The purpose of this CXTech Week 23 2020 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Zoom’s Latest Quarter was Impressive to say the least at $330M, estimate of $500M for next quarter

Zoom reported revenue of $328.2 million, up 169% year over year, and accelerating from the 78% growth the company generated in the previous quarter. Earnings per share (EPS) was $0.20, up 566%. Both top and bottom line eclipsed analysts’ estimates, which called for revenue of $202 million and EPS of $0.09.

Zoom reported 265,400 customers with greater than 10 employees, up 354% compared to the prior-year quarter. Even more importantly, the company added a net of 128 enterprise customers, i.e. those that individually contributed at least $100,000 in trailing-12-month revenue, bringing the total to 769, up 90% year over year.

For the eighth successive quarter, increased business from current clientele grew 90% compared to the year-ago quarter.

Zoom expanded its international presence. While revenue in the Americas increased 150%, year over year, in the Europe/Middle East/Africa (EMEA) and Asia Pacific (APAC) regions, it grew even more quickly, by 246%.

Future revenue that is under contract but has not yet been recognized, grew 183% to $1.07 billion. Of that total, Zoom expects to recognize $722 million in the coming 12 months.

Zoom updated its full-year forecast and now expects revenue in a range of $1.775 billion and $1.8 billion, which would represent year-over-year growth of 187%. That’s nearly double the full-year forecast of $910 million management issued just last quarter. The company is also expecting EPS of between $1.21 and $1.29, more than triple the $0.35 it generated last year.

Given all the free services offered to schools during the pandemic and its core freemium model, its gross margins dropped to 68% from 80% from one year ago. We mentioned this possibility in the CXTech Week 13 2020 newsletter. The results are impressive. Kids are using Zoom at schools, and then using it while gaming on virtual playdates at home, and for after school lessons. Freemium, easy of use, and asking for forgiveness when security issues catch-up with it works. It’s the classic Bay Area service model. Given the consumerization of enterprise communications, even the security issues have not yet impacted its growth.

Zoom’s predicting a Q2 of $500M, its not a foregone conclusion such growth will continue given some social restrictions being lifted; free competition from Google and Facebook; and lots of Jitsi-based competition, like meet.simwood.com. We’ll be using Simwood Meet as the video collaboration platform for TADHack Global on October 10/11, along with Riot.im (messaging platform) from New Vector which recently extended its series A, as reported in CXTech Week 22 2020.

Interview with Sinch CEO, Oscar Werner

Since Covid-19 lockdowns Sinch has announced three acquisitions: Wavy in Brazil, Chatlayer in Belgium and SAP Digital Interconnect (SDI).

The driver for Wavy and SDI is consolidation in a mature market. As confirmed by this quote from Oscar, “Larger companies in this space will get a lot of power to invest in new SaaS solutions and will thereby gradually be more competitive.”

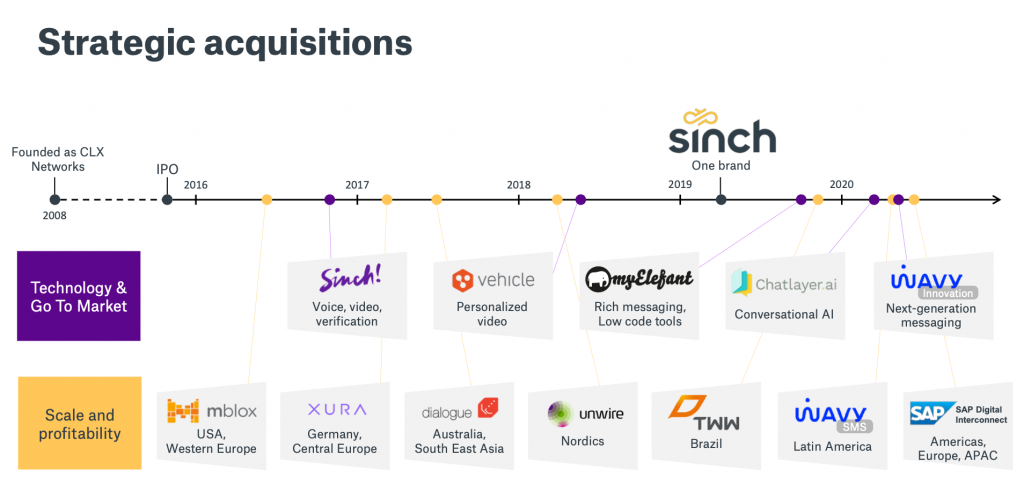

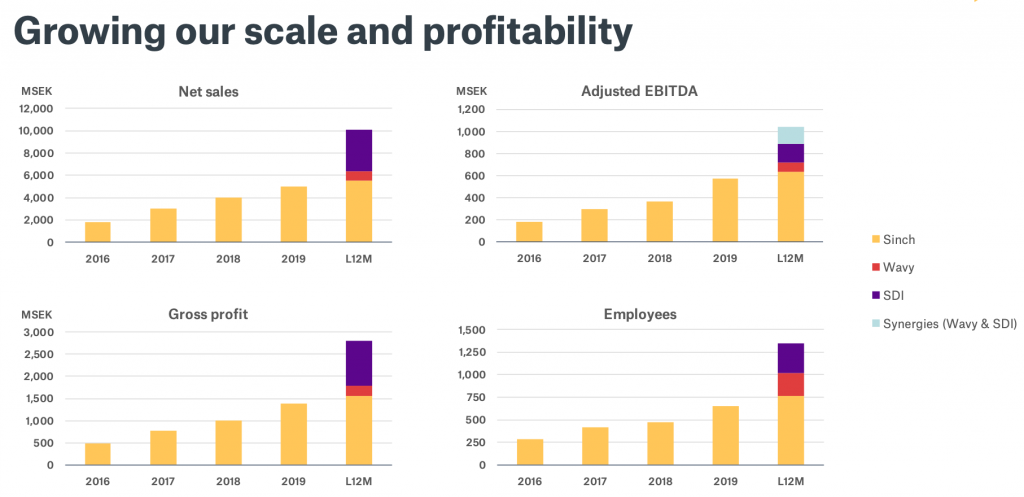

The investor slides on the SDI announcement are interesting. I show a couple of slides from the pack below. Sinch has for many years been buying up growth and end customer reach beyond the core A2P / carrier aggregation business.

SDI brings the wholesale US carrier deals we discussed in CXTech Week 19 2020, which immediately impacts profitability. They’ve likely halved their cost-basis of US SMS traffic. While with Wavy removed a significant Latin American competitor, so the impact will take a little longer to show up in profitability.

For the other A2P providers, Sinch has become the gorilla in this market. Twilio in the past relied heavily on Sinch (CLX) for SMS aggregation. It’s been moving traffic off Sinch for some time, building direct carrier deals and using local champions where available, e.g. Unifonic. I discussed this consolidation back in 2017, this is not a recent phenomenon. But we’re moving towards an end-game, where Infobip, OpenMarket, Tyntec, IMIMobile and a host of others need to consolidate to compete.

Five9 shows the Importance of Partners

I’ve been highlighting the channel deals companies like Aircall have made in building out their ecosystem in previous CXTech newsletters. Five9 is a great example of how those partners deliver impressive results. Though this quarter showed a softening in growth to 16.5% versus a historic 33% CAGR. Five9 did add a big account with AT&T.

The linked analysis focused on comparisons. While history also has an important role on Five9’s success. Avaya has struggled for many years, this helped Five9’s growth. It’s surprising in the analysis they did not mention Talkdesk in the comparisons, nor the impact of Twilio Flex that addresses an emerging partner channel that perhaps Five9 can not yet fully reach. And could also put further pressure on channel margins. While CPaaS and collaboration continue to show impressive results, we made see CCaaS show some softness as some sectors downsize or delay further call center investments.

People, Gossip, and Frivolous Stuff

Congratulations to Riza Alaudin Syah (TADHack Winner) for starting a new position as Chief Technology Officer and Co Founder at Eateroo

Well done to Paul Stovall for being promoted to SVP of Worldwide Sales and Customer Success at TeleSign

Congratulations to Izabella Coeli for starting a new position as 5G Core Cloud Native R&D Solutions Developer at Ericsson. I have great respect for Izabella’s telecoms knowledge.

Eva Endress is now Sales Manager Europe at Flytxt. She was there at the start of TADHack Global and TADSummit.

Remembering Ashraf Samy, CEQUENS Chief Corporate Officer. We’ve lost so many people in telecoms so far this year, including family members of telecoms people. Most not related to COVID-19. 2020 will be remembered as a year of loss for many of us.

James Kisner is now Vice President of Investor Relations at Supermicro. I’ve known James since 2012, his Jefferies days when he covered telecoms. I always seemed to have the same message about how a particular technology or business model was going to be big, just not for telcos.

Bill Welch is now Director of Product Management at Volta Networks. He was previously with Affirmed (bought by Microsoft), I’ve known him since his Tekelec / Oracle days.

Simon Ross is now Director of Emerging Business at Ericsson

Steve Goodwin is at it again 🙂

You can sign up here to receive the CXTech News and Analysis by email.