The purpose of this CXTech Week 2 2021 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Kount (Identity Verification / Fraud Management) Bought for $640M on about $25M Revenue

Equifax announced it will acquire Kount, digital identity and fraud prevention, for $640 million. Equifax said it plans to use Kount’s technology to bolster its footprint in digital identity and fraud prevention.

At TADSummit we covered this topic from TeleSign with a Skype case study, onboarding in EMEA / Asia, onboarding in Americas, and in Financial Services; as well as from SmartNumbers.

Kount is focused on chargebacks, using fraud data signals from digital interactions, devices, and annual transactions. Of course phone number / mobile device ID is a big one as discussed by TeleSign and Smartnumbers at TADSummit.

There are many other Kount competitors, such as Sift, Signifyd, Riskified, ClearSale, etc. Having access to the phone number and the intelligence around that number is a significant differentiator for TeleSign and Smartnumbers. And hence why most of the major web properties use TeleSign.

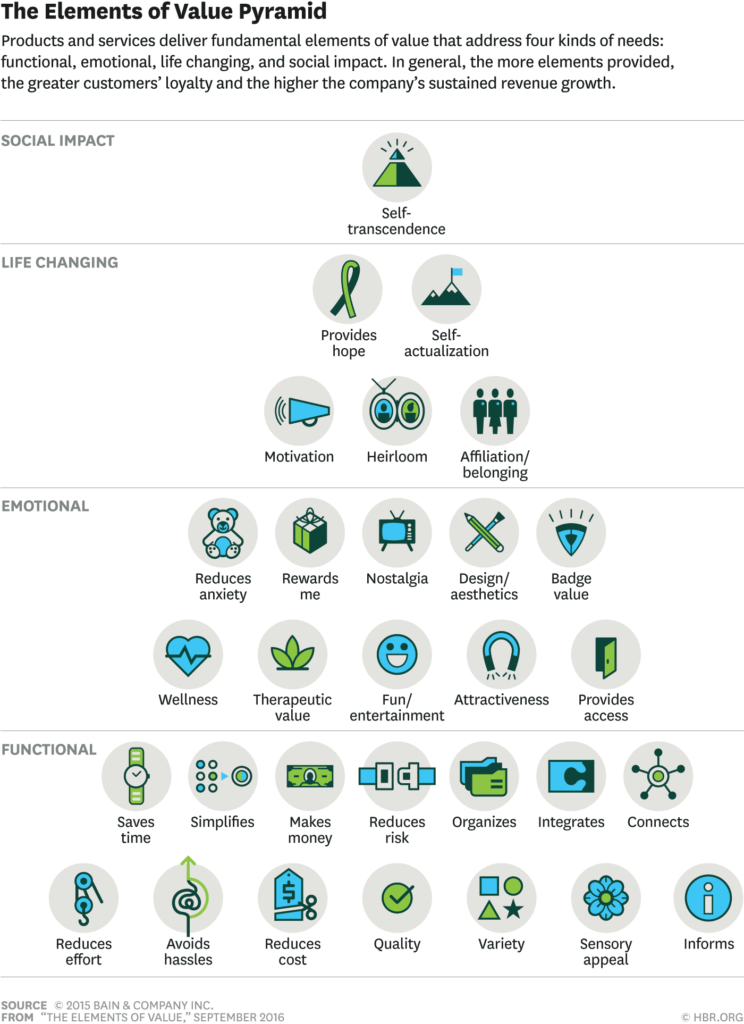

The Elements of Value

This article is from 2016, it’s a good framework in understanding how customers’ value your product or service. I really like this quote on the method:

In our research we don’t accept on its face a consumer’s statement that a certain product attribute is important; instead we explore what underlies that statement. For example, when someone says her bank is “convenient,” its value derives from some combination of the functional elements saves time, avoids hassle, simplifies, and reduces effort. And when the owner of a $10,000 Leica talks about the quality of the product and the pictures it takes, an underlying life-changing element is self-actualization, arising from the pride of owning a camera that famous photographers have used for a century.

The Elements of Value. Measuring—and delivering—what consumers really want by Eric Almquist, John Senior, and Nicolas Bloch. https://hbr.org/2016/09/the-elements-of-value

Zoom Phone Reaches 1 Million Users

Microsoft Teams has 115M daily active users (DAU), so there’s a fair way to go to be top-dog. But Zoom Phone is only 2 years old, and it’s not a simple incremental buying decision from conferencing to a phone system. That was my main concern when Zoom Phone was announced in 2019. How would they bridge that gap?

Conferencing is often an individual or group decision. Phone system is a corporate decision. You can run multiple conferencing apps and decide A is better and B. With phone systems you have to migrate, its a bigger decision with some disruption, you really need to know A is better than B. Yes, green field is easy, but its limited.

Zoom have won over existing conferencing customers. Pricing is annual and appears targeted to SMB (Small Medium Business) were migration costs are lower. $120 per year for pay as you go, and $180 per year for unlimited US/Canada, with add-ons for adding international calling and local callings in other countries. Pricing and bundled features are competitive.

They’ve enabled Zoom Phone to be as easy to embed as Zoom Conferencing. And both services are integrated with other services like Zoom Rooms, Zoom Webinars, and real phones / collaboration gear (hardware as a service). They’ve successfully bridged the gap from being a conferencing provider to a phone provider. The pandemic definitely helped in having Zoom conferencing explode across the world, and also a more subtle shift that many businesses now realize you do not need your telco to provide telecoms.

However, it’s not that simple. I often see local small businesses paying $300-$400 per month (not per year) for business internet and a few phone lines with Optimum or Verizon. The Internet is $200-250 (300-500 Mbit/s) and $30-$40 per month for the phone line. Internet is harder to change given the local oligopoly and need for rapid support if there’s a problem. And equipment rental charges ($10 per month for a router, were an equivalent is <$100 to buy), which are required for business class repair.

Four or five years ago you could play the internet providers off one another. I found on my last ‘renewal’ they seem fine with me leaving, I suspect antitrust behavior, but could never prove it. Even dropping the phone line seems to raise the internet price because of unclear ‘legacy’ bundle pricing.

It’s hard for many small businesses in the US to break-out of the hold of the incumbents. They’re too small for a local integrator to be bothered, and lack confidence to break free by themselves. The UK market is so much more open and competitive, I know it has issues (see Simwood’s blog for excellent commentary). Perhap because I know providers like Simwood, Sipalto, SureVoIP it biases me a little on how open the UK is. But I do much prefer advising small businesses in the UK than the US.

Congratulations to PAiC for a Successful 2020

Congratulations to Fernando and Celeo for a successful 2020. You can see Fernando’s TADSummit EMEA / Americas 2020 presentation here.

Example of Why I Struggle with most most Financial Analysis Articles

These 2 articles popped into my inbox at roughly the same time. Well, into the marketing folder when I checked it. And yes I still use email, and will continue to do so for decades to come.

- Dump Twilio, Buy This Explosive Growth Stock Instead; and

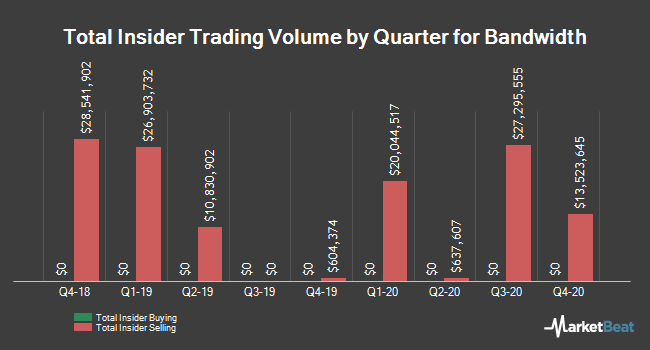

- David A. Morken Sells 47,205 Shares of Bandwidth Inc. (NASDAQ:BAND) Stock.

David sold roughly half his stock in one go, not the structured insider selling to enable diversification of wealth, see below. Which seems at odds with a stock that is about to explode.

Bandwidth has done well in 2020 thanks to companies like Zoom as it provides the US local numbers. But internationally there are providers like BICS and Colt, which is why Bandwidth bought Voxbone, a consolidation play.

However, Voxbone is a partial offer (principally DIDs) compared to the global interconnect and infrastructure of BICS and Colt. Physical infrastructure, compliance, and deals built over decades can not easily be replaced, Twilio has tried repeatedly. Can a consolidation play, based on physical infrastructure, compliance, and deals built over decades explode? Unlikely.

People, Gossip, and Frivolous Stuff

Congratulations to Saad Syed is now MENA Sales Leader at SUSE. I’ve know Saad since his time in Apigee.

John Carl Triano is now Senior Director of IVA Sales at Five9.

Moshe Maeir is now Business Development at Shidroog, server parts and upgrades.

Sajeel Hussain is now Vice President, Head of Strategic Alliances / Partnerships & BD, Digital Services at Xerox. He’s been with CafeX since 2013, and has the same company footprint of many in CafeX of: Avaya -> Thrupoint -> CafeX.

Greg Mason is now Alliances at Xelion. Previously Summa. Back in CXTech Week 46 2020 we reported Miguel Monforte Nicolas had moved from Summa to be Head of Telecom at OXIO.

Sami Maikelainen is now Head of Strategic Foresight at Telstra. I’ve known him since Telstra where interested in APIs, a long time ago. I’m pleased he used the term Foresight, than futurist.

Alex Ciubuc is now CCO & co-founder at DAS Solutions from BICS.

André Barbosa is now Principal Voice Engineer at MessageBird, previously Talkdesk.

Dominik Blanckenstein is now Head Of Operations at KONUX. I’ve known him through his time in tyntec.

Brian Schunke is now President, Americas at Synchronoss Technologies. He was there in the early days when Synchronoss got its big break in iPhone provisioning with the carriers. Today Synchronoss is well positioned for RCS in several countries. Regardless of enterprise and end-customer adoption, RCS is being deployed, just like IMS.

Fun post from Anthony Presley on never forget about the end user!

You can sign up here to receive the CXTech News and Analysis by email.