The purpose of this CXTech Week 44 2023 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email or by my Substack. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- TADSummit Podcast Episode 8

- Prove Identity nabs $40M at a $1B+ valuation to expand in mobile-based authentication tech

- Ooma Acquires 2600Hz for $33M

- TADSummit Summary: Keynotes

- People, Gossip, and Frivolous Stuff

TADSummit Podcast Episode 8

TADSummit Innovators

Bogdan sponsored TADSummit 2023 and provided an excellent keynote, The Symbiosis of Open Source and Industry or how they do self-support one each other – study case of OpenSIPS and SIPhub.

This podcast covered the origin of OpenSIPS, the rise of SIPhub as a method to monetize all the knowledge within the project through the creation of SIP Engines that are licensed. And a frank discussion on how to make money from such a broadly adopted open source project, Johnny’s reactions are quite funny, as he grapples with the how open source makes money.

Across the many monetization methods I’ve seen in open source telecoms / communications, this is interesting, and I’ll be tracking closely. It’s well aligned to the skills of the team, and delivers a product (SIP Engine) where the benefits are easy to quantify for the customer.

Truth in Telecoms

A broad review across the industry’s news, such as Tata communications appear to be doubling down on the lawsuits against Kaleyra. We covered Bill’s case here. To my connections in Tata Communications: Tata needs to do their own independent review on what has gone on. Lawyers will keep billing for as long as they can.

There are solutions being discussed that can solve the SMS SPAM problem without the complexity of TCR.

We review how Twilio’s stock price rise to $450 during the pandemic set off a chain of unintended consequences across the industry from Telco jealousy. Which is stifling innovation in the programmable communications industry and now we need to act on multiple fronts:

- an industry-wide call to action that Twilio must also get involved in; and

- we must simplify the findings from our earlier analysis on messaging monopolies and TCR, so the general public can realize what is happening.

Prove Identity nabs $40M at a $1B+ valuation to expand in mobile-based authentication tech

This news is a couple of weeks old, with TADSummit, TADHack, Network X, and catching up with everything else, I’ve been lax in reporting on interesting developments. It’s a nice valuation, and shows areas of programmable communications remain quite healthy.

Prove Identity presented at TADSummit last year, “Supercharging CPaaS Growth & Margins with Identity and Authentication” from Aditya Khurjekar.

Prove has around 1,000 business customers, mostly in financial services, helping their customers with sign-up and sign-in. Prove’s technology links up data from a phone’s SIM card, which “acts as a privacy-centric proxy for digital identities”, to functionality offered on smartphones, such as facial recognition, to authenticate users. Passkey is part of their solution. This subsequently triggers other actions such as the pre-filling of information, customer verification flows and password-free authentication.

Prove said it plans to use the funding to build out more tools for digital payments and commerce, as well as fraud detection, and it sounds like the mobile handset will remain a central part of the proposition. The raise is being co-led by strategic backers MassMutual and Capital One, and it is coming at a time when digital identity continues to be a hot topic.

Ooma Acquires 2600Hz for $33M

Ooma bought OnSIP for $10M in Sept 2022, approximately its annual revenue. However, 2600Hz ARR was about $7-8M, so it’s a really nice multiple at $33M. A heartening valuation given everything that’s going on in the industry.

Ooma has been a customer of 2600Hz for over one decade. Bringing the technology in house, helps secure Ooma’s business applications (including UCaaS) going forward, and likely explains the solid multiple. Ooma’s annual revenues are about $219M for 2023 across residential and business VoIP, with 12% annual growth.

My view was 2600Hz are a really nice group of engineers, that have a solid following through working closely with their customers. Quite US focused, and never achieved the CPaaS potential they aspired towards, rather UCaaS remained their bread and butter. I know some resellers found their platform a little resource heavy, but clearly it worked for Ooma and others.

TADSummit Summary: Keynotes

I completed reviewing all the TADSummit content this week. Running the event means I’m often too busy to absorb all the excellent content. However, reviewing after the event, makes me realize how high the quality of the content is, and how it sets the direction of the industry, and clearly differentiates from the book clubs.

Thank you to everyone who took part. And a special thank you to our sponsors: Strolid, Stacuity, Unifonic, SIPhub, Jambonz, and TelecomsXchange

From the keynotes:

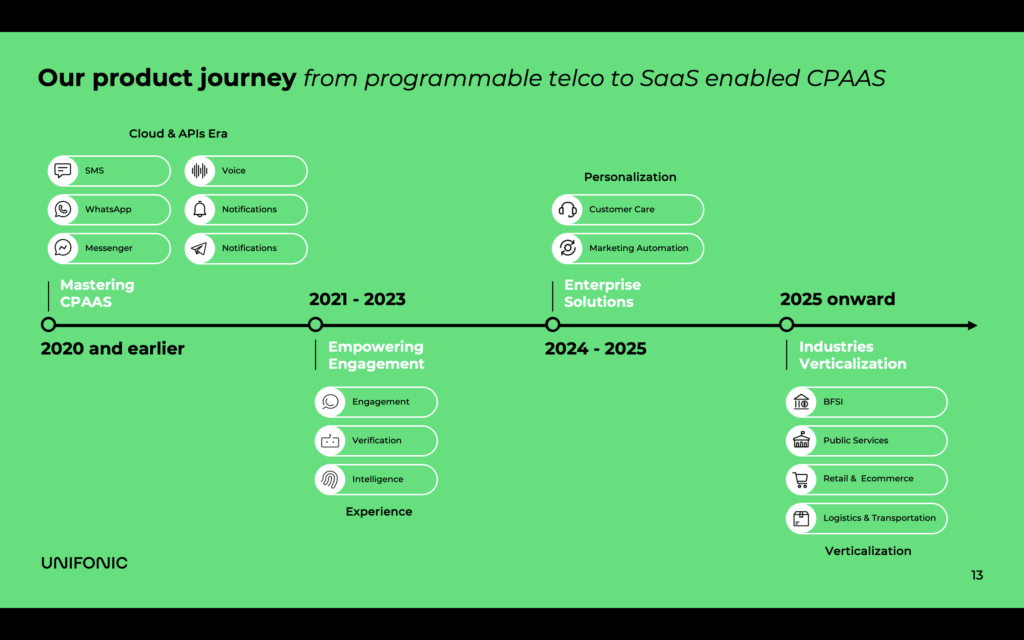

Unifonic set out a roadmap for the programmable communications industry, shown below.

Stacuity enables the mobile network to be treated like an extension of the enterprise network. The hacks built on them at TADHack also demonstrated the importance of the end to end VPN and the application of the key value store.

TCXC showed how Telin, the international arm of Telkom Indonesia, is delivering wholesale voice, SMS, and numbers business using TCXC’s PaaS (Platform as a Service). This is where telcos should be focusing their efforts in programmable communications.

I’m a fan of Jambonz, and Dave set out powerful arguments for Jambonz adoption given the evolution of the voice industry, how his community works, and the mistakes he’s made over the years. For example, listening to pundits 🙂 I’d also recommend checking out Dave’s TADSummit Innovators podcast, there’s a great discussion on where he can take Jambonz.

Having Dave and Bogdan presenting back to back really set up the challenges open source projects face, and their efforts to improve monetization. While often project specific, I think Dave and Bogdan’s work here is important for the health of free and open source telecom projects. Also check out the Bogdan’s TADSummit Innovators podcast, it really sets out the challenges open source can have in monetizing their knowledge.

Everything is coming together on vCons, the standard, the data sets, and developers able to slice / dice the data and use bots to automate many workflows around customer and employee communications. the big-data vision around conversations is now happening. Seeing Matt William’s hack at TADHack on vCons drove home how powerful vCons are in making conversations like every other piece of data available in an enterprise.

And finally Johnny and Bill shared some of their views and answered the audience’s questions on the state of the industry. They are available for anyone in the TADS ecosystem who seeks advice, help, or support. Especially in entering or growing your position in the US market, it’s about 50% of the programmable comms industry.

I’ll review the Open Source, Enterprise, and LLM presentations next week.

People, Gossip, and Frivolous Stuff

Nitsan Sharon is now CTO, Strategic Clients Group, Israel at Oracle. I’ve known Nitsan for a decade, since his time at Amdocs.

Mark Windle is now AVP, Platform Access Development (Product Management) at Console Connect. I’ve known Mark for well over one decade.

Giorgio Ramenghi is now Top & Large Business Development & Innovation Management at wind tre.

Jeremy Copp is now Head of Sales at Netduma. I’ve known Jeremy since he was with ComScore.

Talbot Hack is now AVP Network Visibility PLM at NETSCOUT. I’ve known Talbot since he began at Sycamore Networks, 15 years ago.

Werner Eriksen is now Senior Director, Engineering at Cisco.

Nipun Chamikara Weerasiri is now an Engineering Intern at H2O.ai. He’s also a TADHack 2023 winner.

You can sign up here to receive the CXTech News and Analysis by email or by my Substack.