The purpose of this CXTech Week 17 2023 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- The EV Transition Explained

- OTR Global: Public Cloud Vendors Report

- Some (about 7-20%, many on Three) phones did not receive the UK emergency alert

- Monnai Accelerates Growth with “Global, Yet Hyper Local” Approach to Fintech Decision-Making

- The UK’s Online Safety Bill is Undermining Encryption.

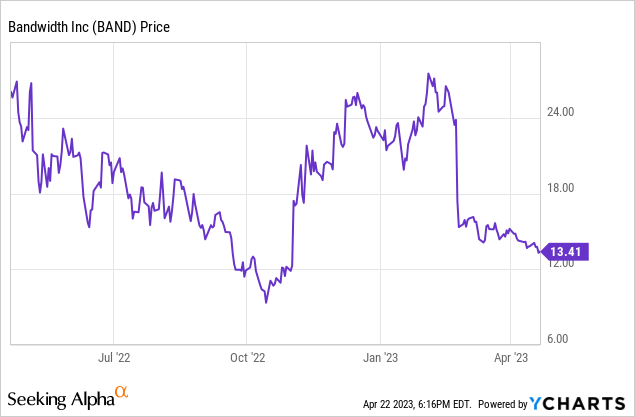

- Bandwidth Expecting zero-growth for 2023, Sinch shows growth albeit small

- People, Gossip, and Frivolous Stuff

The EV Transition Explained

Like many of the articles from the IEEE Spectrum, this is an excellent review from an engineering perspective of the challenges and limitations of the EV transition. The EV transition is one of the most complex problems facing humanity. And the transition only addresses one quarter of the CO2 problem. It’s a long read and exceptionally well referenced.

The EV transition cuts across global supply chains; national and global politics; old, new, and emerging technologies; limited primary resources, limited refining capacity, and a large human skills gap; the wholesale change of the transportation infrastructure of most nations; cultural issues; massive power grids changes; and impacts across most industries. The 2035 and 2050 target dates in policy documents remains just that, dates in policy documents.

I like the quote at the end; “Policymakers would be wise to follow the risk-management adage ‘Master the details to master the risks.'” In all my projects success comes from I worrying about the details, the ‘gotchas’ aways lurk there. Or put another way, never assume, always trust and verify.

BTW, I still have an ICE car because it works fine, I have no need to replace it yet. I do so few miles, just reached 50k last week after 11 years. Only when the EV transition becomes clearer, or that car breaks down will I buy an EV, and it will not be a Tesla.

OTR Global: Public Cloud Vendors Report

OTR Global product many reports, they capture the state of a market or vendors’ pipelines.

They talk with the partners of the public cloud vendors to gauge the state of the market. AWS (14), Azure (18) and GCP (8) in North America (13) and Europe (13), representing more than $2.4 billion in partners’ 2022 provider-related business (nearly $1.2 billion with AWS, more than $1 billion with Azure and more than $200 million with GCP).

Q1 ’23 was tough, the partners confirmed a continued slowdown in customer spending causing project delays and project cancellations. Between the cloud vendors most of the the differences were linked to partner incentives.

There is another trend as discussed in CXTech Week 16 2023 in the article “Are We Countering Cloud Skepticism the Wrong Way?” with the cloud backlash. Do not treat the OTR numbers as impending economic doom, rather further confirmation of businesses using cloud compute were appropriate, not as a universal panacea.

Some (about 7-20%, many on Three) phones did not receive the UK emergency alert

My sister’s reaction to the alert was, ‘what’s the point?’ And that reaction seems to align with many of the people I know the UK.

An intrusive noise from the government that they’ve never needed in their life and doubt they ever will. And in a ‘real’ situation will either come after the event, e.g. unexpected flooding; not be localized enough; or simply provides some entertainment when everyone’s phone starts blaring when there’s less than a 1 cm of snow on the ground.

Initially the government said 20% did not receive the alert, then revised it down to 7%.

Monnai Accelerates Growth with “Global, Yet Hyper Local” Approach to Fintech Decision-Making

Monnai is a global consumer insight infrastructure that enables fintechs to navigate efficiently the four key pillars of onboarding, trust and fraud risk, credit underwriting and collections. By connecting disparate data, identity and network behavior in a single API, Monnai’s technology enables customers to grow rapidly and securely. Headquartered in San Francisco with a footprint across Asia, India, and Latin America, the company was founded in 2021 by Pierre Demarche and Ravish Patel, both are ex-Telesign (identity and rating).

According to Monnai CPO and Co-Founder Ravish Patel, “Monnai’s vision to become the single source of truth for fintech decisioning globally requires creating a global infrastructure by default. Whether customers are local, regional or global they must have the ability to grow and expand with Monnai’s infrastructure ubiquitously and enable any cross-border transactions.”

Where they’ve focused in SEA, Indonesia in particular. In April, Monnai appointed Riza Kristanto as its Country Director for Indonesia. Kristanto has extensive experience in the credit score and credit data ecosystem. He joins Monnai from his previous role as Senior Vice President at PEFINDO Biro Kredit (idScore), one of Indonesia’s leading financial services providers and largest credit bureau.

“With digital payments already exceeding US$80 billion in Indonesia, we are seeing a need for efficient infrastructure providing access to insights and analytics into a diverse set of demographics to unlock massive growth opportunities in the financial services space,” said Riza Kristanto, Monnai Country Director for Indonesia. “In Indonesia and like in many other countries the challenge is to get access to the insights that will inform decisions across silos and use cases, complementing the capabilities built by Businesses.”

Monnai’s approach is smart, avoid the mature markets where the credit agencies dominate like Experian and LexisNexis; and the risk profile is skewed towards big ticket items like cars. Or if the agencies are extending their offers, it’s still premium priced. Focus on emerging markets that have a broader trust and rating problem across e-commerce, using local data sources with lower costs that the traditional rating agencies would not bother with as the margins are too slim for their operations.

There are other SEA focused providers in this space, e.g. trustingsocial. However, the fraud detection and prevention market size was $29B in 2021 and is expected to reach $190B in 2030. There’s loads of opportunity, we’ll see country-wide and regional champions emerge. And as they scale they’ll then enter more developed markets in segments were the traditional rating providers are simply too expensive. And once they become a big enough PITA, the Experians will buy away the competition.

The UK’s Online Safety Bill is Undermining Encryption.

This is an accurate and enjoyable article, it opens with, “It’s not often a government formulates a policy so misguided that it galvanises some of the biggest names in tech to join forces. But on privacy, the British government has managed it, aligning itself closer to China than the Western liberal democracies it purports to lead.”

Matthew Hodgson, CEO and co-founder of encrypted messaging app Element, adds that such a system would also be a magnet for bad actors. “If an attacker breaches the moderation system – either by hacking into it or by compromising a moderator – they could access unencrypted content which has been identified by the scanning system,” he tells Assured Intelligence. “A more sophisticated attacker could also hijack the opaque scanning logic to locate and access other sensitive data. Alternatively, a child abuser could break into the system to hit the jackpot of potential child abuse material.” This consequence is unthinkable.

The conclusions is spot on: “the government already has a law forcing tech companies to do their bidding on E2EE: the Investigatory Powers Act. It has chosen thus far not to pick a battle with big tech over the provisions. A similar stalemate is the most likely outcome of The Online Safety Bill.

Bandwidth Expecting zero-growth for 2023, Sinch shows growth albeit small

Shares of Bandwidth plummeted after releasing Q4 results, primarily due to its zero-growth guidance for FY23. The company cited macro-economic challenges as well as the loss of last year’s election messaging revenues as the reasons that growth is constrained. I didn’t realize Bandwidth did so much campaign messaging. I thought that was the domain of Tatango, as others tried to avoid the smear of politics.

Sinch released its Q1 ’23 results. Net sales increased by 6 percent to SEK 6,927m (6,550). Gross profit increased by 8 percent to SEK 2,260m (2,096). EBITDA rose by 7 percent to SEK 692m (648). The loss after tax for the quarter was SEK -78m (88).

People, Gossip, and Frivolous Stuff

Henrique Rosa is now a Senior Software Engineer at 1NCE, as part of the 1NCE OS team. He will continue his Telco journey, this time in IoT, and with some old Telestax colleagues including Fernando Mendioroz and Jaime Casero.

Giorgio Natili has added a role as Member Board of Directors at medVR Community / Medical XR Bootcamp and Accelerator.

Todd Stone is now Vice President Operations at Direct Line Global.

Brian Day is now Co-CEO of Clockworks Analytics. I’ve known Brian for over 2 decades, since his Octave Communications, a Teltier partner (my startup, focused on presence APIs).

Matthew Philips is now AI Strategy Leader | Generative AI at Asurion. We met while he was at Cincinnati Bell wireless.

Hugo Lenssen is Program Manager Digital Safe Equipment – IOT at Rijksinspectie Digitale Infrastructuur.

You can sign up here to receive the CXTech News and Analysis by email.