior and is accelerating the decline in A2P SMS.

We covered ways these behaviors can be limited in The Honest CPaaS Review.

If you can corroborate this data, or have other data from the LATAM region, please let me know.

BTW VOX Solutions are hiring in LATAM. And I suspect looking for an aggregator to buy to help close more LATAM deals.

Chilean Success

Infobip attempted an exclusive A2P monetization deal with the Operator WOM (Chile), which holds 25% of market share. However, the deal did not thrive due to the Chilean regulator being clear on the importance of a Free Market in Chile. An operator can not monopolize its network and hand it to an international aggregator.

In Chile there are plenty of companies competing in the A2P Market. Both local, regional, and global. The National Economic Prosecutor’s Office sent a letter to the Telecommunications Regulator to create a provision that regulates both international and national messaging in Chile.

In addition the Comptroller General of the Republic of Chile is reviewing that the regulated rates are respected among the telephone companies, to avoid arbitrary charges from a larger operator against a smaller one. Overall, Infobip failed trying to copy-and-paste bad behaviors from other countries to Chile, and of course lost their investment and prepaid money for a Firewall monetization deal.

The SMS companies active in Chile brought Wom (Chile) and Infobip to court claiming that the implementation of the Infobip service should not increase rates by 66 times. Wom defends itself, assuring that it made a benchmark between companies, establishing that the verification messages are of an international nature. The charge that Infobip makes to SMS companies is very similar to that made for this service in Mexico, Argentina and Peru.

From several Chilean sources, Infobip are now in conflict with WOM (Chile) because they failed to meet the financial targets to monetize their network with Firewalls.

Chile has good legislation on Free Trade, which helps on the current A2P SMS shenanigans, and is an example to the whole of LATAM.

Corroborating documents

Latercera News Article on “From witness lists to failed negotiations: SMS companies and Wom spark dispute over anti-competitive practices” also translated to English. https://www.latercera.com/pulso-pm/noticia/desde-el-listado-de-testigos-a-una-fallida-negociacion-empresas-de-mensajeria-de-texto-y-wom-encienden-disputa-por-practicas-anticompetitivas/ESS5IM47YVF6PBD4JNOZ5EECDY/

English translation of the Latercera news article: https://docs.google.com/document/d/1Dvz3t-Uic4UJf0h_79oq3TH56OZonWXz/edit?usp=sharing&ouid=110218336577902470954&rtpof=true&sd=true

From Fiscalia Nacional Economica (National Economic Prosecutor’s Office) Case No. 2699-22 FNE.

Complaint against WOM in the SMS market. (English) https://drive.google.com/file/d/1S29ksuI5LMVo12Mjgss-qkbpWg4GKbsj/view?usp=sharing

Complaint against WOM in the SMS market. (Spanish) https://drive.google.com/file/d/19fC4LjSVtDD30HZysJ3Oo4oL46GS9x8f/view?usp=sharing

GSMA Mobile Economy Reports: The GSMA’s “Mobile Economy Latin America 2024” report highlights that by 2028, Latin America and the Caribbean are expected to have approximately 951.5 million mobile subscribers, resulting in a penetration rate of 137%. This figure includes connected devices, machine-to-machine (M2M), and Internet of Things (IoT) accesses, indicating a significant expansion in mobile connectivity. (Developing Telecoms)

Statista Projections: Statista’s analysis indicates that mobile phone penetration rates in Latin America are anticipated to rise steadily. For instance, Argentina’s penetration rate is projected to increase from nearly 80% in 2023 to higher levels by 2030, with similar upward trends expected in other countries across the region. (Statista)

Altice exclusivity with PCCW

Bitel Local SMS rate increase

Pingback: TADSummit and TADHack's Secret Sauce: Truth and Integrity. - Blog @ Telecom Application Developer Summit (TADS)

Pingback: MEF: A case study in one lie leads to another - Blog @ Telecom Application Developer Summit (TADS)