The Policy Control and Data Pricing Conference took place between the 16-17th April. Its a ‘who’s who’ of Policy Control and Charging (PCC), and provides a great litmus test on the state of industry. The discussions this year were quite frank with open disagreements; the worry of signalling storms appeared to have abated. Reviewing the state of Policy; phase one of Policy deployments focused on sweating the network assets and meeting regulatory requirements of bill shock avoidance. A sad indictment on the telco industry, when the regulator has to force operators to stop billing customers for thousands of dollars of unintended data roaming. Phase Two focuses on a myriad of use cases, with ‘policy everywhere’ including the handset, attempts to be a toll-collector on the internet, surreal visions of ‘thinking networks’ and the words simplicity often said, yet the use cases and customer interaction models depicting the exact opposite. Many of the presentations displayed this ‘cognitive dissonance.’ Which is in part responsible for the delay in phase two policy deployments, the other reason is the purchase decision now requires network, IT and marketing to agree and sign-off on the purchase order, when in Phase One of Policy deployments network engineering could do it by themselves.

So what is happening in mobile data? Global mobile data traffic grew 70 percent in 2012, rather than the predicted 96%, thanks to the charging tiers of data use operators finally introduced, that is no more unlimited mobile broadand, customers pay for what they use. Mobile video traffic exceeded 50 percent for the first time in 2012. The top 1 percent of mobile data subscribers generated 16 percent of mobile data traffic, down from 52 percent at the beginning of 2010. Again thanks to the tiers of data use. According to a mobile data usage study conducted by Cisco, mobile data traffic has evened out over the last year and is now lower than the 1:20 ratio that has been true of fixed networks for several years. Average smartphone usage grew 81 percent in 2012. The average amount of traffic per smartphone in 2012 was 342 MB per month, up from 189 MB per month in 2011. Smartphones represented only 18 percent of total global handsets in use in 2012, but represented 92 percent of total global handset traffic. Put simply, people love mobile broadband and are using it more and more, which means more and more revenue for operators, as unlimited mobile broadband is a thing of the past. The data tsunami is abating, and operators have aligned their pricing so growth is good!

A popular misconception is customers are confused on their data access. This is incorrect, customers had no easy way to monitor their data usage. This is changing, on the customers’ devices they can see in almost real-time their data usage. As people are now accustomed to using mobile broadband, they sort of know now much they use in a month, and can manage their use or pay for more depending their needs. Some families are 2GB per month, some are 5GB per month, just like voice minutes and SMS monthly usage – people now get which bucket suits them. The underlying trend is people consume more and more mobile broadband as pricing has become reasonable and MBB becomes a part of everyone’s daily lives.

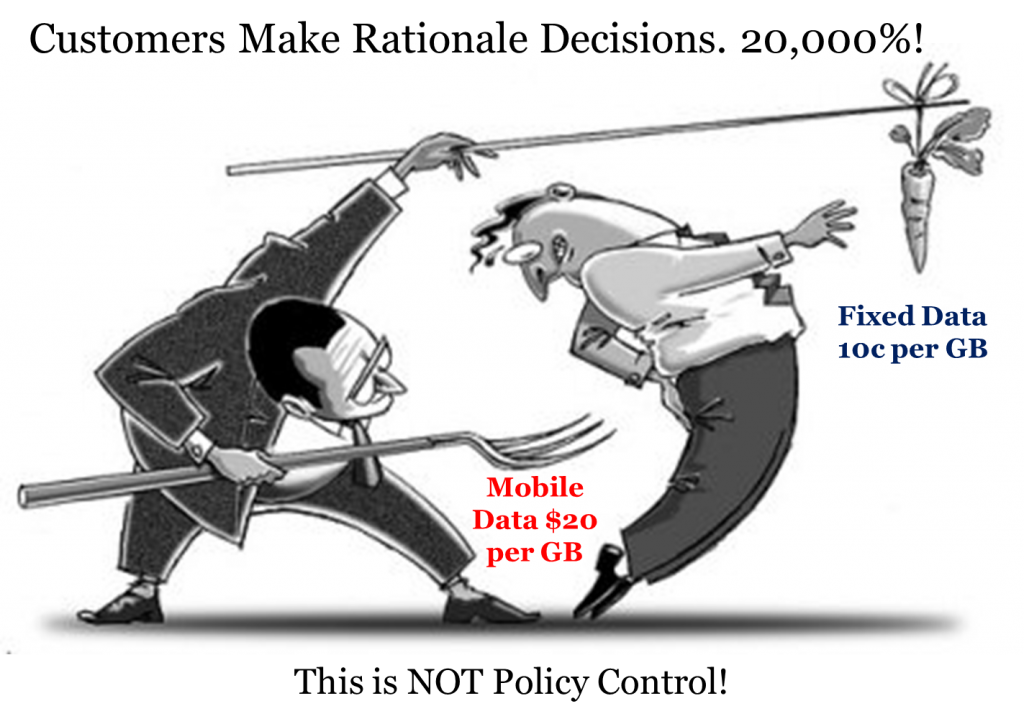

There are two problems being managed through PCC: Managing customer behavior and willingness to pay to generate the best revenue / utilization of the fixed resources of the network (yield management), similar to airlines and their pricing. And creating new charging models and unlock new revenues (revenue management). However, its fair to say the current pricing difference between fixed and mobile broadband, a 20,000% difference means customers implement a simple policy, if WiFi is available, use it.

I’d recently moved to Verizon, and they provide a great roaming offer 100MB for $25, even better than that its pro-rated, so for 10 days I need only pay $8 for 32MB. Unfortunately roaming voice pricing remains at $1.30 per minute and SMS is 50c to send. The reason for this daft difference in pricing is likely the international voice and messaging roaming pricing manager sits in some dusty office as they have done for the past decade and considers the internet a passing fad. This pricing has one simple impact on behavior, I used other voice and messaging service providers like Skype and Whatsapp while roaming. Pricing drives customer behavior.

Below are a few slides from the conference to highlight some of the great material presented.

- David Sharpley from Amdocs clearly set policy evolution in context and gave an good timeline. By 2017 is could be a $2.4B market, and consolidated to a handful of vendors from today’s 40+ vendors. Many of the policy use cases require customer interaction, or have business model challenges, or have been trialed and failed, e.g. Turbo Boost. In developing markets there is definitely opportunities today, e.g. zero rated Facebook, but there is a migration to simply straight MBB like developed markets, so is the current gaming of internet access simply a passing phase?

- Christophe Coutelle from Huawei explained the use of analytics for sweating the network further and managing congestion. Its taking the Phase 1 of PCC deployments to the next level. From a customers’ perspective they do nothing, simply MBB just keeps on working, the best way to keep customers’ happy.

- Cassio Sampaio from Bell Canada gave an important presentation on UDR (Unified Data Repository) and the need to break through the data silos and present a complete and real-time view of the customer. This is a critical across most projects including policy, analytics, VoLTE, RCS, etc. It should be a mandatory project in most operators, however, it lacks an ecosystem-wide approach to realize the benefits.

- Alex Harmand from Telefonica gave a good review of SPDY and its impact on the network. He also reviewed opportunities in creating internet bundles, which increasingly I see as a temporary opportunity as in the limit customers simply want access to the internet to use a range of services.

- Antoine Mercier from Bouygues sumed it up well, telcos need a DSC (Diameter Signaling Controller) to solve the problems created by telco standards people not learning from the fixed network. And ‘The Money’ is in the OCS (Online Charging System)!

- There were no discussing on signaling storms, let’s face it the fixed guys solved this a decade ago. Though there were still statements like “chatty applications.” Which ignores the fact that customers want those chatty applications to they receive alerts almost instantaneously. So any ‘filtering’ of chatty application is gong to make their customers experience poorer. Its critical to look at the customer impact, not just the network impact.

- Simplicity is key. As an ISP focus on providing a service that just works, and keep customers updated on their usage, so they either control usage towards the end of the month, or buy more GB. Other service providers (so called OTTs) care about the telco as a channel to market, they do not believe the stories of QoS (Quality of Service) based on their extensive knowledge of the internet.

- Ersin Guray from Turkcell shared interesting data on their market. They offer a combination of rates and MB plans. The base plan has a cap of 100MB plans and has rates of Eco 256kbps at 8TL (Turkish Lira) about $4 USD per month, Std 7.2 Mbps for 10 TL ($5 USD) per month, and Turbo 43.2 Mbps for 12 TL ($6 USD) per month, split in take-up is 12%, 81%, 7%. Just a $1 per month, a 20% difference in price, between std and turbo for 6 times the speed! People are smart, for their devices 7 Mbps is good enough. For bigger MB caps: 250MB add $4TL, 500MB add $5TL. They also provide daily and monthly FB, Social (FB and Twitter) plus 20MB data bundles. In chatting with friends in Turkey they increasingly see people adopting straight internet access as their use becomes more sophisticated, especially as Whatsapp takes off in a market.

- John Aabers from Volubil gave a nice review of how and where policy control and charging is working, and the importance of analytics in reviewing the profitability of the offers.

- Julius Mueller from Fraunhofer Fokus gave a great review of the implementation of SDN (Software Defined Networks) in a Telco network. Its complex, adds cost, and delay, its going to be many years before it breaks outside the data center into the wide area network.

- Ben Toner from Roke gave a simple use case on the importance of using the Telco self-service portal also as a promotions vehicle when the customer is in specific scenarios. The label used is policy on the device, but its much more than that. Knowing the customers’ context can be used to tap the massive lost opportunity in roaming fees now operators have been forced at least in Europe to prevent bill shock and offer reasonable roaming rates.

- Shira Levine from Infonetics gave a great summary of the current status, policy has got more complex, need a new deployment model. Here my recommendation is dump the RFI/P/Q model as it only selects the biggest liar. Rather define the 5 top use cases and the test parameters for each case, invite the vendors in and perform a Proof of Concept (PoC) against those use cases, and based on those direct objective measurements select the vendor.

Some of my other take-aways from the conference include:

- There is a diversity in Telco situations, in developing markets its about speed of execution and encouraging customers to use MBB, hence the important role of policy and OCS. While for developed markets its more about delivering a fair MBB offer and clear communication of plan usage. This is a critical question, is the complexity we see in the policy use cases a phase, simply about getting customers hooked on MBB, with the end state being simply a solid network like the fixed ISPs?

- WiFi Control use cases appeared silly, its the device / user that makes the determination based on the simply rule: connect to WiFi as its virtually free else MBB.

And a final thought. A phase mentioned several times, “Policy and QoS are inherent to LTE, you can’t monetize premium services without them.” Come-on, QoS over LTE is like one legged man in an arse kicking contest, because its not end to end its near useless. We’ve got to be honest to ourselves.

Glossary of Terms

Nokia 9000 Communicator

Smart connected device – A BS term used by marketeers that do not know what they’re talking about. Smart as a term made sense back in 1996 when the Nokia 9000 Communicator was a phone that could also do email (well sort of), that was smart. Today we have computers of different form factors: wearable, phone, phablet, tablet, laptop, desktop, workstation, and embedded (you can not see it). They’re all computers, and computers are connected by default, else they’re not much use. The word device means nothing. Once we realize we’re talking about computers connected over the network, we can start drawing analogies to what the good old broadband ISPs can teach us, as they went through the growing pains of realizing they cannot place a toll gate on the internet, rather focus on providing really good access to the internet to keep customers happy.

Over The Top – a pejorative term used for anyone that dares to deliver a better services to a telco’s customers than either the telco’s current services or any future service the Telco many choose to deliver in the future. They are simply internet-based service providers, or alternate service providers, the customer is allowed to choose. And its not just about offering unlimited voice and messaging, its also about the experience and the context of the communications. Telcos no longer control all of a customer’s communication.

Big Data – a term used for no apparent reason other than it appears fashionable.

Monetize – a term used for a proposition of no clear value. Example usage: “Our platform helps you monetize your assets,” really means, “Our platform has no a clear value proposition, please buy it.”

Thank you for the opening paragraph! I didn’t go to the conference but spend a lot of time looking at the Policy and Charging space. The Policy “2.0” use cases normally brought forward always seem to me the the antithesis of what customers want. ie a simple low cost tariff that they don’t have to have a PHD to decipher. Thankfully many of the analysts this year seem to have dropped the “Turbo Boost” use case from their examples although many vendors still talk about it. Cognitive Dissonance sums it up nicely. I have always felt there was a considerable amount of the emperors new clothes about the booming Policy and Charging market.

On data traffic I would point you to the considerable number of articles questioning even the lowered CISCO traffic forecasts from Analysys Mason and Telecom, Media and Finance Associates amongst others.

What is your view on QoS business models for selected applications? There also seems to be less emphasis on that this year. Are the examples of this working well in practice?

Thx Michael,

I think QoS can work, VoLTE will be the first example. Enterprises are running their business on the mobile network, and are willing to pay to ensure their employees work as efficiently outside the office as inside. Net Neutrality issues will make this a little challenging in some markets, but as long as the buckets are defined and they meet the regulatory policies; QoS can have a role, though as part of a service than an explicit API.

On the video streaming QoS examples, I think its more challenging, working with CDN providers can help optimize traffic over their network and save money, rather than charging the content providers. There are already existing TV content delivery models every PayTV provider agrees to.

The issue of sponsored data is interesting, I remain circumspect on the gulf between what operators get per MB when the customer pays versus from the sponsor. Let’s see what happens, its worth an experiment for sure, but I think its being talked up a little too much without a firm commercial basis.

Alan