The purpose of this CXTech Week 45 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list, I also publish this on my weblog. And please let me know any CXTech news I should include.

Astricon 2019 Review

This was my first Astricon in-person. I’d watched the videos and twitter stream remotely in the past. For reviews of Astricon by old-hands, rather than a newb, check out Fred Posner’s reviewand Dan Jenkin’s review.

The power of any open source project is its community, together they make change happen in a market. The community is not only about the creation, maintenance, and evolution of the core product; it’s also about all its commercial applications.

For me, the main value of Astricon was the conversations with the many small and medium sized companies deploying Asterisk, FreePBX, Wazo, as well as the commercial products in the Sangoma portfolio such as Switchvox, PBXACT, phones and gateways.

In this weblog I review a few of the presentations I attended. Overall Astricon should be the annual rallying call to the programmable communications industry!

TADSummit EMEA only 2 weeks away

TADSummit is a small, independent, no-BS event (see our policy statement). We’re proudly independent: you’ll not hear silliness about the API economy (check these thought-leading articles on “The Great API Con” and the coming “API Economy correction” to understand why); nor trite phrases like “digital transformation” or “video is the new voice”. Rather clear, thoughtful, common sense insight based on decades of experience to help you make decisions that are right for you, and not influenced by misinformation and silly industry framing.

A big thank you to our sponsors Wazo, VoIP Innovations, TeleSign, Automat Berlin, SiPalto for making TADSummit EMEA possible; IdeaLondon for the location; our many partners for promoting TADSummit EMEA; and everyone for taking part.

If you want to understand the latest thinking, ideas, opportunities and insights in programmable telecoms / communications before everyone else. TADSummit is the only place to be for 7 years running. We also call the category CXTech (shorter, more catchy term). The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers. Check out the CXTech newsletters.

Examples of what falls into CXTech includes: Programable Telecoms / Communications, CPaaS, UCaaS, CCaaS, open source telecom software, CPaaS enablers, Multi-Factor Authentication / Instant Authentication, Telecom APIs, WebRTC, Cloud Communications, CPaaS enabled services, omni-channel, telecom infrastructure as code, telecom service dashboards, the myriad of UIs making APIs and enablers and services useable beyond coders.

Nextiva: Beyond UCaaS — Platform Selling Key for Future Prosperity

After Vonage branded everything under Vonage, as discussed in last week’s CXTech Newsletter, with a combo UCaaS/CCaaS/CPaaS pitch, Nextiva followed suit with its combo pitch. Its important to note any modern service should include APIs and management interfaces for integrations and customizations. You can label them CPaaS, but we’ve covered why having a Public and Private CPaaS segmentation makes more sense.

Employee and customer communications are generally different purchases by different groups, sometimes they are done together. The advantage of an independent CPaaS is the services can span both platforms without being locked into a particular vendor’s potentially slow and expensive roadmap. This is a critical question being tested in the market, a single comms supplier or multiple suppliers? This will be an interesting story to see infold over the coming years.

Ribbon’s Q3 Results

As expected Ribbon Communications’ results fell short on top and bottom lines in its Q3 earnings after declines in revenue and profits. Revenue fell more than 9% to $138M, and gross profit fell 4% to $78.9M. Revenue breakout: Product, $61.2M (down 20.9%); Service, $76.5M (up 1.8%). The impact of layoffs in sales / business development about 18/24 months ago have propagated through the organization.

However, the continuing cost cuts have led to a swing to an operating profit of $2.7M vs. a year-ago loss of $7.6M, as well as to a net profit of $1.65M from a loss of $10.2M. Going forward its going to be interesting to see how Ribbon grows product revenues. At TADSummit Americas I shared some of the Telco CPaaS revenues where Ribbon dominates.

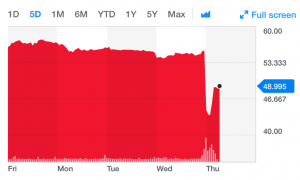

Bandwidth Q3 Results

We discussed the interesting case of Bandwidth in this panel discussion at TADSummit Americas last month on “Closing the Gap with Twilio”. Bandwidth’s Q3 EPS of -$0.06 beats by $0.09; GAAP EPS of -$0.04 beats by $0.19. Revenue of $60.49M (+19.9% Y/Y) beats by $1.71M. A good result.

However, Fourth Quarter 2019 Guidance: CPaaS revenue is expected to be in the range of $50.3 million to $50.8 million. Which is below estimates, hence the dip in share price seen today. But is inline with the outlook Twilio offered, and covered in last week’s CXTech newsletter.

Total revenue is expected to be in the range of $58.4 million to $58.9 million. Non-GAAP loss per share is expected to be in the range of ($0.15) to ($0.17) per share, using 23.5 million weighted average shares outstanding.

Full Year 2019 Guidance: CPaaS revenue is expected to be in the range of $194.8 million to $195.3 million. Total revenue is expected to be in the range of $229.0 million to $229.5 million.

Mobile operators band together in an attempt to push the need for Rich Communications Services

An interesting read as the broader press look at the mess that is RCS. Some important notes on RCS and the aggregators likely pricing:

- There is no formally agreed pricing for RCS, and the CCMI likely puts a spanner in the works of current pricing assumptions, as they want pricing control.

- RCS pricing is likely to emulate WhatsApp pricing. Because if it emulates MMS pricing it’s dead in the water.

- A complication is for replies, where the SMS model is generally free and that could carry over to RCS. While Twilio will likely charge 0.5c either way for messages. You’ll likely see other providers copy the SMS model, while Twilio relies on its dominant market position.

- There’s loads more speculation around the situation, as Google is trying to make the pricing more favorable than WhatsApp. I have RCS enabled on my phone using Google, which isn’t much to write home about, as mentioned in last week’s CXTech newsletter.

RCS is a designed and deployed by committee train wreck. Which is a shame as WhatsApp is owned by an evil monopolist known as FACEBOOK.

Back in 2015 I called for an RCS reset, and in 2018 I explained what the US carriers and Google should do on RCS. And here we are at the end of 2019 with blood in the water and unclear pricing, sigh! I’ll avoid zombie references, and instead state: a one-legged man in an arse kicking contest would do better than the GSMA/Telcos on RCS.

People, Gossip, and Frivolous Stuff

Richard Im has moved from Apigate to be Head Of Product Marketing and Sales Support at Axiata Enterprise.

Greg Thompson is now N American Lead for API Mgmt Presales and Adoption at Broadcom Inc. (Broadcom bought CA Tehnologies in 2018, which bought Layer7 in 2013)

Aran White is now Global lead for API Management Adoption and Presales at Broadcom Inc. (Broadcom bought CA Tehnologies in 2018, which bought Layer7 in 2013)