The purpose of this CXTech Week 8 2022 newsletter is to highlight, with commentary, some of the news stories in CXTech this week. What is CXTech? The C stands for Connectivity, Communications, Collaboration, Conversation, Customer; X for Experience because that’s what matters; and Tech because the focus is enablers.

You can sign up here to receive the CXTech News and Analysis by email. Please forward this on if you think someone should join the list. And please let me know any CXTech news I should include.

Covered this week:

- Clickatell raises $91m

- Radisys Introduces Engage Digital Platform for Service Providers

- Zoom Contact Center

- Federated Wireless Raises $58 Million in Series D

- Hyperscalers – Friend or Foe

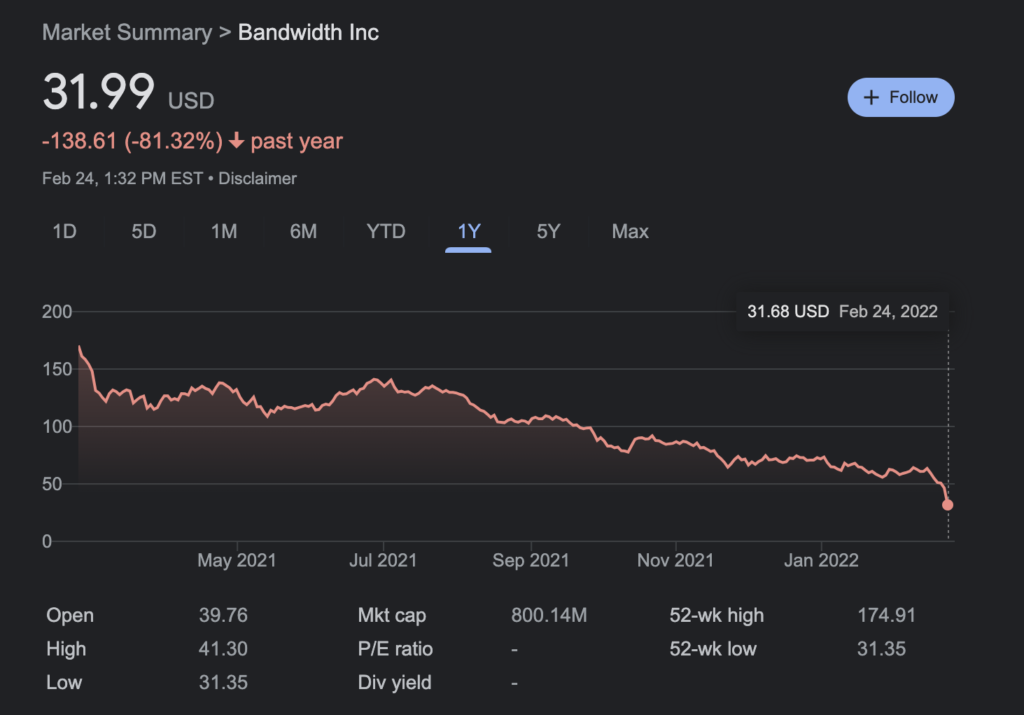

- Bandwidth Continues to Tumble – As Analysts Compare to Twilio

- People, Gossip, and Frivolous Stuff

Clickatell raises $91m

In CXTech Week 5 2022 I covered some of the trends in programmable comms that continue to blur the label CPaaS, citing Clickatell as an example in chat commerce.

Clickatell has led the way for several years with Transact, being able to securely buy stuff in chat. As the ‘nuts and bolts’ (voice and SMS API) business becomes increasingly the domain of consolidators (e.g. Sinch). Smaller regional CPaaS focus where defensible margins remain. Generally further up the stack (identity, conversations, commerce), a regional focus (knowing the customers, their culture, and their industries), though remaining a one-stop-shop (SMS and voice API remain available to retain the customer, it’s just not where the margin resides).

And further blurring what is considered CPaaS, Twilo buying Boku, as reported in CXTech Week 3 2022, gave it a stronger play in identity (beyond 2FA) and brought in mobile / chat commerce.

Clickatell’s US$91 million Series C round was led by Arrowroot Capital, with participation from Kennedy Lewis Investment Management, Endeavor Global and Harvest. The Series C capital will be used to accelerate the development of its product, expand its footprint in the US, and scale its sales and marketing efforts. Plus significantly grow its engineering skills. It has earmarked over 200 positions with a strong focus on boosting its African engineering team.

Radisys Introduces Engage Digital Platform for Service Providers

On the 22nd Feb Radisys announced the availability of their Engage Digital Platform. I think of it as a programmable communications wrap around their media server, focused on voice and video services, with a number of pre-built services such as Intelligent IVR, and Engage Speak2Bot.

You can see their keynote from TADSummit 2021 here:

“Service providers are adopting cloud-based programmable communications to deliver new, compelling, and highly-customized services to consumers and businesses. Advancements in real-time speech and video processing / analytics enable service providers to regain revenues being lost to cloud-based competitors. Radisys’ easy-to-use platform enables service providers, their partners, and their customers to cost-effectively create new, immersive, and engaging communications experiences.”

Alan Quayle, Founder, TADHack and TADHack Summit, said: “

Zoom Contact Center

I remember several years ago being called a liar by an analyst for the legacy call centers, when I explained how Dzinga, a UCaaS, offers a simple remote agent service for $15 pspm (per seat per month). Well, now a video conference provider is offering a contact center as a service across voice and video, with SMS and web chat in beta. All from $60 per agent per month.

The positioning is video contact center, which remains niche. In most use cases neither the customer nor agent want to see each other. And given the multi-tasking world we live in, messaging continues to grow more rapidly as you can easily multi-task while messaging with an agent, rather than waiting on the phone listening to musak.

The failed Five9 acquisition, covered in CXTech Week 29 2021, would have given it a stronger position in contact centers. This one will need to grow organically, and the bundling benefits are not that clear as between UCaaS and conferencing.

Zoom Phone (UCaaS) wasn’t disruptive, $10/$15 pupm (per user per month) for metered / unlimited US and Canada. UCaaS and Collab is an easier bundle to price as it increments on employees, while CCaaS is a separate purchase.

From a technology perspective it’s all programmable communications, we’ll likely see more of the enterprise CPaaS services (workflows) rolling into the bundle across both customer and employee workflows. The battle for the channel will likely intensify, RingCentral is doing well dominating telco and the old PBX channels, generally large enterprise.

Zoom has built an extensive partner network so whether its direct or through a channel, its the customers’ decision. Though I sense Zoom is happiest when customers are buying direct, which given the commoditizing nature of enterprise communications will likely continue and will likely shape its customer focus in the contact center.

Federated Wireless Raises $58 Million in Series D

Federated Wireless, the leader in shared spectrum and CBRS technology, raised $58 million in Series D funding from Cerberus Capital Management, as lead, with existing investors Allied Minds and GIC, Singapore’s sovereign wealth fund.

Last year Federated announced 200 customers, with 70,000 devices deployed. These include the launch of the secondary CBRS spectrum market via its Spectrum Exchange; significant deployments of a dedicated CBRS network for IoT research at Fort Carson, Colo. and another for modernization of the Marine Corps Logistics Command warehouse operations in Albany, Ga.; along with deployment of the first CBRS networks in Puerto Rico and the U.S Virgin Islands, delivering service to the region’s Wireless Internet Service Providers (WISPs) and Mobile Network Operators (MNOs).

2021 has seen 4 times the company’s expected revenue growth, its customer and partner base expand rapidly into new verticals, and the number of active CBRS devices grow to more than 70,000.

We covered in CXTech Week 11 2021 that Emerino Marchetti joined Federated.

Hyperscalers – Friend or Foe

Amazon, Microsoft, Google, IBM are suppliers of cloud compute to telcos. They are also partners in the experimentation of mobile edge compute. I know this work is rather old by AvidThink on Wavelength versus EC2, however, it does highlight the complexity of the decision making on whether to use Wavelength.

The hyperscalers are also partners for enterprise ICT solutions, especially for large national and international enterprises. Just like RingCentral partners with telcos for larger enterprises, as well as competes with them for enterprise communications in the mid-market and SMB segments.

The hand wringing on friend or foe is pointless. Telcos tried to be national cloud computing champions and realized its a scale game they can not win, nor can they retain the talent (organizational trinity issues). Telcos relied on Cisco for enterprise communications, but Cisco struggled to move to UCaaS. So partnering with RingCentral is the better option for telcos to deliver a competitive communications solution to their enterprise customers.

There has always been the risk of the telco being squeezed out by the partner. When I worked at BT, one of the in-jokes was BT stands for Badge Technology. As the BT logo was applied to partners’ equipment. Yet BT continues to work with many partners that also serve enterprises directly and through other channels.

It’s the enterprise that decides, it’s the customer relationship that matters. I remember about 20 years ago being shocked at an enterprise’s conferencing selection decision. The market was beginning to move from dedicated hardware to software. When I investigated I discovered the sales person for that account had worked with them for over a decade and never let them down, they bought from the sales person. Relationship matter, up until the solution is commoditized so a simple A or B decision is possible. Which in enterprise ICT solutions remains most definitely not the case.

No more worrying about whether partners / suppliers are friends or foe. Focus on the customer and delivering excellent value, it’s likely the best long term survival strategy a telco can adopt.

Bandwidth Continues to Tumble – As Analysts Compare to Twilio

Bandwidth reported a loss of $8.2 million in its fourth quarter, a loss of 33 cents per share. Earnings, adjusted for one-time gains and costs, came to 9 cents per share, analysts expected a loss of 14 cents per share, a good result. So why the fall in stock price? 2022 outlook was $547-$555M versus analyst expectations of $570M, the gap with Twilio continues to grow. And below is a panel session from TADSummit Americas 2019, start at 33:52 to see the discussion on Bandwidth.

People, Gossip, and Frivolous Stuff

Uros Mijatovic has joined Plivo to lead their connectivity strategies globally. I’ve known Uros through his time at TeleSign.

Adrian Cole is now Director Of Operations at The PIPE Company OÜ. I’ve known Adrian since his time at LogicaCMG a couple of decades ago.

Ryan Payne is now (Acting) Senior Director Optus Network Planning & Services at Optus. I’ve known Rayne since he was heading VAS at Vodafone Hutchison.

Congratulations to Gavin Henry, SentryPeer is going to be included in the T-Pot – The All In One Honeypot Platform. This is an open source project created by the Deutsche Telekom Security team.

You can sign up here to receive the CXTech News and Analysis by email.